How big is the retail market for outdoor pork?

Thursday, 12 September 2019

- AHDB estimates that, last year, 12% of total pig meat volumes sold in GB retail had an outdoor claim on the labelling

- High penetration for outdoor claims is through the popularity of processed pork, which holds 79% of these claims

- Outdoor pork commands a price premium, attracting older, more affluent shoppers

- More information is needed to help consumers better understand the different pig production systems

Pig production systems have clear rules regarding claims:

|

Indoor bred |

These pigs live indoors for the majority of their life. |

|

Outdoor bred |

These pigs are born outside in fields, where they live until weaning (7 kg). |

|

Outdoor reared |

These pigs are born outside in fields, where they are reared for approximately half their life (at least 30 kg). |

|

Free-range |

These pigs are born outside in fields and they remain outside until they are sent for processing. |

|

Organic |

These pigs are born outside in fields and they remain outside until they are sent for processing. Feed must be organic. |

Source: PorkProvenance.co.uk

Supermarkets in GB vary in the claims they support through labelling or public sourcing commitments. AHDB commissioned research to gauge the size of the outdoor-claimed pork market (either outdoor bred or reared) within retail, a current gap in knowledge.

According to Kantar, in the past year, 12% of total pig meat volumes sold, hold an outdoor claim*, equating to 92,000 tonnes (52 w/e 16 June). The majority of the volume sold with an outdoor claim is processed product (79%) – such as sausages, ham and bacon – with only 11% of the volume coming from primary pork cuts (Kantar, 52 w/e 16 June). As household penetration of the processed pork category is high, at 94%, 70% of households have purchased a pork product with an outdoor claim in the past year.

Pork products with outdoor claims command a price premium, being, on average, £2.50/kg more expensive.

Source: Kantar 52 w/e 16 Jun

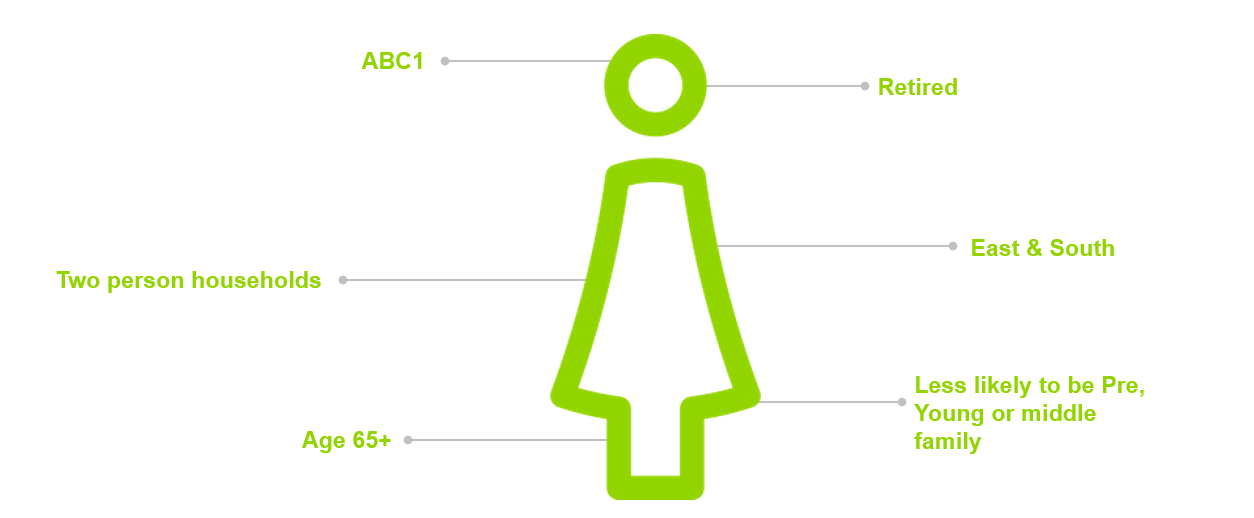

Many outdoor-claimed products sit within premium tiers, therefore typical shoppers for these products are older, more affluent and from smaller households.

Source: Kantar 52 w/e 16 Jun

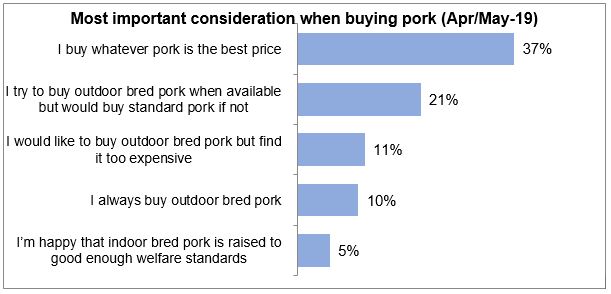

The price premium remains a barrier for some shoppers, with 37% claiming they choose pork purely based on the best price and 11% claiming they would choose outdoor but it is too expensive (AHDB/YouGov Tracker Apr/May19). This also explains why more outdoor-claimed pork is sold on promotion than total pork, at 42% versus 31%.

Source: (AHDB/YouGov Tracker Apr/May19)

Because of the price premium there may be a need for more information about different pork production systems. According to the AHDB/YouGov Tracker, 45% of consumers claim outdoor is important to them when buying pork, but nearly the same number of people (41%) claim they do not know or have an opinion on it. Coupled with this, 48% of consumers claim not to know/care about the difference between outdoor- and indoor-bred production systems (Apr/May19).

The amount of pork sold with an outdoor claim label is lower than the level of production. The producers and supermarkets are free to decide what pork to brand as outdoor. However, it highlights that, if consumer demand increases for outdoor pork, the industry will be able to meet this demand by simply increasing the amount of product labelled as such.

Evidence: AHDB estimates that 40% of British pigs are outdoor-bred and, according to the 2009 Defra Farm Practices Survey, an estimated 2% live outdoors for their whole lives. It is important to recognise that GB retail figures will include imports, with approximately 62% of domestic consumption coming from imported products (AHDB 2018). If we assume that imports don’t carry an outdoor claim, we can estimate that about one-third of UK produce is sold with an outdoor claim,** which highlights a gap to the 42% of production.

This research is the first of its kind and represents a snapshot of the outdoor-labelling claims market. We know that within retail, both free-range and organic are outstripping total growth in the Meat, Fish and Poultry (MFP) category, indicating there may be opportunity to grow outdoor pork. This will be monitored going forward. However, the research also shows that information on the types of production systems may be needed for shoppers, especially considering the price premium it commands.

*The read AHDB has collected is using on-pack outdoor-bred or reared claims (via barcode descriptions), combined with retailer claims, allowing us to understand the consumer-facing view of the outdoor market.

**Considering outdoor volumes sold (12%), versus domestically used production (38%).

Related content

Topics:

Sectors:

Tags: