Coronavirus update: impact of eating-out closures

Monday, 30 March 2020

Key points:

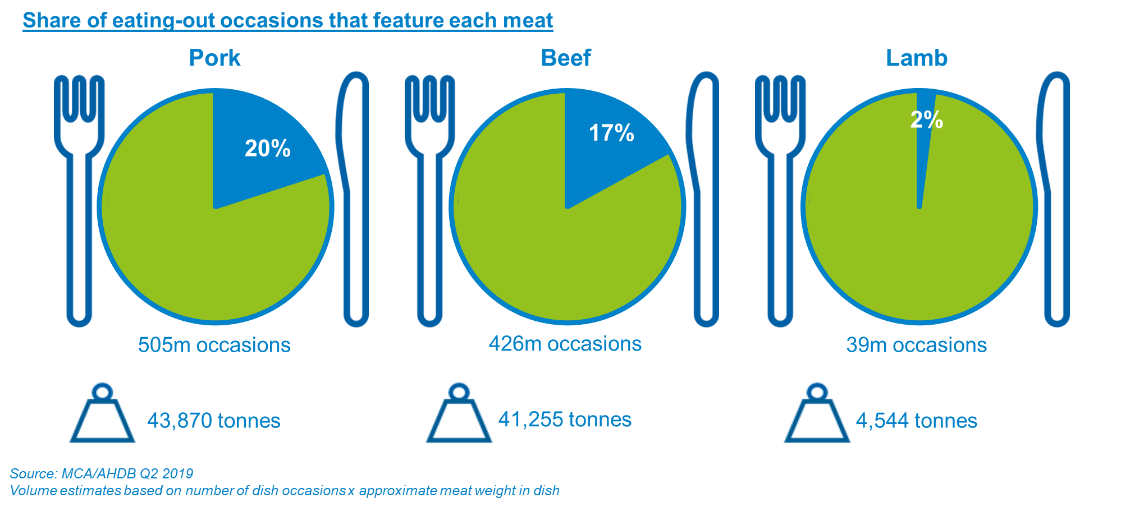

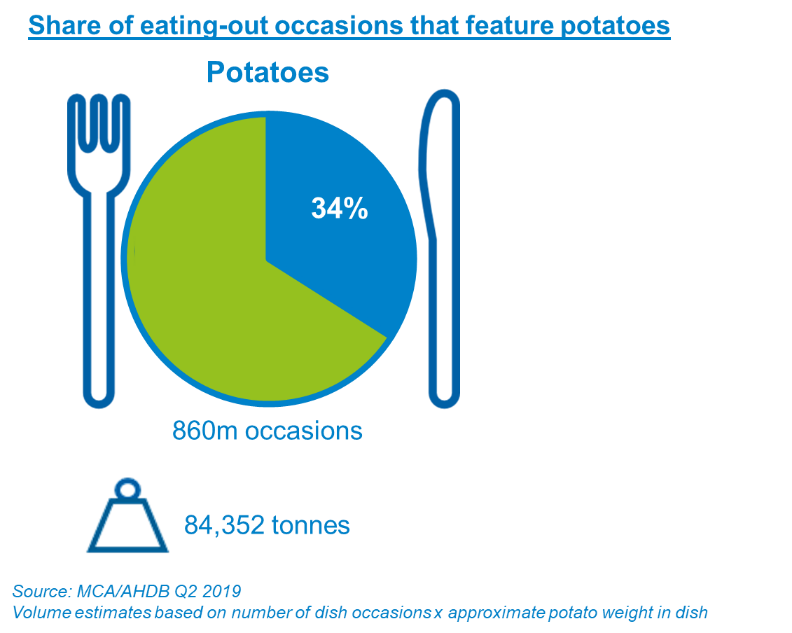

- The eating-out market is an important channel for food sales. For instance, 21% of beef volumes go through eating-out, 15% of lamb, 14% of pork and 13% of potatoes. We know over half of foodservice visits include dairy.

- Food service operators are responding to the forced closure in a range of innovative ways. Many are trying to introduce or increase their home delivery services, but this will not offset expected loses in eating-out.

- There will need to be a significant increase in retail sales to offset the lost volume of sales in eating-out. News coverage suggests that this is happening but at present we do not have hard data to quantify what products are being sold. We will make detailed analysis on this available the week commencing 6 April

How important is the eating-out market?

According to MCA, the UK eating-out market1 was worth £81.1bn in 2019. AHDB estimates that this accounts for approximately 80% of all food service, with the remainder made up of channels such as food delivery and public procurement into schools and hospitals. AHDB have published a detailed review of this market which can be accessed here: Foodservice Review 2019.

Below we touch on the key aspects of eating out in the second quarter of 2019 to understand how this market operates in ‘normal’ conditions:

Red meat

Of the total 2.5 billion eating out occasions, in the quarter, a significant number involved meat and potatoes meaning substantial volumes went through this channel.

Pork featured in a fifth of eating out occasions. Processed pork is particularly important here as the full English breakfast, sausage/bacon sandwiches and sausage rolls are the most popular pork dishes out-of-home. Pork sales rely heavily on pubs, sandwich retailers, coffee shops and fast food with 59% of occasions going through these channels during this time period. These channels will be impacted by coronavirus and despite home delivery still being an option, many big brands have decided to close.

For beef, over half of occasions go through two channels; fast food and pubs. Both relying heavily on burger sales, the most popular beef dish out-of-home. McDonalds have closed all their restaurants, and they alone accounted for 80% of fast food burger occasions last year.

Although 15% of lamb volumes are through eating-out, lamb is present in only 2% of eating-out occasions. However, the good news for lamb is that the most popular dish, curry, will still be available through home delivery, with Indian cuisine being the third most favoured for home delivery (MCA, Delivery Market Report, 2018).

Potatoes

Over one third of eating-out occasions in the quarter involved potatoes. Half of these went through fast food and pubs alone, with chips/wedges and fries being the most popular potato dish. Delivery offers an opportunity for potatoes, with local fish & chips being available via third party delivery services. However, significant brands for the category have closed; the top four including McDonalds, Wetherspoon’s, KFC and Nandos. McDonalds alone accounted for around half of fast food chip occasions.

Dairy

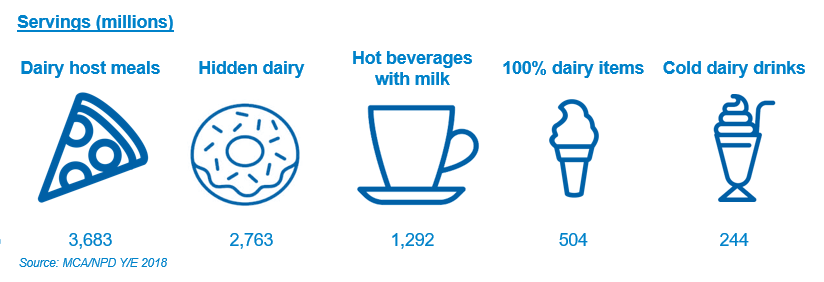

Dairy is also heavily present in foodservice. From our analysis of the market in 2018, we estimated that 51% of meals out involved dairy, equivalent to 8.5 billion servings2. This includes 100% dairy items, dairy host meals, dairy drinks and hidden dairy.

Dairy incidence is highest in quick service coffee outlets, featuring in 72% of visits. One in five dairy servings in quick service coffee outlets is a hot beverage with milk, accounting for a significant volume of liquid milk. McDonalds is a large buyer of UK organic milk, which is used in its bottled milk, hot drinks, cold drinks and McFlurrys. AHDB estimates around 8 million litres of milk is sold per week to foodservice outlets.

Dairy also has high incidence at a number of the top twenty high street chains, particularly pizza shops. A number of these have announced closures in the last week. However, pizza delivery is still an opportunity as Italian is the second most favoured cuisine (MCA, Delivery Market Report, 2018).

How is the market responding?

If establishments want to continue with home delivery this is an option. A study by CGA highlights that over half of the adult population have either already had, or are planning to get a delivery during the coronavirus pandemic (18 March 2020). Some local independents have decided to do this independently using staff that would have previously served to now deliver food. In addition, third party delivery services such as Deliveroo and UberEats have seen brands such as McDonalds suspend partnerships due to closing. This gives more opportunity to support independent restaurants.

For establishments, and their suppliers, that cannot continue to trade we have seen moves to redirect supply. Whether that be to other parts of the food chain such as retailers, or directly to consumers. For instance, Leon restaurants has transformed its UK stores into mini-supermarkets and plans to launch a delivery service.

Conclusions

There is no doubt that foodservice will be negatively impacted by coronavirus. The market is significant in volume terms for the products we have looked at. Whilst operators may offset some of their lost sales through food delivery, we expect the greatest growth will be seen in retail markets.

At this time it may be helpful to discuss the degree of uplift that will be required in retail to offset the losses which are expected. Taking beef as an example, with 21% of volume sales in eating out (around 41,000 tonnes 2019 quarter 2). In very simple terms, which involve making the assumption of no changes in food delivery, retail sales would need to increase by around 27% to completely offset this3. The figure is lower for the other products we have discussed at around 10% for milk, 15% for potatoes, 16% for pork and 18% for lamb. We intend to explore the retail impact as soon as sales data is available.

With such fundamentals occurring between channels we recognise there is impact on farmers and the wider supply chain. The analysts at AHDB are monitoring this and will be regularly providing information. This will be available through are regular publications and can be accessed via the coronavirus area of our website here: https://ahdb.org.uk/coronavirus

Footnotes:

1The eating-out market is defined by MCA as anything eaten out-of-home. Therefore it does not include delivery or takeaways eaten in-home. Their market read excludes free public sector (hospitals, schools, armed forces and prisons), drinks only occasions, under 18’s and tourists. The dairy read commissioned by NPD includes drinks only occasions.

2 Please note AHDB does not continuously purchase out of home dairy data. The NPD data available is for the 2018 calendar year.

3This assumes that other aspects of the market such as food deliveries and public procurement remain unchanged. We have make this assumption due to the lack of data we have on these areas. The uplift figures are the degree of uplift we would need during Q2 2020 in the retail market. We will track this and put out analysis when data is available. Analysis on the uplift for milk has been published here: https://ahdb.org.uk/news/just-how-much-fresh-milk-goes-to-foodservice.