Understanding red meat buying behaviours in Southeast Asia

Tuesday, 24 May 2022

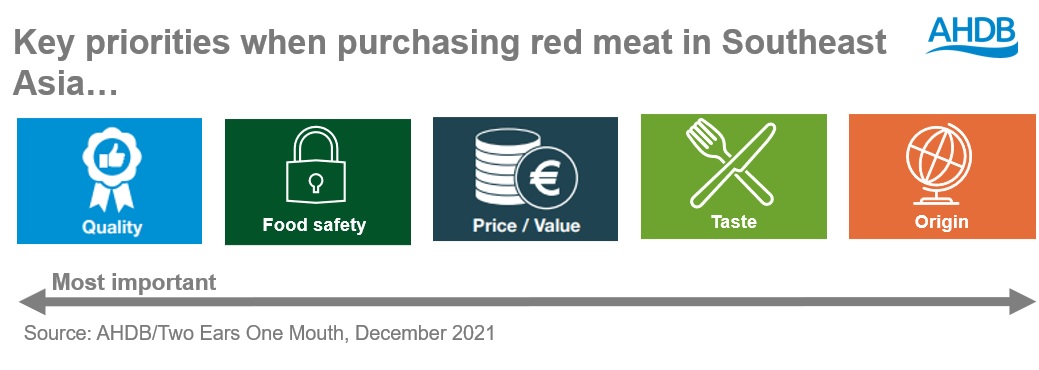

Consumer buying behaviour in Southeast Asia is influenced by three overarching factors: quality, food safety and price. This was explored as part of bespoke research within Southeast Asia to unpick opportunities for British meat exports.

The AHDB study with consumer research agency Two Ears One Mouth gained valuable insight into the buying behaviours of consumers across Southeast Asia: China, Hong Kong, Japan, Singapore, Taiwan, South Korea, Vietnam, and the Philippines. More than 9,000 consumers across eight markets across the region took part in an online quantitative survey to better understand the context behind where British red meat fits into current consumer purchase habits. This research expands on previous work on harnessing consumer buying behaviour for British exports and Exploring Asia reports. Here, in this article, we will look at the key findings across Southeast Asia and identify key nuances between the different markets.

Meat buying behaviour in Southeast Asia

Consumer buying behaviour in Southeast Asia is influenced by three overarching factors: quality, food safety and price. Quality is the most influential factor behind consumer buying behaviour, however what a consumer considers as ‘quality’ is unique to the individual and can encompass further factors such as product taste. Food safety sits in second place, this is understandably so, as food safety has consistently been a top concern for consumers in many Asian countries, especially those without trusted food-safety systems. Food safety scares throughout Asia such as the 2008 Melamine contaminated milk issue, led to a great deal of consumer mistrust in domestic products.

Our previous article goes into more depth on global buying behaviours. Price or value for money sits in third place, which is a little surprising as often price has the greatest impact on consumers at point of purchase.

Further priorities when purchasing red meat

When we look beyond the top three priorities driving red meat choice we see wider factors such as taste and origin start to pull through as a priority when choosing what red meat to purchase.

