Carbon markets insight: Grain market daily

Friday, 24 February 2023

Market commentary

- UK feed wheat futures (May-23) gained £1.60/t yesterday, to close at £233.60/t. New-crop futures (Nov-23) gained £2.10/t over the same period, to close at £234.00/t.

- Domestic markets followed European wheat markets higher yesterday, as buyers saw an opportunity after Paris wheat futures (May-23) hit a four-week low on Wednesday, pressured by competitive Russian wheat picking up global demand.

- A lack of news on the Black Sea Initiative renewal (Ukrainian grain export corridor) continues to support prices too, as today marks a year since Russia invaded Ukraine. The initiative is due for renewal on 19 Mar.

- Chicago maize futures (May-23) fell $5.90/t yesterday (2%), to close at $259.55/t. The lowest point in 6 weeks. Pressure was felt on markets following yesterday’s US planting data release for 2023/24.

- Paris rapeseed futures (May-23) fell €13.50/t yesterday, to close at €544.50/t. This followed weakness in Chicago soyabeans and soy oil, on yesterday’s announcement of a record US soyabean crop due next season (2023/24), if realised.

- Australian rapeseed export campaign is strong according to Australian Bureau of Statistics data. In December, 884Kt of canola (rapeseed) is set to have been exported, a new monthly record.

Carbon markets insight

The agriculture policy environment is changing. As such, businesses will need to balance business profitability with environmental sustainability going forward.

There are many reasons to learn more about carbon markets, including the net zero commitments across industry, and tangible on-farm benefits to building carbon stocks and reducing greenhouse gas (GHG) emissions.

The AHDB have recently produced articles on why should famers care more about carbons markets, what is the value and an explainer between the compliance (compulsory) market and voluntary market. Building up knowledge across this developing area is essential.

Today, we look at Charlotte’s in-depth explainer on regulated carbon markets.

Understanding regulated carbon markets

Carbon markets are beginning to create quite the stir across multiple sectors, not least in agriculture. AHDB has been looking at the implications of different environmental schemes and what this means for the future of farming, of which the industry challenges and opportunities were summarised by our former head of environment Jon Foot in his Carbon Outlook. Whilst carbon markets have significant environmental implications, they also have economic ones which we have started to analyse. Recently we have summarised information on the importance, value and the types of carbon markets available, as well as in our analysis of the recently updated SFI standards, and potential impacts of the UK ETS for agriculture.

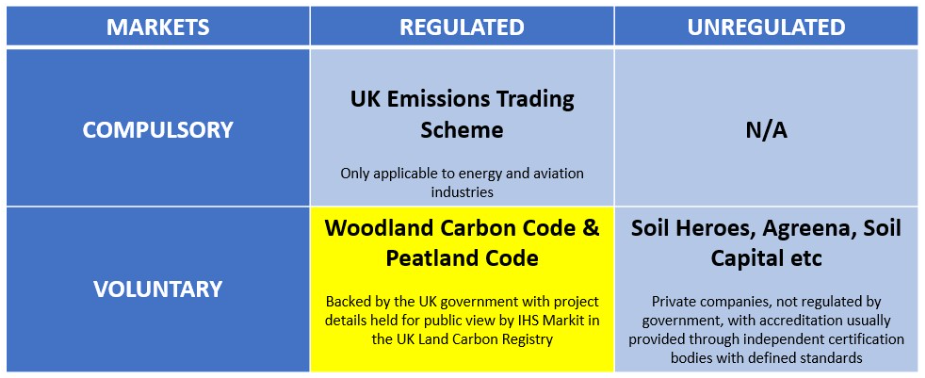

Regulated or unregulated?

Within the carbon market, there are both regulated and unregulated schemes available for generating additional income for sequestering carbon. In regulated markets, the government establish a regulatory body, which has the function of ensuring compliance within annual rules and limits. The regulator also determines the minimum price for carbon credits. At present the two main regulated schemes in the UK which affect land managers are the Woodland Carbon Code (WCC) and the Peatland Code (PC). We will explore the unregulated carbon schemes in later articles.

Woodland Carbon Code

The potential of woodlands to help reduce CO₂ emissions is becoming increasingly understood, with afforestation regarded as having the ability to reduce climate change over the longer term. Woodlands can also help to increase biodiversity by providing shade, shelter, and erosion protection for wildlife.

The Woodland Carbon Code, first launched in 2011 as a quality assurance standard for creating woodland in the UK. Its aim is to create high integrity, independently verified carbon credits that are backed by government, the forest industry, and carbon market specialists. It is a voluntary code, designed to help individuals and businesses wishing to contribute to tree planting to help offset the carbon they emit, with contracts lasting between 35 – 100 years. It’s main aim is to contribute to the UK’s national targets for reducing greenhouse gas emissions to Net Zero by 2050. Purchasing carbon credits from WCC projects allows companies to compensate for their UK based emissions, however, it excludes any emissions from overseas, international travel, or shipping.

