As we emerge from the pandemic how is the dairy sector performing

Thursday, 2 September 2021

2020 saw record-breaking growth in retail for nearly all food sectors and dairy was no exception, rising by 11.4% in value terms last year. As restrictions have eased and the majority of the population is now vaccinated, how has that impacted dairy purchasing habits?

Negative growth in last 12 weeks as we lap 2020’s lockdowns

The latest annual Kantar data (52 weeks to 13th June 2021) shows that total food and drink growth in retail has eased slightly to +8.5%, but dairy is lagging a little way behind at +5.8%. The pandemic pattern of dairy fats including butter, cream and cheese outperforming healthier options like milk and yogurt has continued. Cream remains the star-performer with volumes growing at 12.7% year on year, followed by butter (8.9%), cheese (7.7%) with milk and yogurt bringing up the rear.

However, in the latest 12 week period as we lap past the core growth period of lockdown, the reverse is true and the biggest volume losses are coming from cream and butter as consumer buying habits start to return closer to normal. Milk and yogurt, conversely, are seeing less change.

Out of home market still lagging

In the first 24 weeks of 2021, the food service market continues to be suppressed by Covid legacy behaviours as working from home and reduced socialising continues. While the total eating market value has risen by 1.8% versus last year, it is down by 33.1% compared to 2 years ago. This means that the current patterns are likely to continue for some time.

Lunch continues to be the key battleground

More in-home lunches and hot drinks and snacks at home have been the key engines of change during the pandemic and these key forces are set to continue. Many have not returned full time to the office and many companies are offering a blended model going forwards with some collaborative time in the office and the remainder at home. This will put both on ongoing brake on food service recovery and continue opportunities in retail to provide ingredients for in-home lunch and snacks.

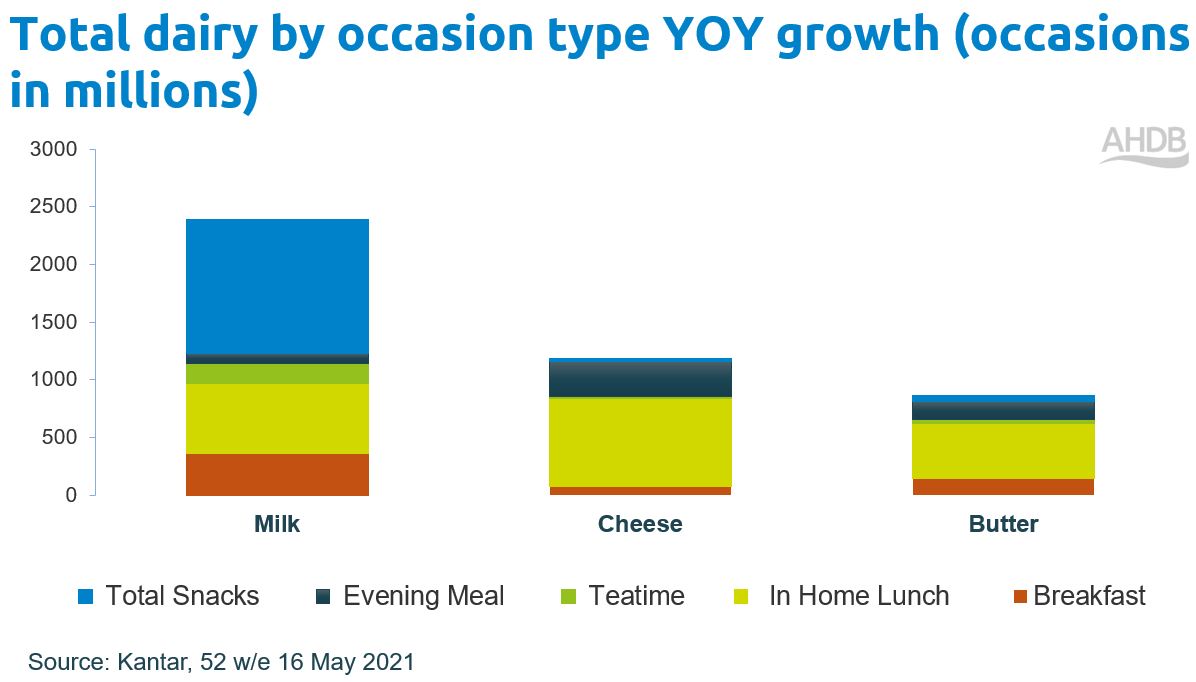

At the in-home lunch occasion alone there have been 761mn more cheese occasions (Source: Kantar, in the 52 weeks to 16 May 2021) and 473mn more of butter. The other really significant change has been the 1160mn more snack occasions for milk, mostly fuelled by all those extra teas and coffees at home. Tea alone accounts for 48% of all milk consumption occasions, coffee a further 28.5%. Milk on cereal is their other significant use at 28.3% of occasions.

Dairy needs to assert its place in the lunchbox

While many consumers expect to work from home more often, we will see a notable return to offices and schools versus 2020. This presents an opportunity for dairy products, particularly as schools return in September. In the 12 weeks to 13 June 2021, there were 100mn more carried out occasions than in the same period last year – which represents an astonishing growth of 465%. Children accounted for 20.3% of these occasions. The products most likely to benefit here are yogurt, cheese and butter and spreads. This is a particularly important opportunity for yogurt which has under-performed in retail during the pandemic.

Health and convenience will be key needs to address

Scratch cooking was an area in key growth before and during the pandemic as consumers became more engaged with food and also wanted to save money. 2020 saw an acceleration of that trend as we found ourselves with more time to cook, bringing benefits to all dairy categories but particularly cheese which saw an uplift of 138mn occasions, accounting for 16% of scratch cooked meals using cheese (Source: Kantar 52 w/e to 16 May 2021). Butter, cream and yogurt also saw good uplifts. As the economic effects of the pandemic start to bite, this will favour more scratch cooking for some, particularly families.

However, there are now signs that the growth has peaked as people start to return to work. Ease of preparation has returned as a priority when cooking - growing from 18.6% in the first lockdown to 20.5% in the latest period. Innovation in products that can aid in cooking and helping to assemble convenient meals should do well.

As we return to normality, health, rather than indulgence, is coming back up the agenda for many consumers. In recent years dairy has been at a disadvantage as consumers have seen it as slightly less healthy. We should counter these impressions by highlighting the health benefits of low-fat dairy products such as containing calcium, vitamin B12 or iodine and also continue to innovate in more health focussed products. Yogurt and yogurt drinks have a strong claim to target health needs – consumers see yogurt as offering health benefits, being natural and lower in fat/salt/sugar compared to other dairy products. However, most dairy sectors can tap into the health need with higher protein, lower fat claims or highlighting specific nutrients.

For more on consumer attitudes towards health please see our latest report.

Conclusion

The next few months, although challenging due to uncertainty, also present many market opportunities for dairy producers and processors to capitalise on.

- Cheese is well placed to tap into in –home lunch occasions, scratch cooking and lunchboxes.

- Yogurt should seek to become THE go-to snack in the home and in lunchboxes, and should particularly emphasize health focussed lines

- As with cheese, butter will benefit from continuing growth in sandwiches. However, price could become a factor as consumers face more economic pressure

- Cream could face a more challenging few months as home baking and indulgence decline. However, there is potential for a big Christmas as families get together without restrictions. Ensure NPD taps into these sentiments.

For more on the outlook for dairy and other markets please see the AHDB Agri-market outlook

Related content

Topics:

Sectors:

.JPG)