Dairy – Retail year in review

Monday, 7 February 2022

COVID-19 restrictions easing in 2021 allowed a return to the eating-out market for some consumers, which meant 2021 grocery sales were unable to retain the volumes seen during the height of the pandemic. However, due to price inflation, the market value remained stable at -0.1% (Kantar, 52 w/e 26 Dec 21). So how did dairy fair?

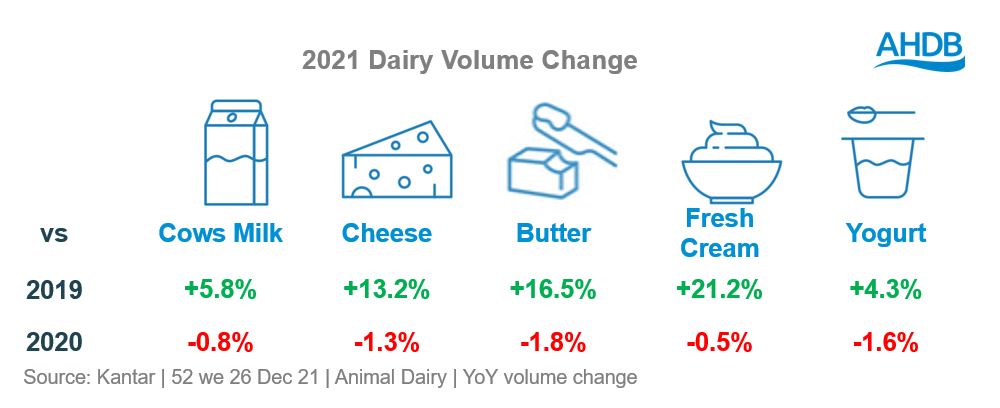

The story for animal dairy is in line with total grocery. Unsurprising as 77% of consumers say dairy is a vital part of their everyday food (AHDB/YouGov, Nov 21), making it a staple in the shopping basket, and reflected in that 99.5% of households shopped the category every month in 2021 (Kantar, 52 w/e 26 Dec 21). Spend in retail is flat year-on-year, while volumes are down -1.2%. When comparing back to pre-pandemic levels (2019), so a more normal time, animal dairy remains significantly elevated at +11.3% in value and +6.3% in volume. The biggest driver of this is existing shoppers buying more per trip to cater for the increased need for in-home food occasions.

As a comparison, dairy alternatives are seeing year-on-year volume growth and increases of 37% versus 2019. However, the market remains small at only 5% of total dairy volumes.

How did each dairy category perform?

In 2021, with foodservice reopening and some consumers returning to the office at least some of the time, cow’s milk has experienced volume declines of -0.8% year-on-year. Hot drinks account for the most milk occasions, followed by cerealswith both seeing the impact of restrictions easing. However, when comparing back to 2019, cow’s milk volumes are up 5.8%, meaning there were an additional 302 million litres more milk sold versus pre-pandemic. Semi-skimmed contributed the most to these volume gains versus 2019 but whole milk was the only milk type to grow year-on-year. Increased in-home occasions pushed larger pack sizes with 4 pints accounting for 46% of growth and 1-2 litres accounting for 43% (Kantar, 52 w/e 26 Dec 21).

According to Kantar, U.H.T and filtered, although much smaller categories, have enjoyed double digit growth versus 2019. Lactofree again showing a strong trend, growing to 2% share of the cow’s milk market in the last year.

Alternatives have grown their share of milk, now standing at 6%, with oat being the only variety to see gains on both 2020 and 2019. Oat now has the largest share of the alternatives market at 34% in 2021 versus 18% in 2019 (Kantar, 52 w/e 26 Dec 21).

With the milk drink market now worth £273 million and volumes up 25% in 2021 versus 2019, there are opportunities for the dairy sector. Branded products are winning here through iced coffees and milkshakes.

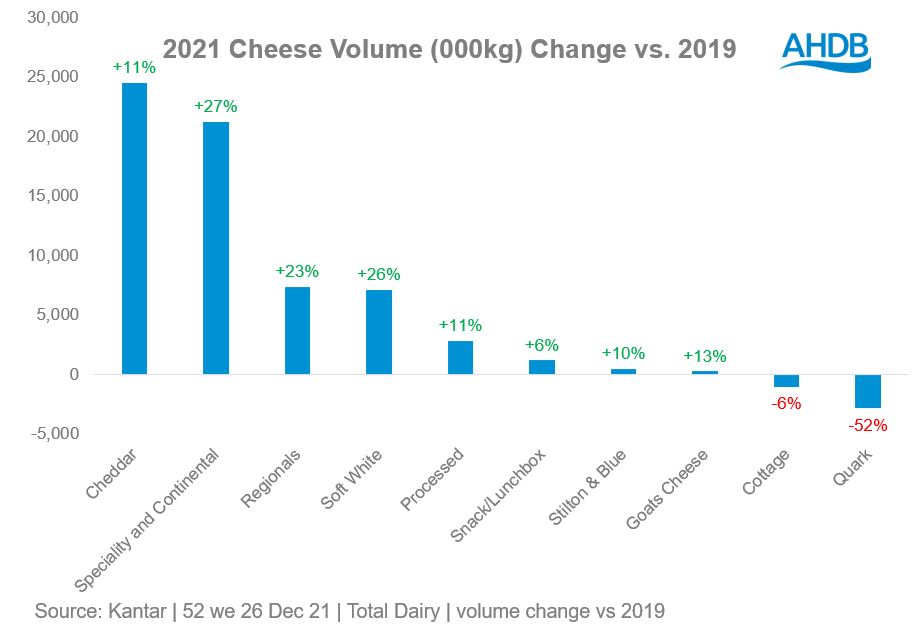

Throughout 2021, cheese (animal based) saw volume declines in retail of -1.3%, with cheddar driving 79% of this as other varieties such as specialities and continentals continued to grow. Despite this cheddar still accounts for 49% of cheese volumes in the last year (Kantar, 52 w/e 26 Dec 21). Compared to 2019, volumes of cheese are up 13.2% showing that the pandemic is still having a strong impact on retail sales. Over half of this (58%) is driven by standard own label ranges which are priced competitively versus branded. Cheddar has gained the most absolute volumes, a substantial amount through mature and extra mature, but speciality and continental saw the fastest growth on pre-pandemic, with mozzarella driving nearly half of this. Red Leicester is performing strongly for British regionals.

Increased cheese occasions during the pandemic came from more evening meals, through cuisines such as Italian and Mexican, lunches through sandwiches, cheese on toast and jacket potatoes, as well as snacking. With more working from home predicted for 2022 the category needs to continue to inspire quick home-made lunches that include cheese.

Butter saw volume declines in retail of -1.8% during 2021. However, it remains significantly elevated compared to pre-pandemic levels, at +16.5%. Spreads and margarines make up three quarters of the BSM market but have lost share since pre-pandemic to both block butter and sunflower/olive/plant based. While spreading remains the key use for yellow fats, block butter will have benefitted from more scratch cooking and baking. However, these are starting to dwindle. Coupled with this, 33% of consumers claim their household finances have been negatively impacted by the pandemic (AHDB/YouGov Consumer Tracker, Nov 21) therefore the lower price point of spreads and margarines, as well as plant-based alternatives, may change the dynamic of the market again in 2022.

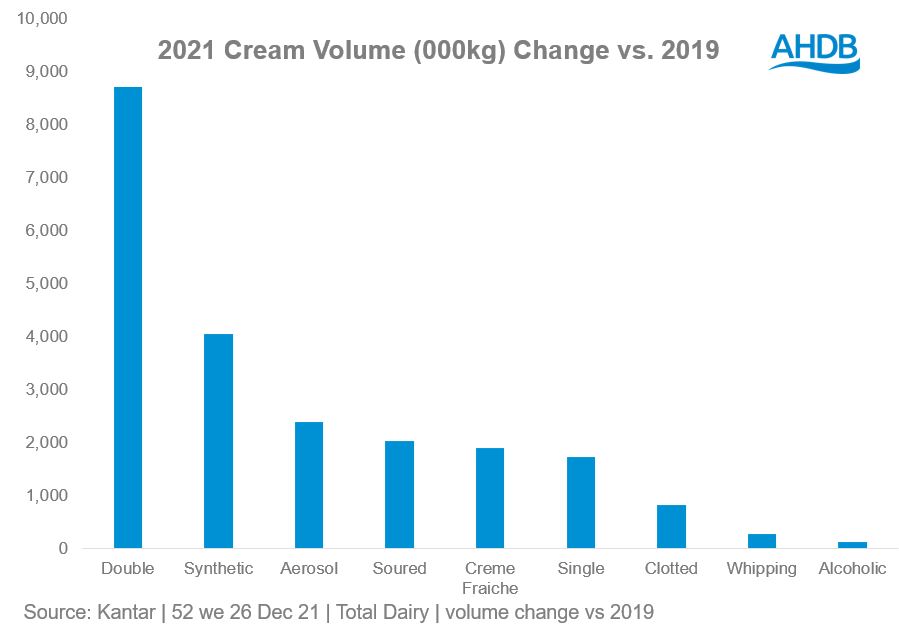

In 2021 fresh (animal based) cream experienced the smallest decline on 2020 with retail volumes down 0.5%, but the most elevated performance compared to pre-pandemic at +21.3%. Cream is predominantly used as a topping (57% of occasions) but its use in savoury cooking has increased year-on-year, now accounting for 29% of occasions, as its use in sweet baking declined as the baking boom subsided (Kantar Usage, 52 w/e 29 Nov 21). Cream is also highly reliant on Christmas, with December accounting for 13% of cream sales in 2021, as consumers look to indulge in the festive month.

Double cream makes up 42% of total cream volumes in 2021 and contributes the biggest growth to the category versus pre-pandemic (although is down year-on-year). Total cream volumes have been boosted by the 92 million cream based Italian and Indian dishes served in home in the 52 w/e 29th November 2021, according to Kantar. These, along with other cuisines such as Mexican, benefit sour cream and crème fraiche which account for 18% of the volume gains versus pre-pandemic. Dessert based creams aerosol, single, whipping and alcoholic are the only creams that see volume gains on 2020, as well as 2019, highlighting that although the country is baking less they have not turned away from desserts.

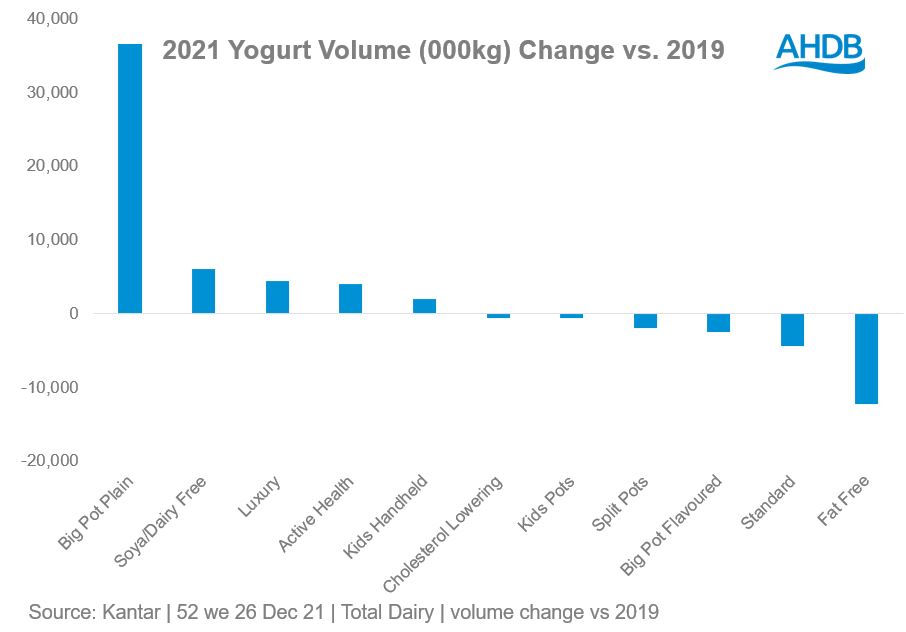

Yogurt (animal based) saw the lowest COVID boost out of the dairy categories with volumes declining 1.6% year-on-year and gains of only 4.3% on 2019. The category suffered from the loss of take-out lunchboxes, as well as a reduction in promotions. Yogurt is typically quite reliant on promotions accounting for 45% of sales in 2019, dropping to 36% in the last year (Kantar, 52 w/e 26 Dec 21). This particularly impacted branded yogurt which saw volume declines on both 2020 and 2019 as shoppers switched to own label potentially due to the lower price point. Despite yogurt seeing the smallest gains on pre-pandemic levels it still equated to 26 million more litres of animal-based yogurt being purchased in retail in 2021 compared to 2019.

67% of the growth for total yogurt versus pre-pandemic is driven by big pots. This is followed by soya/dairy free. As consumers focused less on health during COVID, fat-free has seen significant volume losses over the past two years. However, with health creeping back up the agenda we could start to see an improvement. Despite more carried-out occasions in Q4 of 2021, split pots are yet to see a recovery so lunchbox and snacking use could be pushed.

In stark contrast yogurt drinks (animal based), although a much smaller category, were the fastest growing dairy category in 2021, with retail volumes up 11.8% year on year and up 27% versus pre-pandemic (Kantar, 52 w/e 26 Dec 21).

Going forward

As a staple product, dairy will continue to do well in 2022. However, as 2020 was such an extraordinary year for grocery, growth throughout 2021 has slowed overall as restrictions have eased. Despite this the dairy category remains elevated versus 2019 in retail and we predict this will be the same for 2022. A continuation of more in-home occasions will drive this. However, changed financial situations, coupled with high price inflation, means the category should focus on value for money. As well as this, the dairy industry should aim to address health and sustainability concerns, as according to IGD, the dairy category over indexes versus total grocery on purchase drivers such as healthier options, environmentally friendly packaging and being ethically produced (Category Benchmarks 2021).

For our full predictions please see the latest Agri-market outlook.

To keep up to date with the latest dairy performance please visit the AHDB dairy retail dashboards.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.