Beef market update: GB cattle prices ease into November

Friday, 10 November 2023

Key points

- The GB deadweight all-prime cattle price eased by 2.2p in the final week of October

- The GB deadweight all cow price declined by 9.3p in the final week of October

- Prices were influenced by movements in Irish markets, domestic slaughter levels and subdued consumer demand, causing downward pressure to the market

- Carcase weights remain lighter against last year, reflecting challenging weather

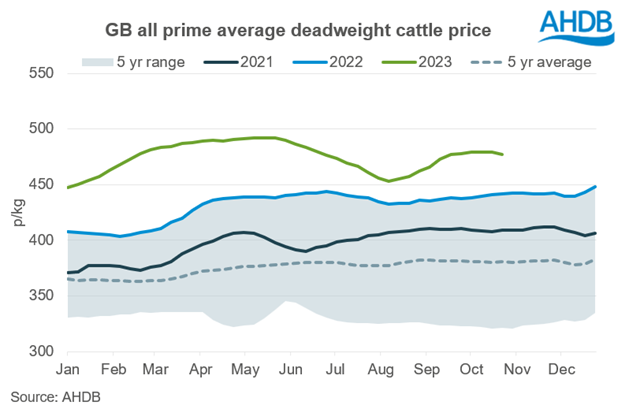

Deadweight cattle prices have plateaued in October following increases throughout September. Prices peaked in mid-October and have eased into November with the all-prime average price currently stood at £476.6p/kg for the week ending 4 November. This was a 34p climb compared to the same period in 2022.

Irish cattle price movements have likely added downward pressure to those seen in GB. In the week beginning 23 October, the Irish R3 steer price averaged 398.7p/kg, sitting 89.7p below the GB R3 steer price. An increase in Irish slaughter rates has been anticipated for Q4, with population data suggesting a larger number of older prime cattle on-farm. With an increasing Irish kill rate noted through October, plus the current price differential, this is likely to have maintained the incentive to source Irish product.

.jpg)

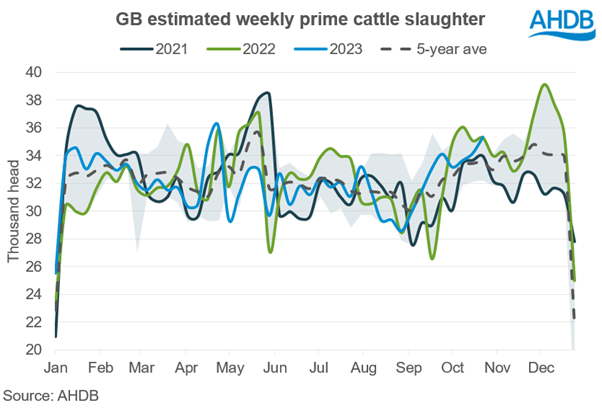

Data indicates an increase in GB slaughter rates recently, with AHDB estimated prime cattle slaughter currently following an upward trend, with rates reaching the same level as record figures seen last year. Meanwhile, average carcase weights have remained lower in September at 340.3kg, down 0.4% (-1.5kg) year-on-year. Market reports have suggested increased occurrence of leaner cattle this year, potentially reflective of unsettled weather resulting in poorer grazing ability and variable silage quality. The increasing influence of dairy beef could also be contributing to lower weights on a longer-term basis.

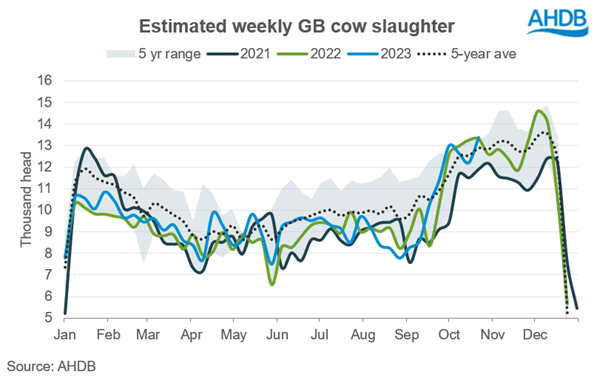

GB cow slaughter figures are following suit, also reaching the highest rates of slaughter seen so far this year as space is freed up in sheds as cattle move indoors for the winter. Cow prices have generally seen more pressure since the summer, deepening their discount to prime cattle. Market reports suggest there are ample supplies of manufacturing beef in Europe for current demand levels, following a lacklustre summer. Indeed, wholesale values for VL material have shown downward movement through this time.

GB retail demand data shows that in the 12 weeks to 1 October, household beef purchase levels have declined by 1.0% (in volume) compared to figures seen last year, with a rise in prices. Burgers and grills have driven most of the annual volume decline.

Elsewhere in the cattle trade, store prices remain at elevated levels, but have shown downward movement in recent weeks. Prices rallied through the summer as numbers were generally shorter year-on-year, while forage supplies and growth in finished values potentially aided confidence. Recently store values seem to have reached a ceiling and have moved downwards; more cattle have moved through store sales in recent weeks, with reports of variable quality due to poor weather.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: