Baking boom is over for burnt out home cooks

Wednesday, 17 November 2021

During the first lockdown we saw a baking boom, with many people starting sourdough, baking biscuits and teaching their children to bake while they had time off school. However, with the return to a more normal way of life, many people have now stopped, which has affected home baking and pre-packed flour sales over the last year.

Home baking trends

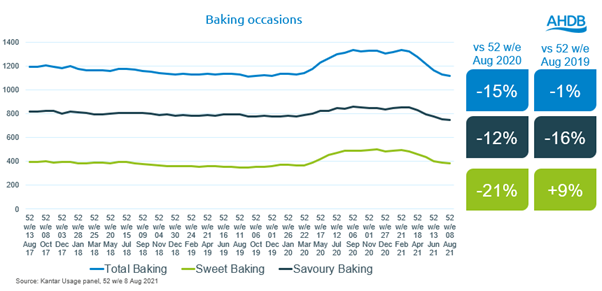

Now as we enter a period of recovery, we have seen the baking trend slow, with 195 million fewer home baked goods in the 52 weeks ending the 8 August 2021 than the same period the year before according to Kantar. This is also 14 million fewer occasions than we saw pre-pandemic in 2019.

Savoury baking has seen a decline of 12% year on year and a drop of 16% compared to 2019, showing many bakers have felt baking fatigue and have greatly reduced the amount they bake (Kantar, 52 w/e 8 Aug 2021). Home-made bread is one of the main drivers of decline, having seen a sharp drop over the last year with 28% fewer meals containing homemade bread than the previous year. Home-made pizzas remain popular with bakers and have seen growth of 5% year on year.

For sweet baking, the decline has been faster than savoury baking, falling 21% over the last year but still remaining heightened compared to 2019, up 9% on pre-pandemic levels. This is a trend we see across sweet treats, with cakes and pastries, pie and crumble and biscuits all falling year on year but still much higher than in 2019 (Kantar, 52 w/e 8 Aug 2021).

Pre-packed flour sales

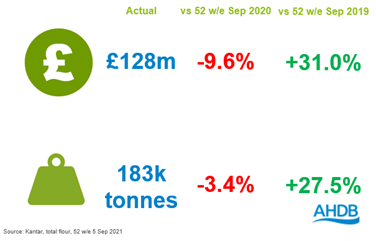

This rise and fall of home baking has had a huge impact on the pre-packed flour market. British shoppers spent £128 million on 183 thousand tonnes of flour in the 52 weeks ending 5 Sep 2021. However, like baking this is down from the heights we saw in 2020, with spend on pre-packed flour declining 9.6% and volumes down 3.4%. Flour sales still remain very positive in comparison to 2019.

The decline in value was steeper than that of volume due to the average price paid for a kilogram of flour being 5 pence cheaper this year than last year, a fall of 6.4%. This was mainly due to shoppers trading up into more expensive flours last year due to supply issues and there being less choice on shelves.

The decline in volumes was driven by a loss of shoppers, with 1.2 million fewer people buying flour this year, a decline of 5.9%. However, 69% of GB households still bought flour over the last year and these loyal flour shoppers actually increased their flour purchases buying 200g more than last year, the equivalent of a 2.7% increase. However, this was not enough to balance out the loss of shoppers.

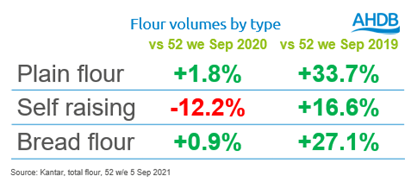

Plain flour makes up the majority of flour sales accounting for 53% of total volumes. This is followed by self-raising flour at 33% and bread flour at 14%. Over the past year, plain flour has gained volumes, up 1.8% but self-raising flour has declined and therefore lost share.

Something we have seen throughout the pandemic is people looking for their products to be more versatile and foods which have multiple uses have done well. Therefore, people may be buying plain flour due to its versatility, as they know you can add baking powder if making a cake.

Opportunities and recommendations

- Research from Mintel suggests to help home bakers stay engaged, 58% think recipe ideas in the aisle would encourage them to bake more. Healthier recipe ideas appeal to 63% of consumers while 76% would like recipe ideas which can help to reduce food waste.

- A key area people are looking to baking companies and brands to solve is products or recipes which can make Instagram perfect confectionery. 60% say products which offer shortcuts to better-looking bakes would appeal (Mintel, 2020).

- Research from IGD shows much fewer impulse buy items for home baking than we see across total grocery. Therefore, getting flour on the shopping list is very important and this means communicating to shoppers while they are at home.

- Taste, quality and price are the three most influential factors when shoppers are buying home-baking ingredients, according to IGD shopper benchmarks, so we need to play on these in communications.

- Ease of use is the fourth most important and one of the only factors which is more important for home baking than the average for total grocery (IGD 2021), This is an opportunity to make sure simplicity is clear for shoppers when they’re at the fixture.

- Flour has lost shoppers over the past year, so encouraging them back to the category would be a welcome boost. Where these shoppers are feeling cooking or baking fatigue, we need to make it as easy and accessible as possible.

- An area where pre-pack flour under indexes is in snacking. Flour is not being used as much as we would expect in snacking, which shows that there is potential to encourage consumers to bake their own. This is potentially a huge opportunity as snacking was the biggest growing meal type, up 16% over the past year with an extra 64 million snacks consumed in Britain each week (Kantar 52 w/e 8 Aug 2021). Snacking also increases during times of economic uncertainty but currently we aren’t baking our own snacks. Encouraging healthy snack recipes could see shoppers switch to homemade.