- Home

- News

- Beef market update: Another strong year for Australian beef, but what could this mean for the UK?

Beef market update: Another strong year for Australian beef, but what could this mean for the UK?

Thursday, 27 March 2025

Australia is expected to experience another year of record beef production levels in 2025. As a major player on the global marketplace, with multiple free trade agreements (including the UK) this stands to impact all beef producing and consuming countries.

Key Points:

- Australian beef production hit record levels in 2024 and is anticipated to increase a further 2% in 2025.

- The United States has become the prime destination for Australian beef exports as Australia continues to diversify export markets away from China.

- Although Australian beef exports to the UK have increased, the quota introduced under the UK-Australia Free Trade Agreement (FTA) is being significantly underutilised.

Production

Australia had a strong year for beef production in 2024, producing a record 2.57 million tonnes and exporting record volumes and values of beef around the world.

The total cattle herd has been growing since 2020 and peaked at 30.6 million head in 2023, with populations remaining relatively stable throughout 2024, falling only 0.1% year-on-year.

In 2025, the Australian herd is anticipated to enter a destocking phase of the cattle cycle as climatic conditions impact producers in the south, pushing production volumes up even further. MLA estimate that in 2025, production will increase by 2% to 2.62 million tonnes.

Therefore, there is potential for more Australian beef to be available on the global market throughout 2025, whilst other major cattle producers like the US and Brazil are facing reductions.

Exports

Total Australian beef exports were valued at £7.9 billion in 2024, up 17% from 2023.

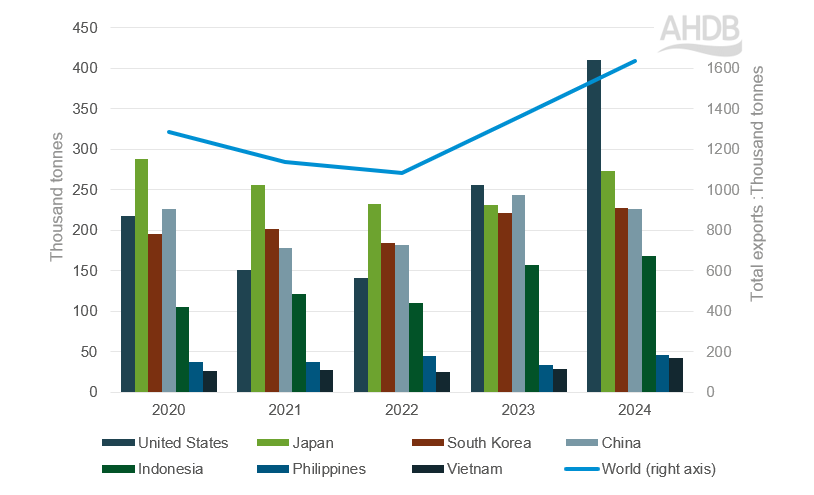

Over the past five years not only have Australian beef export volumes grown reaching 1.6 million tonnes in 2024 (rising 20% compared to year earlier volumes), but the predominant destinations for products have also changed.

The data shows a marked pivot away from China and a diversification of export recipients. In 2019, 23% of all Australian beef exports were destined for China, whereas in 2024 this proportion was reduced to 14%.

Australian beef exports by destination

Source: TDM LLC

Most noticeably, volumes to the United States have increased significantly over the past 2 years, increasing by 61% between 2023 and 2024 alone. This is in line with supply tightness and sustained demand in the US which is expected to remain into the future.

