Large US crop outlook for 2023/24: Grain market daily

Thursday, 23 February 2023

Market commentary

- May-23 UK feed wheat futures closed at a three-week low yesterday of £232.00/t, down £4.25/t from Tuesdays close. The Nov-23 contract also lost ground, closing at £231.90/t, down £4.10/t over the same period.

- Global and domestic markets were pressured yet again yesterday by competitive Russian supplies, with Russian wheat the cheapest to be offered for the latest Egyptian tender. The most expensive offer, and the only one not from the Black Sea, came from France. After close of trade yesterday, Egypt’s state grain buyer GASC, booked 240Kt of Russian wheat.

- Paris rapeseed futures prices (May-23) settled at €558.00/t yesterday, down €2.75/t from Tuesdays close. Beneficial rains across parts of Argentina weighed on soyabean markets yesterday, pressuring the wider oilseed complex too.

Large US crop outlook for 2023/24

Today is the first day of the 99th USDA Agricultural Outlook Forum (AOF). As part of the AOF, earlier today the USDA released outlooks for the coming season, including projections for US wheat, maize and soyabean supply and demand for the 2023/24 season.

Below is an overview of the key findings from today’s release for wheat, maize and soyabeans.

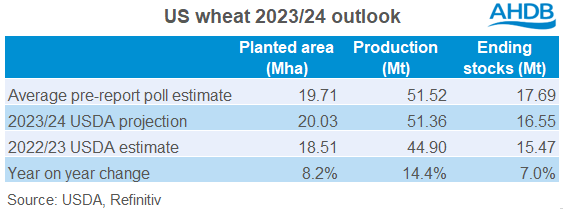

Wheat

The outlook for US wheat supply and demand for the coming season is one of bigger supply, strong demand, and a slight uplift in carry out stocks.

The US wheat area for harvest 2023 is initially projected to be 20.03Mha, which is marginally higher than the average trade estimate from a Refinitiv pre report poll of 19.71Mha. Compared with the area planted for harvest 2022, 2023’s projection is 8% higher and would be the largest wheat area since 2016 if realised. In terms of production, the USDA are initially projecting output at 51.36Mt, broadly in line with the pre report poll average of 51.52Mt and 6.45Mt up on the year. End-season stocks for 2023/24 are projected at 16.55Mt, which is 1.14Mt lower than the pre report poll average, but within the estimate range of 13.96-21.23Mt. Compared with 2022/23, ending stocks are 1.08Mt higher.

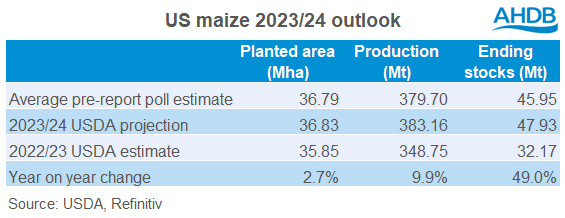

Maize

In 2023/24, the outlook for US maize is for larger output outweighing an uptick in usage and exports, leading to bigger end-season stocks.

The area planted to maize is projected at 36.83Mha, relatively in line with the 36.79Mha average estimate from the Refinitiv pre report poll. With an increase in area on the year and projected yields, US maize production is pegged at 383.16Mt, 3.45Mt above the average pre report estimate. If realised this would be the second largest US maize crop on record, behind 2016/17. With such a large crop projected, ending stocks are initially forecast at 47.93Mt, nearly 2Mt higher than the pre report poll average estimate and nearly 16Mt higher than what is currently estimated for 2022/23.

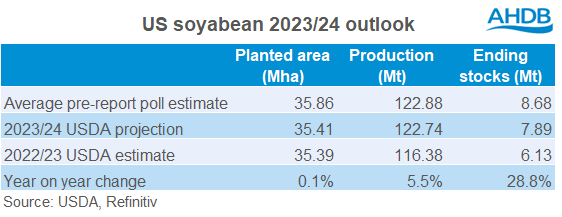

Soyabeans

Like with wheat and maize, the outlook for US soyabeans for 2023/24 is one of higher supply and usage and exports, but also end-season stocks.

The area planted to soyabeans for 2023/24 is projected at 35.41Mha, which is slightly lower than the pre-report poll average estimate of 35.86Mha. Soyabean production is pegged at 122.74Mt, which is broadly in line with the pre report poll average estimate of 122.88Mt and if realised would be the biggest US crop on record. Despite a rise in usage and exports projected, US ending stocks are expected to grow to 7.89Mt.

What does this mean?

Its important to note that these are the first projections for 2023/24 US supply and demand and a lot can change between now and the crops actually being harvested, with the full impact of the extreme cold/dry conditions on the wheat crop yet to be fully known. However, with a global grain market that is already being weighed on by more than ample Russian supplies, a possible record South American maize crop and recessionary fears, these initial US projections from a grain perspective may add to the pressure. Likewise, for soyabeans, with this record Brazilian crop expected to outweigh any Argentinian loses, a record US crop could also add some pressure to the oilseed complex.

The USDA will release its updated US projections, and first global estimates for the 2023/24 season, in its World Agricultural Supply and Demand Estimates in May.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.