- Home

- News

- Milking the opportunity: Understanding milk's challenges and opportunities in an evolving consumer landscape

Milking the opportunity: Understanding milk's challenges and opportunities in an evolving consumer landscape

Thursday, 21 August 2025

Over 95% of all dairy occasions occur within the home. However, over the last year, usage has dropped by 2% (Worldpanel by Numerator UK Usage, 52 w/e 15 June 2025), with milk being one of the dairy products contributing to this decline. So, what is affecting milk’s performance?

Key findings

- In-home milk occasions have seen declines over the past year, largely driven by evolving breakfast trends

- Health concerns, such as ultra-processed foods (UPFs), are affecting the consumption of cereals, which are typically consumed with milk

- Changes in consumer preferences in hot drinks, such as tea, are also affecting milk consumption, as consumers opt for alternatives with perceived functional health benefits

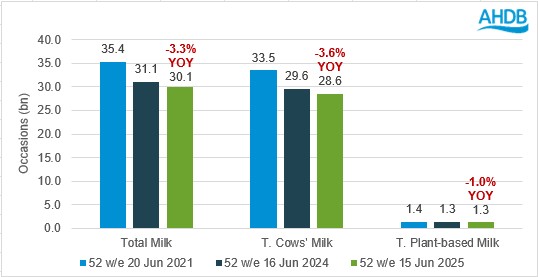

While being the most commonly used food and drink category in the home, milk usage has declined over the past few years. In the past 12 months, total milk saw in-home occasions decline 3.3% to 30.1bn. Cow’s milk experienced steeper reduction in occasions, down 3.6% year-on-year, while plant-based milk saw a 1.0% decline (Worldpanel by Numerator UK Usage, 52 w/e 15 June 2025).

Figure 1: Declines in occasions for total milk, cow’s milk and plant-based milk (bn)

Source: Worldpanel by Numerator UK Usage, 52 w/e 15 June 2025

The decline in cow’s milk has partly been driven by rising milk prices. Retail data shows that the average price for a litre of cow’s milk is now 81 pence, a 2.0% increase year-on-year (Nielsen POD, 52 w/e 12 July 2025).

Although also in decline, and making up a small percentage of in-home occasions, plant-based milks are seen to be more popular with consumers aged 25–64 years old, while cow’s milk is more popular with over 65s (Worldpanel by Numerator UK Usage, 52 w/e 15 June 2025).

As a staple for many in daily life, milk features in 41% of all consumption occasions, whether in tea and coffee, over cereal or in meals (Worldpanel by Numerator UK Usage, 52 w/e 15 June 2025). However, declines across each of these key occasions have contributed to the overall drop in usage, impacting both cow’s milk and plant-based alternatives, which account for 94.8% and 4.3% of total milk usage occasions respectively.

Evolving breakfast trends

Breakfast remains the key occasion for cow’s milk, accounting for 47.1% of in-home milk usage. However, it has also seen the steepest decline, with in-home breakfast occasions containing milk down 2.3% YoY (Worldpanel by Numerator UK Usage, 52 w/e 15 June 2025).

This is less about consumers drinking less milk and more about inclusion in breakfast foods. Out-of-home breakfast has also experienced the largest year-on-year growth in share (+0.6%pt), reflecting changing routines such as increase in hybrid working, emphasising consumers’ need for convenience (Worldpanel by Numerator UK Out-of-Home, 52 w/e 29 December 2024).

Additionally, more consumers are also turning to other easy-to-prepare options such as porridge oats and granola, both of which have seen increases in recent years (Worldpanel by Numerator UK Usage, 6 October 2024). However, there is an opportunity to position milk as an essential ingredient in the preparation of these dishes, by creating these options in-home and reinforcing its relevance in evolving breakfast trends.

Health trends

While concerns around ultra-processed foods (UPFs) continue, more consumers are turning to whole milk or organic milk as they are minimally processed and contain natural health benefits. Volumes of cow’s whole milk and cow’s organic milk increased by 2.0% and 5.7% respectively in the last year (Nielson POD, 52 w/e 14 June 2025).

According to Mintel, 79% of consumers agree that standard cow’s milk is a good choice when avoiding UPFs, while 61% agreed that the protein quality in cow’s milk is superior to that of plant-based alternatives (Dairy and Dairy Alternatives, Milk and Cream – UK – 2025).

This underlines the continued relevance of cow’s milk in the everyday diet, as well as the emphasis that needs to be placed on the naturalness of milk, which is rich in calcium, vitamin D and protein source, as highlighted in our trending dairy products article.

Cereals

Milk features in 95% of all cereal breakfast occasions, the majority of which use cow’s milk, yet cereal is also one of the key sources of decline for milk usage as consumers shift away from traditional cereal consumption due to lifestyle changes or potential concerns around UPFs (Worldpanel by Numerator UK Usage, 52 w/e 15 June 2025).

Tea

The traditional British cup of tea provides a central role for milk consumption, although this has experienced decline due to reduction in consumers drinking traditional tea. Five years ago, 43.2% of the UK population consumed tea in home, compared with 38% in the last year, primarily driven by decrease in the usage of milk in tea (-5.3% YOY) (Worldpanel by Numerator UK Usage, 52 w/e 6 October 2024).

This is mainly driven by consumers shifting towards teas consumed without milk, such as herbal, wellness and fruit teas, especially among consumers aged 65 and above, and those aged 35–54. The rise in popularity of these teas reflects evolving health priorities and demand for functional benefits (Euromonitor International, Hot Drinks 2024).

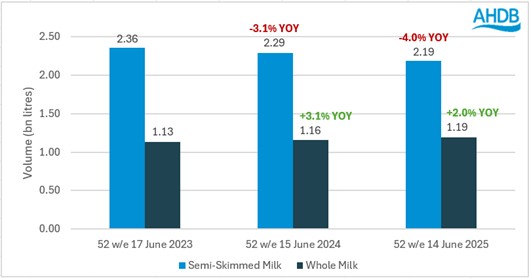

When looking at the impact this has had on cow’s milk usage, there has been a -5.5% reduction in occasions in home (Worldpanel by Numerator UK Usage, 52 w/e 15 June 2025). This shift has had a notable impact on semi-skimmed milk, the most commonly used variety in tea. Volumes fell by 4.4% year-on-year from 2.29bn in 2024 to 2.19bn (Nielsen POD, 52 w/e 14 June 2025), reflecting a gradual year-on-year decline in line with falling tea occasions.

Figure 2: Volume of semi-skimmed vs whole milk 2023–2025

Source: Nielsen POD, 52 w/e 14 June 2025

Coffee

Due to changing lifestyles, 1 in 10 breakfasts are now just a drink, with coffee accounting for 75% of these occasions within the home or carried out (Worldpanel by Numerator UK Usage, 52 w/e 9 June 2024).

This shift is mirrored in the out-of-home market, where coffee shops and cafe channels are seeing increased footfall this year. In 2025, 15.1% of UK adults have a coffee occasion out-of-home each week, an increase of more than 2 percentage points compared to 2022, despite significant price increases in this time (Lumina Intelligence, Eating and Drinking Out Panel, 52 w/e 13 March 2025). This underlines the opportunity for milk to play a central role in helping consumers enjoy coffee-shop style experiences at home at a fraction of the cost.

Key opportunities

- Milk usage in in-home breakfast is down, therefore highlight nutritious, time saving alternatives such as granola or overnight oats for in home or on the go

- Position milk as a key ingredient in helping consumers enjoy affordable, coffee shop-style drinks at home

- Emphasise the functional benefits of milk that align with consumers’ health needs, especially the protein content, vitamins and naturalness

- Reinforce the naturalness and positive health messages of cow’s milk and dairy for younger consumers

To further explore opportunities for milk, AHDB have conducted consumer research focusing on optimising both the milk aisle and milk packaging. Find out more here

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.