Farmbench for better margins: How do the top 15% of breeding flocks turn a profit?

Friday, 24 October 2025

New Farmbench data shows that in the 2023/24 season the best-performing sheep farms reared heavier lambs, cut costs smartly, and cashed in big. Here’s how the top 15% beat the rest, and what other flocks can learn.

Key points

- Profitability was not linked to flock size or system type, rather success was driven by attention to detail, efficient input use, shrewd cost management and a focus on health and nutrition

- Ewe health was a focus for top performers to minimise lamb losses between scanning and birth

- Top performers achieved high daily liveweight gains, initially focusing on genetic selection and lamb health, before refining the feeding system

- Top performers managed overheads to spend on average £32 less per ewe overall but invested strategically in areas with proven returns (feed, forage, vet and med)

What is Farmbench?

Each year AHDB supports farmers to record their business performance through our online tool, Farmbench. Farmers can measure current performance and identify areas to build on by comparing to our national figures, while helping AHDB to better understand and support the beef and lamb industry.

We have recently published our latest national benchmarks for livestock production. These are available for farmers to start benchmarking their own business either individually or with the help of our regional Farmbench Managers.

What is included in this data?

This article looks at Farmbench data covering lambing 2024, with results from 66 sheep farms across England. The average breeding flock net margin of each farm was then ranked from highest to lowest. We then compared the average net margin of the top 15% of farms to an average of the remaining 85%.

What do these top performing flocks look like?

- Flock size on average was 765 ewes, but flocks as small as 100 ewes made it into the top 15%

- Most farms housed all or part of the flock during the year

- Of the top 15% of flocks, 60% lambed some replacements for the first time as ewe lambs rather than shearlings

- The top 15% included farms in both severely disadvantaged areas (SDA) and non-severely disadvantaged Areas (Non-SDA), organic and non-organic systems, and indoor and outdoor lambing flocks

