Beef and Lamb: January trade update

Friday, 21 March 2025

High domestic prices have limited growth in export volumes for both beef and lamb in the first month of 2025. Meanwhile, imports show a far more mixed picture between the sectors, with beef imports down and lamb imports up.

Key Points:

- January beef import volumes fell on the year, driven mostly by a 23% (4,700 tonnes) drop in volume from Ireland.

- Beef exports have risen by 7% in value but decreased 11% in volume, reflecting the elevated domestic prices.

- Reduced domestic sheep slaughtering in the month of January have increased import volumes which are up 7% on last year January volumes.

- Australian beef and lamb continued to gain market share of UK imports.

Beef

Imports

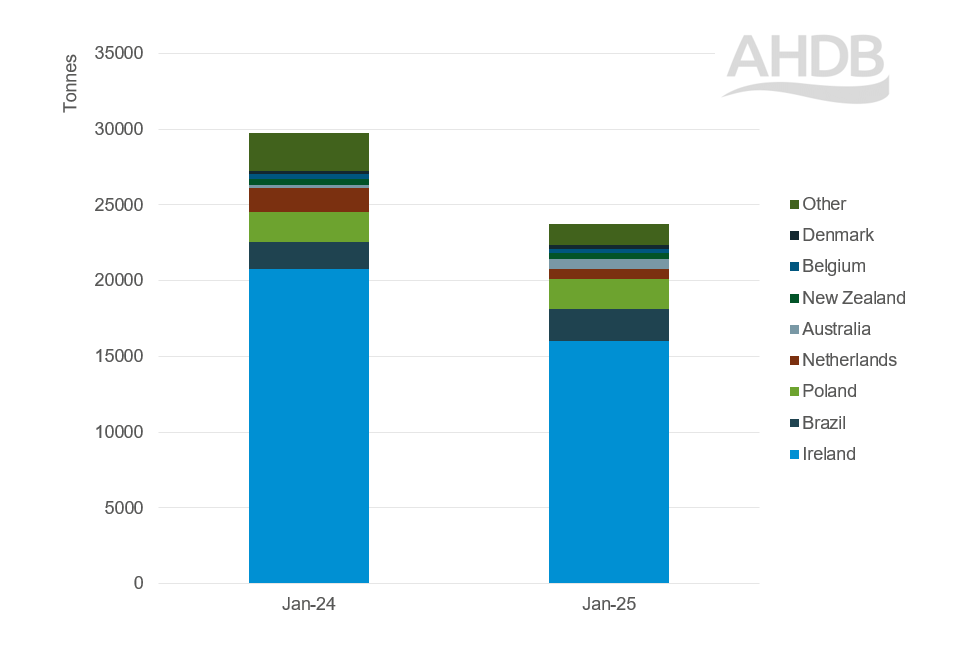

Beef imports appear to have slowed at the start of this year, with the value down 11% to £141million and down 20% in volume to 23,700 tonnes compared to last years’ elevated volumes. Contributing to this overall fall, notable decreases have been seen in Irish imports, down by 23% in volume compared to year earlier levels, which considering the current price differential indicates a tightness of supply in Ireland.

However, there was an increase in beef imports from some countries. Australian imports were up by 436 tonnes (185%) from January last year, continuing the trend of increasing volumes, but still only contributing 3% of total UK beef imports.

Brazilian beef made up 9% of UK beef imports in January, with an 18% year on year increase in volume to 2,000 tonnes. This could be due to the increased availability of Brazilian beef on the market as South American producers reportedly prioritise export markets over domestic sales.

UK beef imports by supplier January 2024/2025

Source: UK HMRC compiled by TDM LLC

Source: UK HMRC compiled by TDM LLC

Exports

The total export value of UK beef was up 7% in January 2025 to £54.2 million, however volumes decreased by 11% compared to the same period last year, reflecting the high domestic beef price.

Primary destinations for beef exports continue to be the EU states of France, Ireland, Italy and the Netherlands; with these four states representing 77% of the UK’s beef export value in January.

Lamb

Imports

The January sheep meat trade data tells a slightly different story; the total value of sheep meat imports is up 15% from January last year to £23.8 million, with a corresponding 7% increase in volumes to 4,800 tonnes. This increase in import volumes can be attributed to supporting supply, with lower domestic sheep slaughter numbers at the end of 2024 and the very start of 2025.

New Zealand and Australian imports continue to provide the bulk of sheep meat imports and appear to be increasing. Indeed, sheep meat imports from New Zealand grew by 12% on January last year volumes to 2,800 tonnes, whilst Australian imports rose to 1,200 tonnes, representing a 30% increase on last year January volumes.

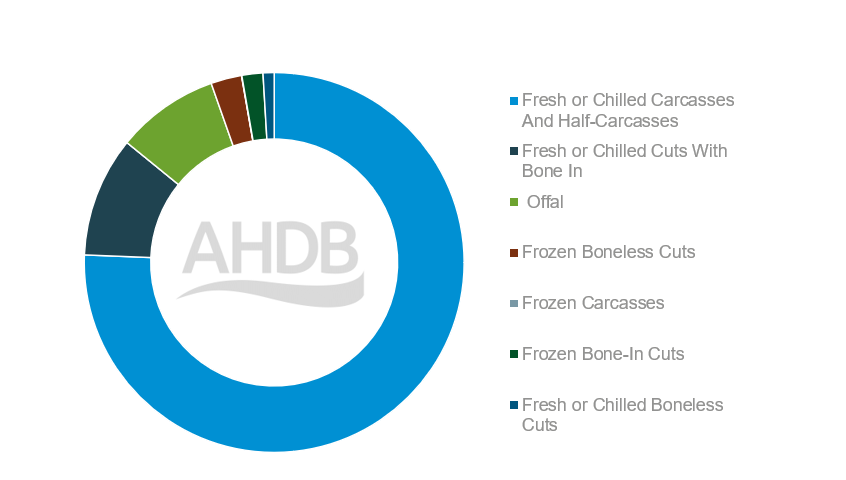

In terms of products there has been a 13% increase in the volume of frozen bone-in cuts (e.g. legs) and a 34% increase in volumes of frozen boneless cuts (e.g. steaks). Frozen bone in cuts are the most popular cut in terms of imported volumes with 1,900 tonnes being imported in Jan 2025 alone. There has also been a marked increase (65%) in the volume of offal imports totalling 700 tonnes, with Australia and New Zealand driving volumes.

Exports

The value of sheep meat exports is up 18% y-o-y to £ 53.7 million, meanwhile volumes remain level increasing by only 2% (170 tonnes) from January last year. This, once again, reflects high domestic prices and limited UK production in late 2024 and early 2025. However, steady export volumes despite significant price rises also indicate sustained demand for British product.

The main drivers for export volume increases came from fresh and chilled bone-in cuts to France, Belgium and Germany. Conversely, trade in fresh half and whole carcases, our most plentiful export product, has slowed in recent months with a 2% decrease in volumes from January last year.

January 2025 UK sheep meat exports

Source: TDM LLC

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.