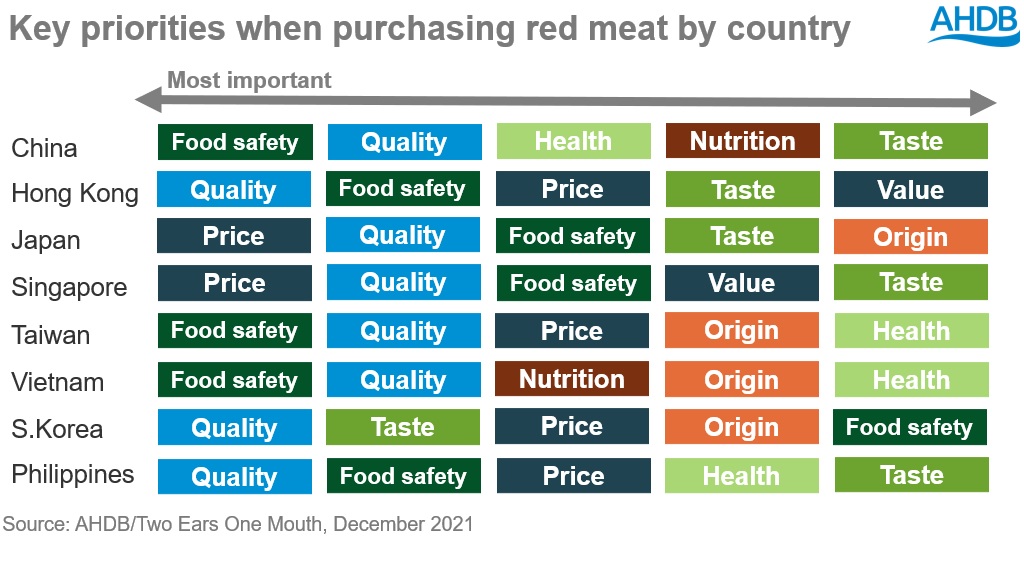

If we break this down by country within Southeast Asia, we can see nuances in the priorities behind purchasing red meat. For example, Korean consumers consider taste more highly when purchasing red meat, while food safety sits much lower down the list. Whereas Chinese and Vietnamese consumers are more likely to consider the health and nutritional credentials of red meat in comparison to other Southeast Asian countries.

Nearly 2 in 5 Southeast Asian consumers claim ’they give a lot of thought to where their red meat comes from’, likely linked to food safety concerns and freshness perceptions. Origin starts to gain importance in countries such as Taiwan, Vietnam, South Korea and Japan. This signifies the need to raise the profile of British red meat at the point of purchase to drive more conscious purchase of British products, alongside promoting food safety credentials.

Southeast Asian consumer perception of British red meat

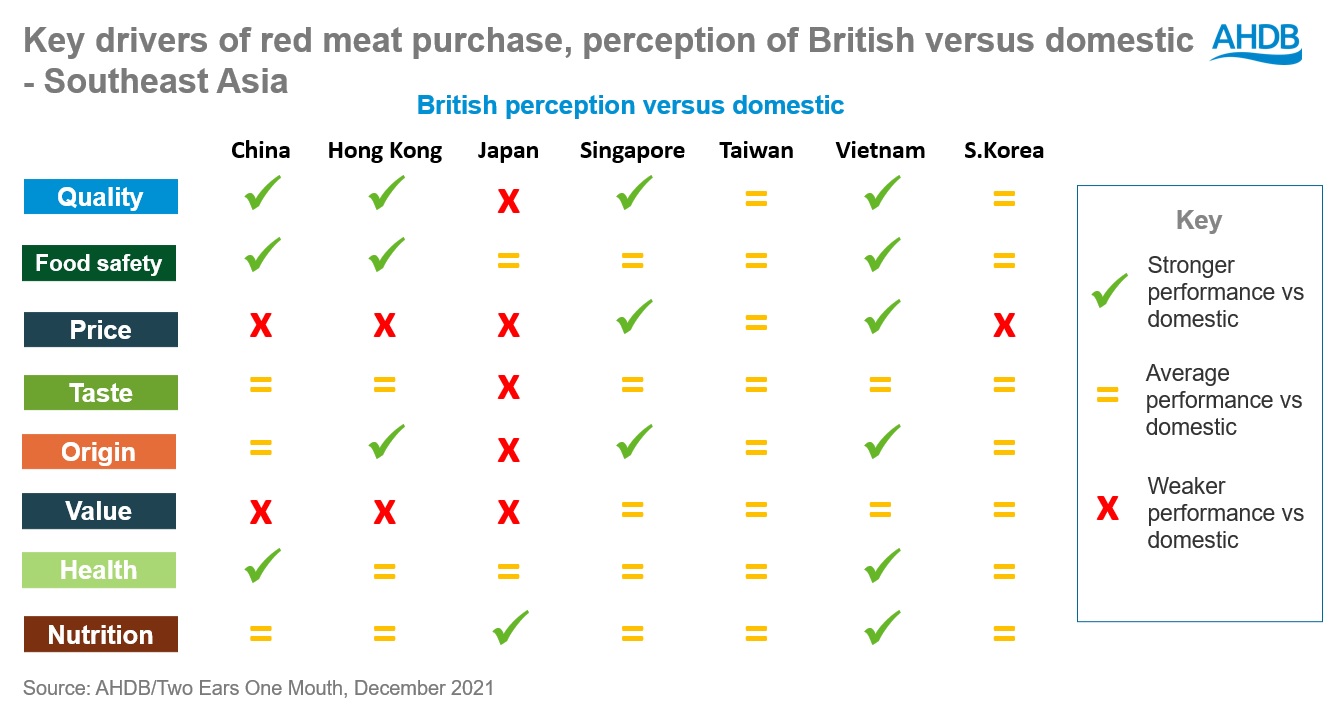

Although British red meat remains niche in Southeast Asia, it performs well in comparison to Southeast Asian domestic product. In the charting below, we can see that British red meat performs the same as or above domestic product in terms of quality and food safety (the top two overarching buying behaviours in Southeast Asia) across all countries, except Japan, with Japanese consumers regarding British red meat the same as or lower than domestic product across all purchase drivers, except nutrition.

Barriers and opportunities for British red meat

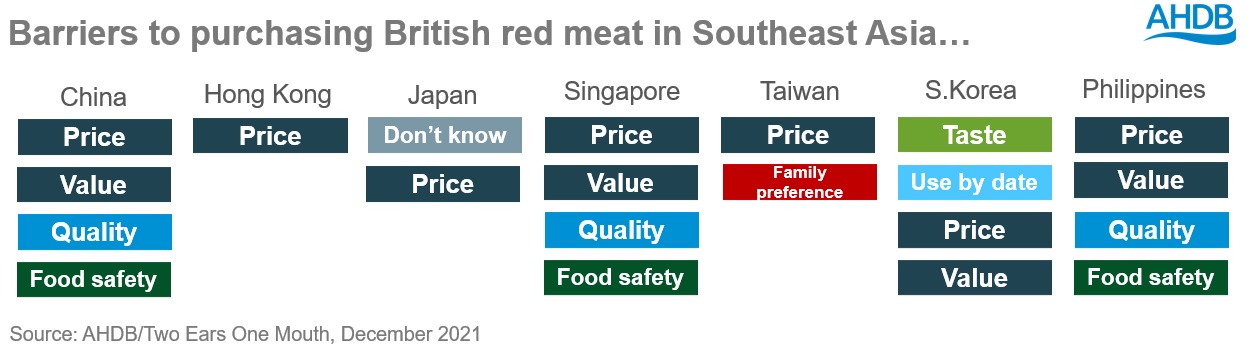

Southeast Asia provides a fantastic opportunity for British exports, however there are some barriers when it comes to consumer perception of British red meat. A key stumbling point for British red meat in many Southeast Asian markets is price and value for money in comparison to domestic product. However, it’s not a universal stumbling block for instance the table above shows it’s not so much of a claimed issue in Singapore/Vietnam. Price is the primary barrier to overcome across most Southeast Asian markets, therefore, we need to ensure that communication seeks to justify a price premium, whilst getting across messaging on the key purchase drivers within given regions, such as quality, taste, and food safety. Around 28% of British food consumed in Southeast Asia is claimed to be purchased for a special occasion, providing the opportunity to leverage this ‘treat’ occasion to reinforce the quality attributes and justify the price premium of British red meat.

When asked directly, other factors such as quality and food safety are highlighted below as barriers for British red meat to overcome. With quality in mind, the key drivers are food safety, taste, origin and freshness. Therefore, showcasing delicious looking product is key here, whilst also reassuring consumers on freshness perceptions – something which is typically perceived as a feature of locally produced meat.

In terms of food safety, British exporters need to provide clear and consistent messaging on the high food safety standards in the UK, promoting high level production standards. With food safety in mind, the key drivers are no additives (hormones, antibiotics, or preservatives), freshness and sanitary/hygienic production standards. This provides the UK with a good grounding to promote the high-quality red meat produced.

At this point in time, environmental sustainability is not a key purchase driver of red meat in Southeast Asia, with it only being considered by 14% of consumers. Evidence from the region, however, suggests the emerging nature of the interplay between red meat purchase and the environment. Realistically few consumers claim to often consider the environment when purchasing food, but they do consider broader sustainability topics to be important. Therefore, British red meat exporters could look to introduce key messaging on the UK’s sustainably production systems.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.