Maintaining a high number of reared lambs

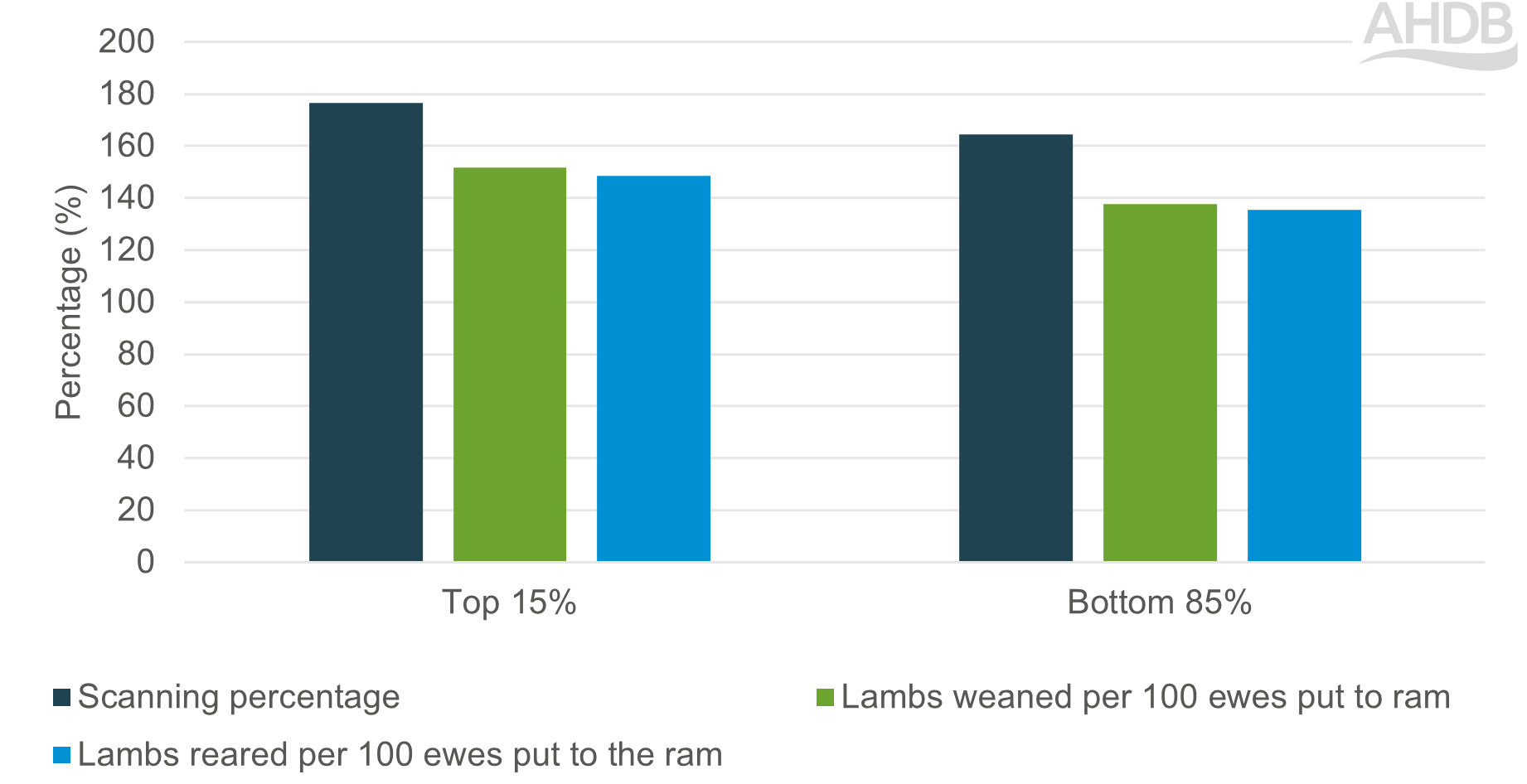

The top 15% reared 10% more lambs than the remaining 85% of flocks. They achieved this in a few ways, notably through having a slightly higher scanning percentage of 177%, compared to 164% in the rest. The top performers still lost lambs, with more lamb deaths per 100 ewes put to the ram than the remaining 85%. However, the top performers lost fewer foetuses through ewe deaths and abortion. Ewe health was a focus here; one top performing farm in the West Midlands used a hard culling and vaccinating policy to maintain a high overall health status in their ewe flock.

Fewer foetal losses meant the overall percentage of lambs lost from scanning to rearing was 2.2 percentage points lower across the top 15% of flocks compared to the rest.

Figure 1. Lambing Key Performance Indicators (KPIs) for breeding ewe flocks

Source: AHDB

Efficient lamb daily liveweight gain

Each ewe put to the ram in the top 15% of flocks produced 61.1 kg of lamb on average, compared to 51.1 kg in the lower performers. The top performers did this partly by rearing more lambs, but liveweight gain was also a factor. An average lamb in the top 15% of flocks gained 0.23kg/day compared to 0.19kg/day in the remaining 85%.

These high daily liveweight gains were achieved in various ways. Some top performers were high input systems (about 30% of the group), lambing early and relying on heavy lambs to hit early season finished markets. Though these farms used higher volumes of creep feed (up to around 40 kg per head), they used it where they could achieve financial returns. One top performer in the West Midlands chose this strategy as they farm on light land, which tends to have grass in the early season. By getting lambs off the farm early, this helps cattle enterprises that need the grass later in the summer.

The top 15% also included forage-based systems. These systems were still achieving up to 0.2kg/day of daily liveweight gain on average, but with a much lower cost. One of these forage-based top performers highlighted they focus in the following key areas to maximise growth:

- Pre-lambing nutrition with spring grass

- Selecting genetics with high growth potential

- Managing nutrient deficiencies closely to give lambs the highest growth potential

- Using herbal leys for lambs post-weaning to provide high digestibility feed with low labour input

This resulted in the top 15% producing reared lambs that weighed 3.5 kg more on average than the remaining 85% and finished lambs that weighed 3.3 kg more.

