Environment and buying sustainably drives consumer focus

Thursday, 28 November 2024

During recent years the high cost of living has dominated consumers food purchasing but as this begins to subside environmental factors are growing in importance. So, what are consumers main concerns and how are these affecting their lifestyle and purchasing habits?

Environmental concerns

AHDB ran a Trust study in conjunction with Blue Marble of 2,000 consumers in August 2024. The study showed that food costs, energy prices and the NHS are still really important concerns for consumers, but these levels have decreased over the last year. At the same time, concerns around the environment have increased. Of all the environmental issues explored in this study, consumers are most concerned about the levels of river and sea pollution (48%) compared with plastic waste or global warming (42% and 40% respectively).

This is also confirmed within AHDB Consumer tracker, where 84% of respondents said they are most concerned about the pollution of the water supply (AHDB/YouGov Consumer Tracker, August 2024). This change could be attributed to the increase in news releases around waste discharge into rivers and sea.

How concerned are consumers about the environment?

Source: AHDB/Blue Marble Trust Survey 2024 (no record for river/sea pollution 2019, 2021)

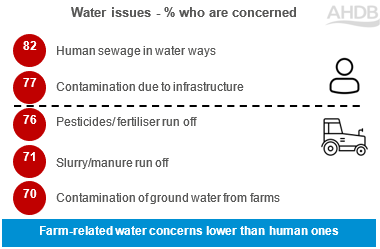

Within the consumer trust study, those respondents expressing concern about water pollution highlighted human related issues, such as sewage (82%) and contamination due to infrastructure (77%), as the largest concern rather than various farm-related issues.

Source: AHDB/Blue Marble Trust Survey 2024

Perception that farming has a positive impact on the environment

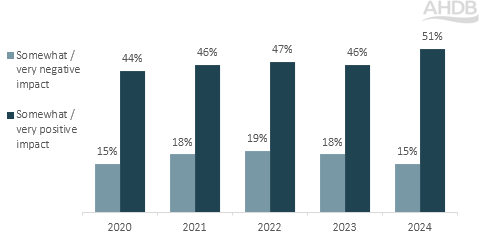

Over the last year, whilst concerns around all environmental issues are rising, it is good to report that perceptions around British farming’s impact on the environment is also improving.

Within the consumer trust study, 51% of consumers perceived that farming has a positive impact on the environment, up from 46% a year ago. This is also backed up by 74% of consumers agreeing that British farmers are doing a good job producing food (AHDB/YouGov, August 2024). It is great to report a really positive sentiment and support surrounding British farming which is boosted by the industry.

How do consumers perceive that farming impacts the environment?

Source: AHDB/Blue Marble Trust Survey 2024

Impact on food choices

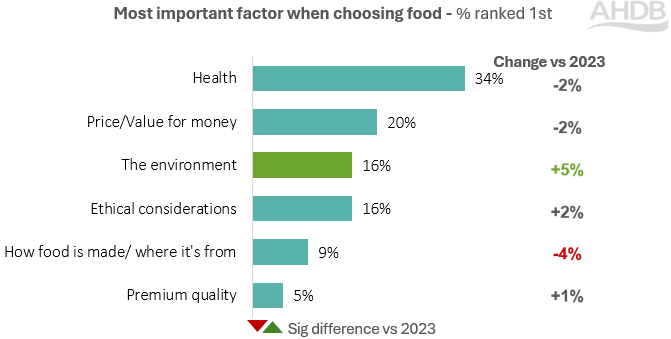

The consumer trust study highlights that health is the top priority when consumers are choosing food (34%), followed by price/value for money at 20%. Both of these measures have reduced slightly this year, whilst selecting food for environmental reasons has increased by 5% showing that consumers are becoming more conscious within their decision making, as worries around cost of living begin to ease.

What is the impact on food purchase?

Source: AHDB/Blue Marble Trust Survey 2024

AHDB understands what consumers say and what they actually do in-store, can differ. While the consumer trust study is attitudinal and conducted pre-purchase, in our AHDB study The Meat Shopper Journey, we found that taste, ease of cooking and price, score the highest when making their purchase in-store.

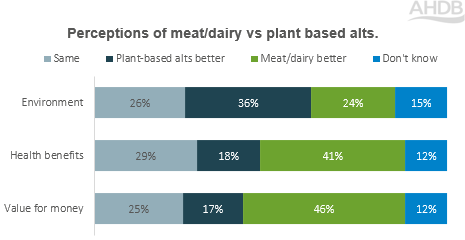

Consumers felt more positive about the impact of meat and dairy on the environment with 24% saying meat and dairy were better for the environment, compared to 21% in 2023. The perception was highest among the Gen Z and Gen Y cohorts.

Source: AHDB/Blue Marble Trust Survey 2024

Buzzwords

With more environmental and climatic changes occurring, it is no surprise that consumers are becoming more aware of their own environmental impact. As an industry, we are aware of a plethora of environmental buzzwords, trying to influence consumer perceptions and reduce their environmental impact. But are consumers aware of these terms and more importantly, do they understand them?

Our research shows us that carbon related terms such as carbon footprint, greenhouse gas emissions, carbon neutral and net zero are relatively well known but levels of understanding and awareness have decreased since 2023. However, understanding and awareness of sustainable production is as well known as these carbon related terms but understanding has improved slightly from 50% to 53%, which reflects an increase since 2023. The younger Millennials and Gen Z (born 1980 or later) are driving understanding in lesser-known terms like regenerative agriculture and ultra processed foods (UPF). In order to drive positive environmental change, the industry needs to highlight and explain the positive attributes of British agriculture.

Environmental sustainability

33% of the respondents agreed they would pay more for foods labelled ‘sustainable’. As part of this research, we dug deeper into consumer views on sustainable food products by conducting a key driver analysis. The results showed a clear correlation towards statements linked to themes such as organic, local, British, unprocessed, seasonal, reduces food waste with a willingness to pay a price premium.

Key drivers of willingness to pay more for food that is labelled as ‘sustainable’

Source: AHDB/Blue Marble Trust Survey 2024

This preference was also confirmed in a separate qualitative study by Blue Marble in 2024 amongst Gen Z consumers, where many consumers expressed a strong desire to buy environmentally sustainable food grown in the UK and a preference to avoid UPFs. It is key to note, that a few of these consumers clarified that their actual purchases both in-store and online, would be determined by the level of price premium added to these sustainable products. Our research shows consumers recognise the benefits of buying sustainable products but are not willing to do this at any cost.

Organic foods are seen as more niche and again, command a premium price. The cost-of-living crisis had an adverse effect on this sector but as pressures start to ease, consumers are reconsidering their organic purchases. In September 2024, we shared the latest trends on organic meat and dairy.

Key implications and opportunities

As highlighted in a previous AHDB article, positivity towards British agriculture and trust in farming is at a six year high. This increased positivity has combined with a greater focus on the environment due to the cost-of-living easing, resulting in a change in consumer’s attitudes and purchasing habits.

This research shows that there is really strong support for buying British, local and unprocessed foods and reducing food waste to reduce their environmental impact. This provides a real opportunity for farmers and the industry to highlight the high quality and sustainability of the products they produce.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: