The inside scoop on ice cream opportunities

Wednesday, 26 April 2023

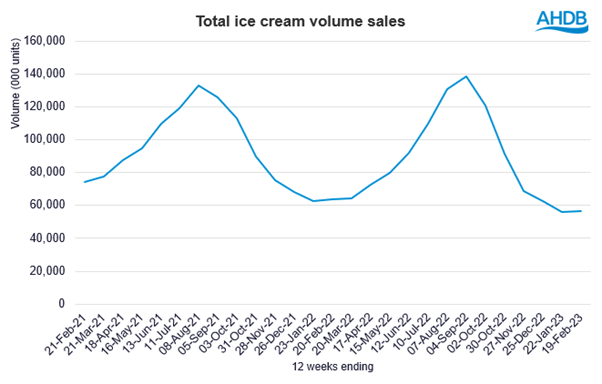

Unsurprisingly, sales of ice creams through supermarkets peak in the summer months, and volumes were up last summer versus 2021. Increased sunshine hours during school holidays likely benefitted sales. With an additional bank holiday this year and the opportunity for another hot summer, could ice cream continue to benefit?

Nine out of ten consumers bought ice cream in 2022, and value sales of ice cream through retail increased by 2.0%. However, despite higher volumes of sales throughout the summer months, overall volumes declined by 6.7% year-on-year (Kantar, 52 w/e 25 December 2022).

This decline is sales is likely due to the cost-of-living crisis as shoppers cut back on discretionary spending. Most shoppers haven’t cut out ice cream entirely but have scaled back how often they buy it from 16.6 times in 2021 down to 15.7 times in 2022. Shoppers are also responding by trading down to cheaper brands or favouring cheaper retailers. So far, they have resisted moving to own label ice cream as own label unit sales are down 6.9% – a faster decline than brands’ 6.6%.

This summer we saw volumes increase versus last year (Kantar, 20 w/e 4 September 2022). The 12 weeks to 4 September 2022 saw the highest volume sales, showing shoppers are buying more in the key period and school summer holiday rather than spreading sales throughout the year. We also saw sunshine in August 2022 reach over 200 hours for England according to the Met Office, higher than we had seen for the month in the previous four years. Family tubs and handheld ice creams saw the biggest increases.

Source: Kantar, Ice cream volume sales, rolling 12 w/e

Plant-based ice cream

Vegan ice cream is still a tiny part of the total category, accounting for less than 5% of the total categories’ £1.4bn in take-home sales (Kantar 52 w/e 25 December 2022). While there were new product launches for plant-based ice creams, the majority of new products were for dairy-based own label products (Mintel Ice Cream Report - UK - 2022).

Research from Mintel shows over half of consumers are interested in ice cream with natural ingredients. This presents an opportunity for dairy-based ice cream to market as a natural product. When looking for healthy ice cream options, low in sugar is the biggest consideration with 55% considering it important. All-natural ingredients are important to 49% when looking for healthy ice cream, whereas non-dairy is not currently considered healthy by the majority of shoppers with only 13% considering this important.

Opportunities for ice cream

Continued social interest in extravagant ice cream sundaes and so-called freak shakes (super-indulgent milkshake style desserts) could be an opportunity for retailers. A third of shoppers would be interested in DIY sundae kits (Mintel Ice Cream Report - UK - 2022). Retailers could tap into this need by displaying syrups, cones, baked goods and other toppings together or in a bundle. Offering linked promotions on these products could boost basket size and value. However, ice cream is subject to the new high fat, salt and sugar (HFSS) regulations, so products which are classed as HFSS are subject to restrictions on promotional activity and store location – which could have a large impact on impulse bought handheld ice creams. There are opportunities for companies who can offer HFSS-compliant ice cream products to both continue with promotions and also highlight their healthier credentials to shoppers.

A new initiative in the US has been a fleet of mobile stores equipped with Mars ice cream products, enabling customers to order ice cream from their smartphones and have it delivered to their location in minutes. Could an on-demand ice cream van concept also take off in the UK? An alternative could be making sure ice cream is available on takeaway and delivery menus for both foodservice and retail outlets. Ice cream is one of the most popular desserts to order via online delivery, so restaurants and supermarkets could expand into this area.

With the current cost-of-living crisis, we may continue to see shoppers restrict how often they purchase this discretionary treat. However, we do see shoppers turn to small luxuries, so another hot summer and an additional bank holiday for the Coronation could see handheld ice creams and out of home sales benefit.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.