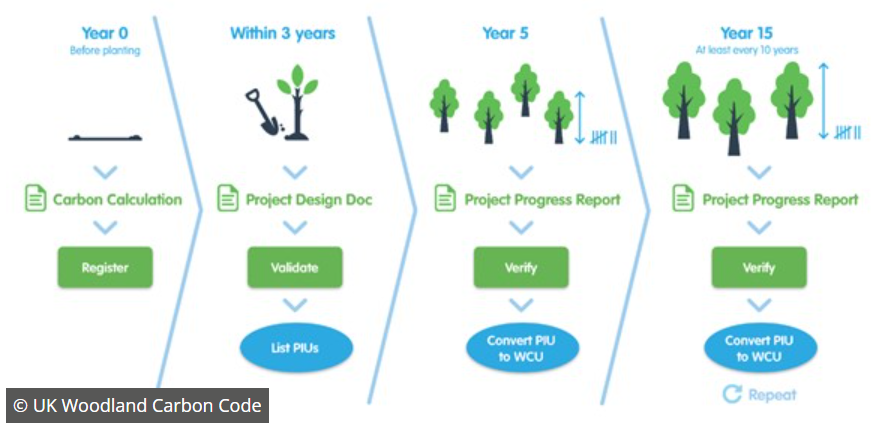

New woodlands which meet the standards set out by the WCC can provide additional or alternative streams of income to the agricultural industry. There are two ways in which income can be generated: upfront with the sale of Pending Issuance Units (PIUs), or as future income as Woodland Carbon Units (WCUs). WCUs relate to an actual tonnes of CO₂e which have been sequestered by WCC verified woodland, and are considered as full carbon credits. PIUs on the other hand are designed to demonstrate the quantity of potential future sequestration, however as they are based on predicted sequestration rather than actual and are not able to be used to offset a company’s emissions. Frequently, companies purchase them to compensate for future emissions, or to make credible corporate social responsibility claims. After a validation period, PIUs are turned into WCUs, and any which have been already purchased are retired, meaning that they are unable to be sold twice. At present, PIUs are reportedly sold for between £10-£20 per tonne CO₂e, and whilst some WCUs have been sold, due to the longer timeframe required to verify actual sequestration levels have been attained there is limited price data available to indicate how prices may differ.

For more information or to find out if you are eligible to register, click here to be redirected to the Woodland Carbon Code website, and here to see the Government’s Woodland Carbon Guarantee.

Peatland Code

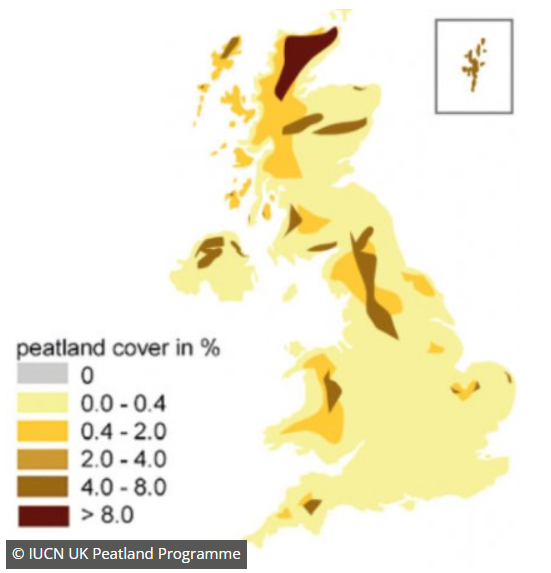

Peatlands, also known as moors, bogs, mires, and fens are. carbon rich soils, formed by dead and decaying plant material under waterlogged conditions. Peatlands cover just 3% of the worlds surface, however, hold nearly 30% of soil carbon. They are the largest terrestrial carbon holder, storing at least 550 gigatonnes of carbon globally- almost twice the amount of carbon stored in all the world’s forests. In addition to this, they support vast biodiversity, alongside supporting and regulating water flows and catchments for drinking water.

At present, the majority of the UK’s peatlands are no longer sequestering and storing carbon due to decades of unsuitable land management practices. They are instead emitting approximately 16 million tonnes of CO2 each year. Preventing further damage and restoring peatlands therefore plays an important role in climate regulations in the UK.

The Peatland Code is a voluntary standard for UK peatland projects, whereby investors in restoration projects can make carbon savings. This is done through emissions reductions by purchasing real, quantifiable, and permanent credits. Projects are for clearly defined durations, with a minimum 30 year commitment. The vision is to prevent further loss of peatland ecosystems, which are depleting by approximately 1cm depth per year without intervention. The Peatland code sets out a series of best practice requirements, and a standard method for quantification of greenhouse gas benefit. Funding is obtained from the sale of PIUs, which sell for between £15-£25. Peatland carbon credits (PCUs) are only available once a project has been verified, which is 5 years after peatland has been restored. At present there are no verified projects, therefore the price of PCUs is not yet known.

For more information or to find out if you are eligible to register, click here to be redirected to the Peatland Programme website.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.