UK – Australia trade

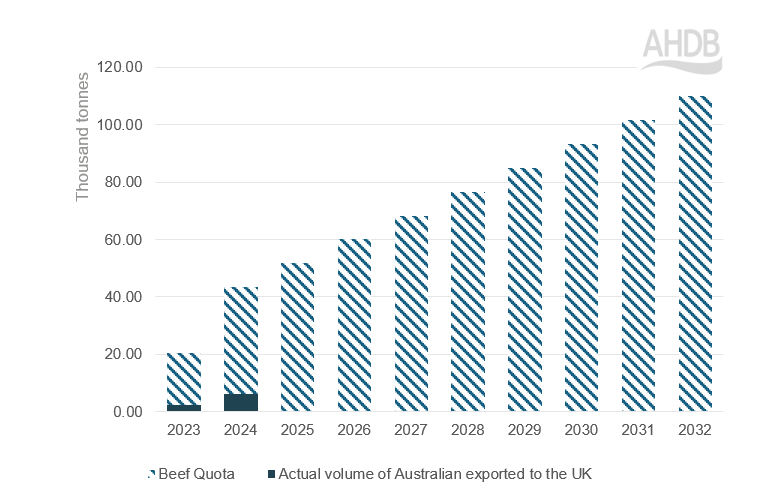

As a part of the diversification of export markets, in 2023 the UK-Australia free trade agreement entered into force. Previously Australia only had access to the post Brexit arrangement of the split quota between the UK and the EU, which works out at 3,761 tonnes a year.

Indeed, under this new FTA agreement more Australian beef has entered the UK with volumes totalling approximately 5,500 tonnes in 2024 up 180% year on year and valuing £46.8 million.

Australia beef quota fulfilment under the UK-Australia FTA

Source: Australian Government DAFF and TDM LLC

However, it should also be noted that currently Australia is currently significantly under-utilising its available beef quota introduced under the FTA. In 2023 Australia only fulfilled 11% of its 20,600 tonne quota, increasing only to 15% in of its 43,300tonne quota in 2024.

This growth appears to be continuing. In the first month of 2025 Australian imports were up by 436 tonnes (185%) from January last year, but still only contributing 3% of total UK beef imports. As the quota increases over the next eight years it will be important to monitor these volumes and their impacts on the domestic market.

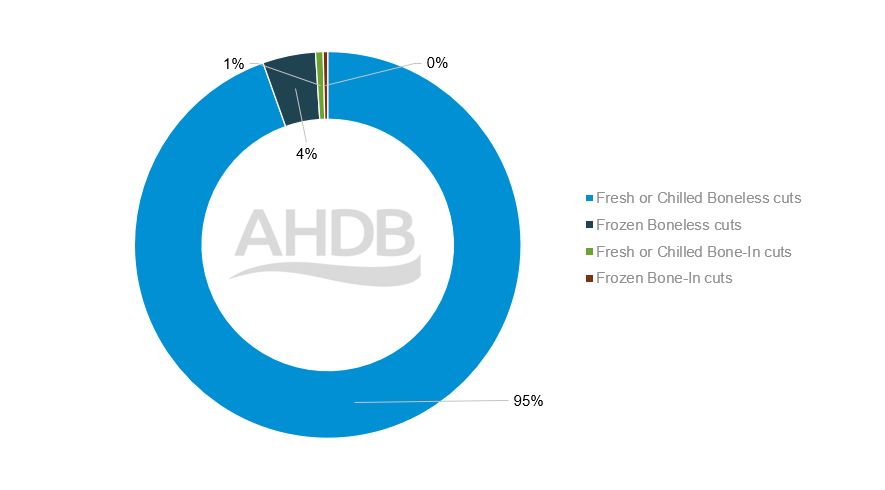

Products

Australian beef exports are incredibly diverse and exported products vary significantly depending on their destination. For example, China receives a higher proportion of frozen offal and manufacturing beef compared to the US which receives predominantly fresh and frozen boneless cuts, with a specific focus on grass-fed messaging. This reflects the differences in consumer preferences between these countries.

Focusing in on the UK, 95% of Australian beef imports into the UK are fresh boneless cuts (i.e. steaks) indicating the consumer preference for these higher value products.

Australian beef products exported to the UK 2024

Source: TDM LLC

Conclusion

There is a significant price differential between Australian and UK beef, with Australian deadweight steer prices £3.48/kg lower in the week ending 14th March. This, coupled with higher availability of Australian product, could incentivise greater imports into the UK.

However, the UK remains a relatively small market for Australian beef, taking only 0.4% of total export volumes and accounting for 0.6% of total beef export value. With global beef supply tight and demand high, larger markets such as the US and Asia are likely to continue to dominate Australian exports.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.