Targeting market premiums

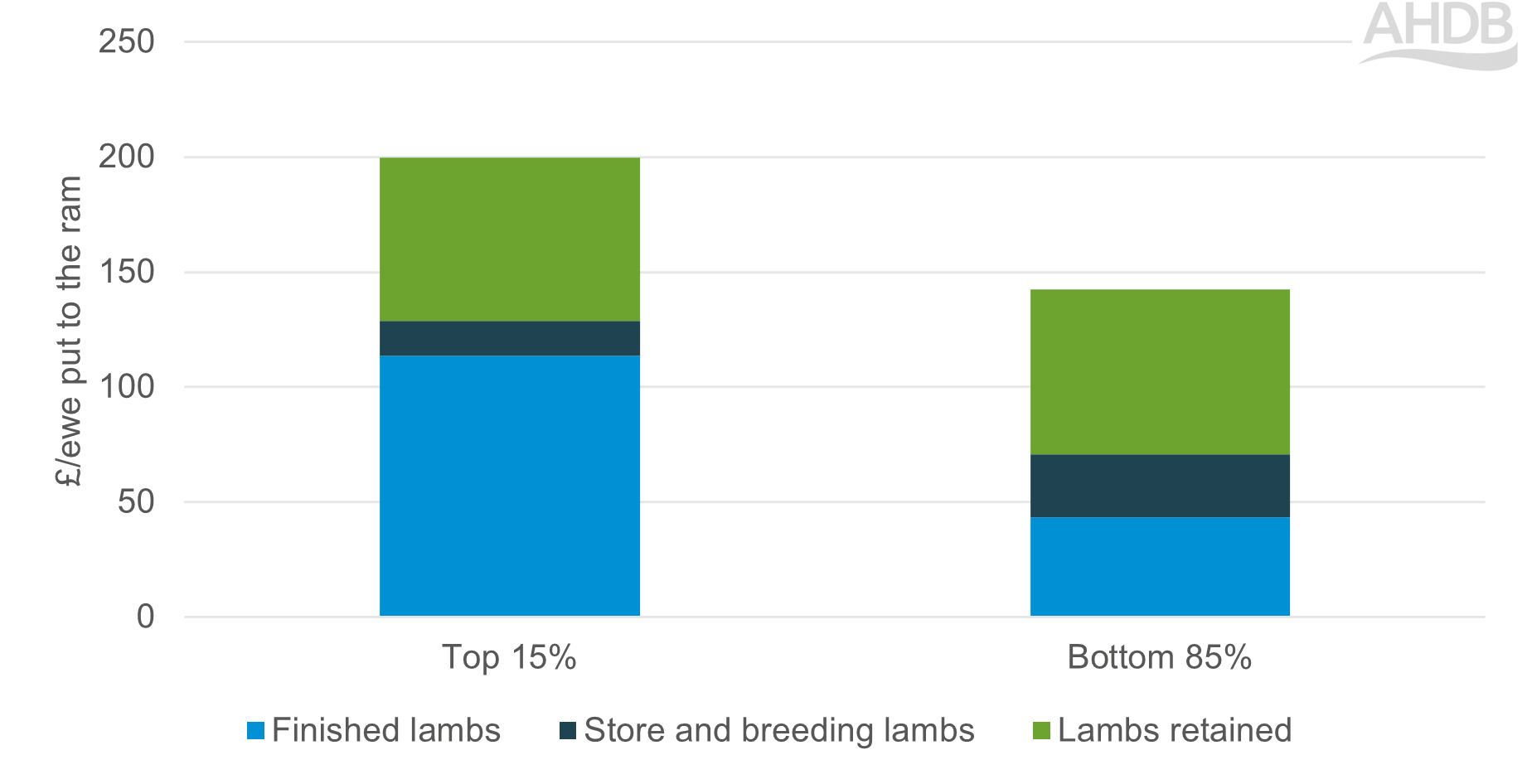

On average, 51% of lambs in the top performing group were sold finished before tupping time, with half of the top performing farms selling 60% or more of their lambs finished. While lambs tended to be finished at heavier weights, the top 15% also achieved £0.99/kg more than the remaining 85%. The weight and price premium resulted in the top 15% generating a finished lamb income of £200 per ewe put to the ram, this was £71 more compared to the lower performers. The only farm that sold store lambs achieved around £100 per head of income but remained profitable due to a low-cost structure.

Figure 2. Lamb income per ewe put to the ram

Source: AHDB

How the top performers spend

The top 15% of farms spent £32 less per ewe put to the ram on average each year. This saving allowed them to reach a total cost of production of £87 per lamb reared, whereas the remaining 85% spent £119 per lamb reared. The top 15% focussed on spending where they would see a return and saving where possible.

Areas where the top 15% spent more on included vet and med, as well as feed and forage. In each of these areas, the top performers could expect to see a return through good health or nutrition. The top 15% spent £19.51 per ewe put to the ram on non-forage feed, whereas the remaining 85% spent £14.73. This was linked to those high input systems who targeted lamb growth to hit early markets. While top performers saved slightly on homegrown forage costs, they purchased in more forage feed, overall spending £8.76 per ewe put to the ram. Grazed forage was a focus for top performers, with a slightly lower reliance on harvested forage than the remaining 85%.

Cutting overheads to boost profitability

Overheads were a key area of saving for the top 15%, who spent on average £61.57 per ewe put to the ram in comparison to £96.90 in the remaining 85%.

The largest difference between the overheads of the top and bottom performers was labour costs. Labour made up nearly half of the overhead savings that were achieved by top performers. The culling and vaccinating policy used by the West Midlands top performer mentioned previously not only improved overall health levels but also reduced time treating unhealthy stock and assisting births. Top performing farmers tended to spend fewer hours of unpaid labour per ewe compared to lower performers. This spread the cost of the farmers’ time across the flock or other enterprises.

What are the top 15% doing differently?

Profitability was good in the top 15%, with farms making on average £73.18 per ewe put to the ram after all costs were deducted, including farmer labour and imputed rent on owned land. A range of systems and flock sizes made up the top group, with no correlation to profitability. Rather, these farms all exercised attention to detail and careful decision making to maximise outputs from the ewe and balance inputs with profit.

Get in touch

The Farmbench tool is fully supported by AHDB through by our regional Farmbench Managers who can assist you in comparing your farm to the national dataset. Get in touch today to arrange a visit.

Our 2023/24 figures are available on our cost of production webpages. Visit these to start comparing.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: