Summer eating and cooking habits, a new normal

Monday, 21 November 2022

Whilst this was our first summer since the pandemic began without any form of Covid restrictions, it was by no means uneventful. Since July, the economic and global environment has changed and we have seen high inflation impact the market for the first time in recent history, 16.4% for food and non-alcoholic beverages (ONS, Oct 2022). Grocery value sales have seen strong growth, up 5.1% year-on-year, whilst volumes declined 3.6% (Kantar, 4 w/e 04 September 22).

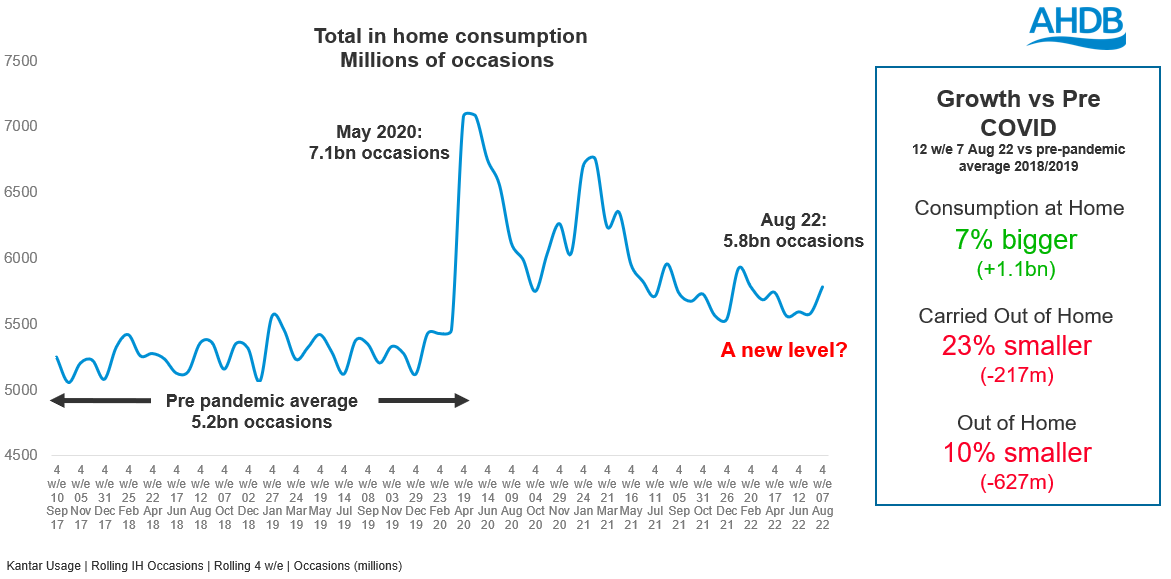

Despite a lack of restrictions, not all our habits have settled back to pre-pandemic tendencies.

Our in-home consumption moments this summer remained at a steady ‘new normal’, still below the record peaks we saw during the pandemic but 7% higher than pre-pandemic levels (Kantar, 12 w/e 7 Aug 22 vs. pre-pandemic average). Despite living without restrictions, we continue to work differently than before, which keeps us in the home more and cuts back on out-of-home occasions.

This is reflected in a 4.5% increase in daytime occasions vs. 2019 led by snacking, teatime, and lunch (Kantar, 16 w/e 7 Aug 2022 vs. 16 w/e 11 Aug 2019). Although the evening meal remains the heartland for MFP, lunch occasions rose to 29.7% this summer – up from 27.5% in 2019.

How we prepare food drives our diet choices over summer, with most consumers favouring assembled dishes which are quick and easy to prepare. Practicality has grown in importance as has speed and ease, driving MFP (Meat, Fish and Poultry) consumption.

Red meat has many synergies with quick and easy main meals and is well suited to match consumer’s needs, particularly pig meat, which has remained a main meal protein favourite over summer. Therefore, opportunities exist for ready-to-cook/ready meals and food which require shorter preparation times.

Meat, Fish and Poultry

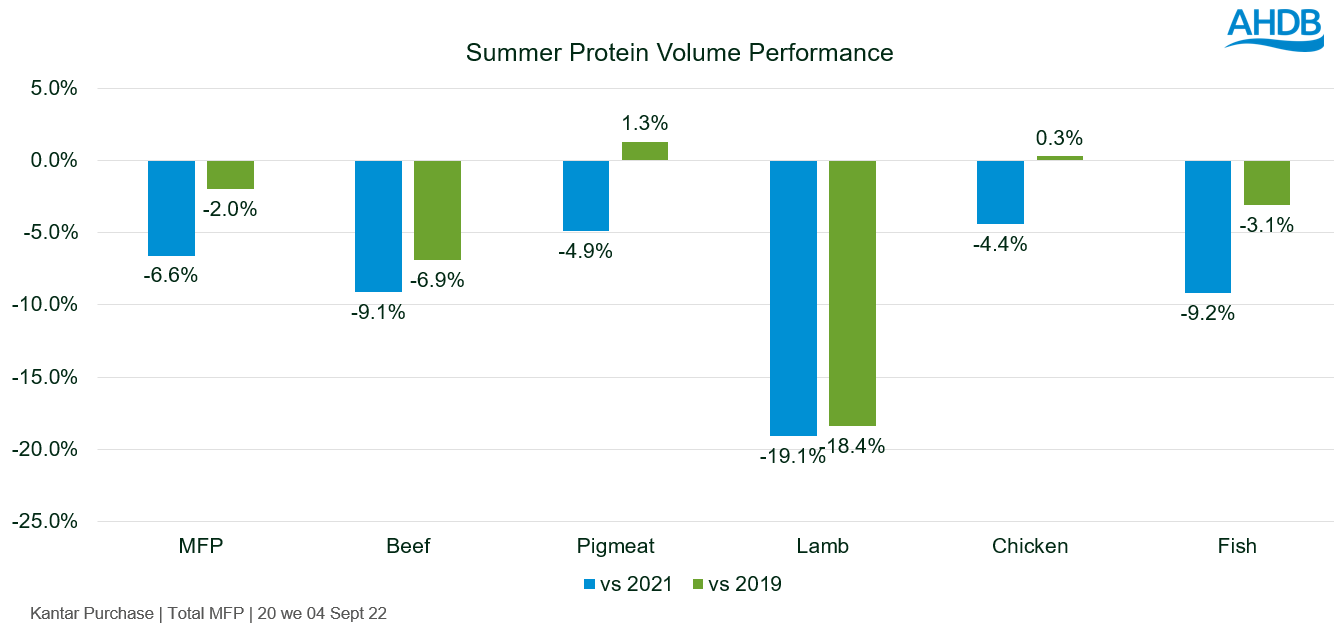

Over the summer, chicken and pig meat remained firm favourites, both seeing slight growth on pre-pandemic volume levels. However, from a total retail perspective, no protein has managed any volume growth versus last summer. Whilst MFP saw a 1.5% growth in value sales, volumes declined 6.6% (Kantar, 20 w/e September 2022).

Practical pork-based dishes back in favour

Over summer, 62% of pork servings were made with practicality in mind which is a record high. Versatility and price made pork a popular protein with sliced cooked meats, bacon and sausages making up over 50% of share. Mince and burgers and grills saw strong volume growth versus last year, both up 10.8% (Kantar, 20 w/e 04 Sept 22).

Communicating value for Beef

Beef volumes saw a year-on-year decline of 9.1% with all cuts contributing to its negative performance. However, roasting, stewing and steaks were the worst performing cuts in the summer.

Beef burgers and grills are still a staple for summer, contributing 14.7% of beef volumes, the second most important cut after mince (23.7%). Both these cuts are essential in holding up overall beef performance, with 6.1 million kg of burgers and grills purchased during the average 4-week summer period compared to 3.7 million kg the rest of the year. Premium tier and branded burgers and grills saw significant year-on-year declines, with standard ranges holding steady, suggesting consumers are trading down towards more cost-effective options.

Mince made up 32.8% of beef occasions – an all-time high for summer – demonstrating mince’s ongoing importance as a budget friendly option.

Potential for out-of-home replacement gains for lamb

Lamb has seen a 19.2% volume reduction versus last summer with almost every cut, apart from burgers and grills, down year-on-year. Burgers and grills saw a 0.5% volume increase versus last year, with some consumers switching from beef to lamb burgers (Kantar, 20 w/e 04 Sept 22).

The evening meal made up 79.5% of lamb occasions, which is above pre-Covid levels (Kantar, 16 w/e 07 Aug 22). The year-on-year growth of lamb meals labelled as a treat suggests consumers are searching for some form of indulgence as the cost-of-living pressure intensifies. This puts lamb in a good place to demonstrate itself as a suitable treat alternative from those out-of-home restaurant occasions.

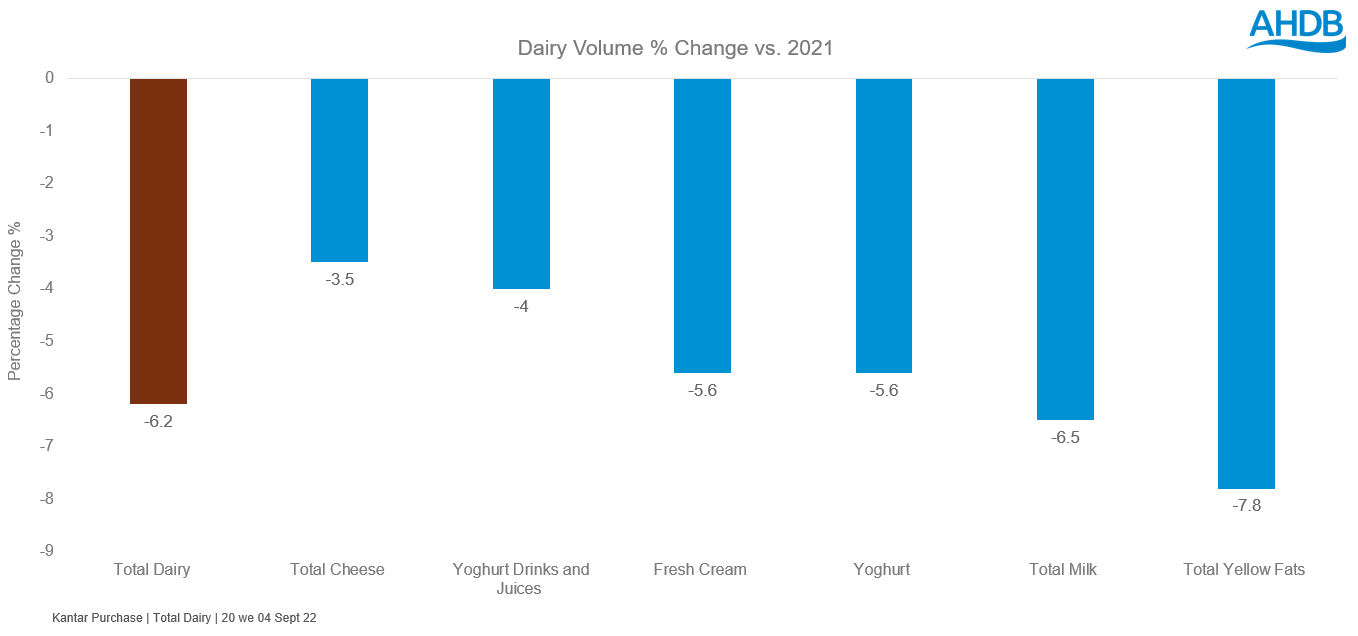

Dairy

Sales of dairy slipped back to pre-pandemic levels this summer, following an uplift during lockdown. All dairy categories saw volume declines compared to last summer, with total dairy down 6.2%. This is a result of price increases, up 14.7% versus last year, and shoppers buying dairy less often. Alongside this, volumes sold through retailer promotions on dairy products saw a 27% decline (Kantar, 20 w/e 04 Sept 22). As prices increase, promotions are an important way to tackle rising prices and benefit overall sales of dairy.

Unsurprisingly, ice cream remains a firm favourite during summer – up 0.6% on last year, with growth in family tubs (+5%) and handheld ice cream (+2.3%).

BBQs

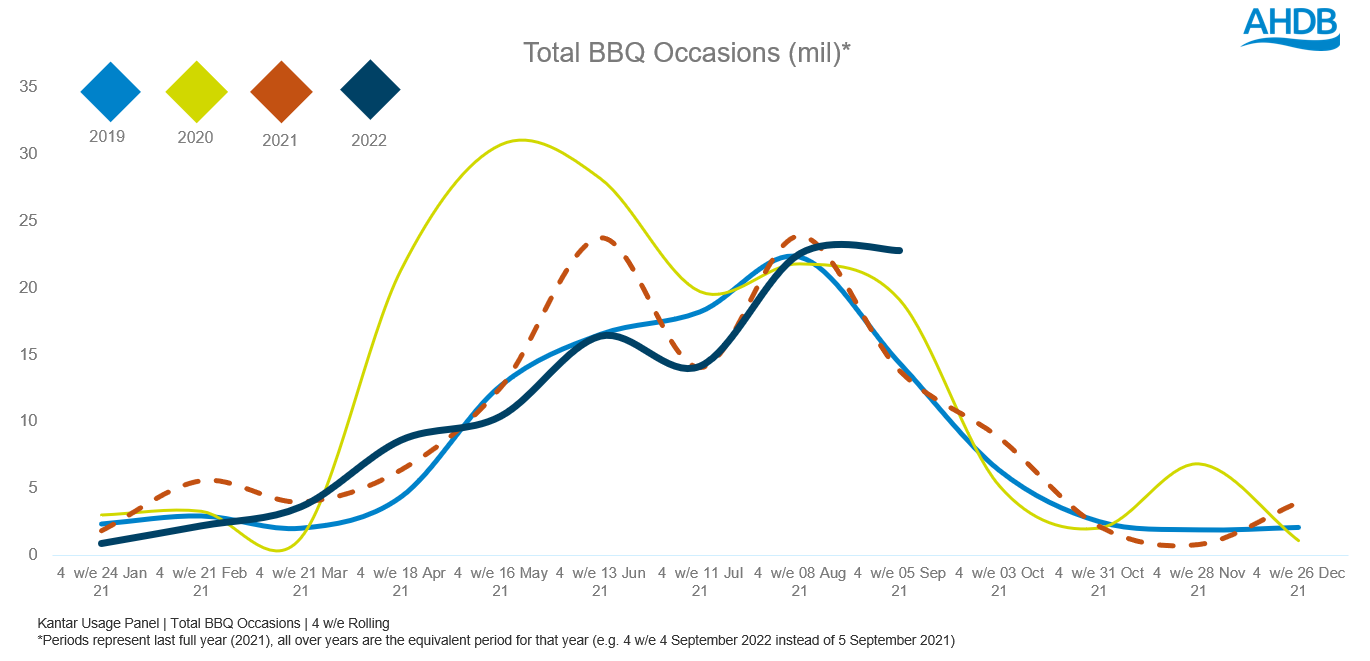

This summer saw BBQs outperform the wider market as total in-home and carried out food and drink occasions fell by 3.3% year-on-year.

Brits barbecued 86 million times this summer – down 1.9% on 2021 levels but higher than 2019 levels by 2.7% (Kantar, 20 w/e 04 Sep 22). The latter part of summer saw a rise in temperatures which was matched by a spike in BBQ occasions in August, however the same did not happen for the record temperatures in July.

Protein share of BBQ occasions

From an MFP perspective, pigmeat recovered from a dip in performance in 2021 (41%) to remain the largest protein present at BBQs (43.8%), whilst all others saw share declines.

Burgers remained a firm favourite, making up 34.9% of occasions. However, compared to the last few years, burgers saw a decline in share overall. Sausages increased slightly to 34.3%, likely due to price, and steaks saw growth after a slump in 2021, up 3.8%pts to 11.6% for the 16 w/e 7 Aug 22 (Kantar).

It is also worth noting, meat free remains a small part of our BBQ’s, only 2.7%, and saw reduced importance versus 2021 and 2019.

The value of BBQs

Whilst BBQs were worth £146 million for retailers this summer, spend was down on 2020 and 2021 levels – averaging £2.31 per total BBQ occasion, as consumers tried to manage costs. This decline could be due to BBQs containing a smaller protein repertoire. BBQs with one protein present gained share by 7% year-on-year, and 24% when compared to 2019 (Kantar, 20 w/e 22 Sep 22 vs the same period in 2021/2019). BBQs are still an important staple summer occasion and lend themselves to treat occasions. When red meat is present, the BBQ occasion is 25% more valuable than the average total BBQ occasion (Kantar, 16 w/e 07 Aug 22). Therefore, it is vital red meat is encouraged at these extra occasions to grow category sales.

Outlook and opportunities for Summer 2023

IGD predicts that the cost of food and drink is set to reach a peak rate of 17-19% year-on-year inflation in early 2023 before a slow run-down over the subsequent 12 months (IGD, Nov 2022). We’ve seen food and non-alcoholic beverage prices rise to 16.4% in October 2022, suggesting we might reach these levels sooner than expected (ONS, 52 w/e Oct 22). With the 2023 summer set to feel the lasting impact of the changing economic environment, it is likely this will define what we put in our shopping baskets, something red meat and dairy needs to be prepared for.

- There is increased demand for practical dishes which are fast and easy to prepare which is set to continue. Red meat and dairy have many synergies with quick and easy main meals and is well suited to match consumer’s needs.

- Tradition within inflation – the classic summer repertoire will continue to be the main feature of our summers whilst cheaper alternatives will grow in importance. It’s important to keep those consumers within the MFP category to achieve the best value sales.

- Continued movement towards cheaper and simpler BBQs with fewer proteins featuring. These occasions remain valuable with red meat playing a crucial role, therefore retailers should focus on growing BBQs where red meat features.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors: