US beef market update: tight supply and stable demand to support global beef prices

Thursday, 20 March 2025

The United States is simultaneously one of the largest producers of beef, and one of the largest consumers of beef. Therefore, prevalent market dynamics such as reduced headage, sustained production, and strong domestic demand stand to impact the global beef market.

Key points:

- The US herd continues to decline, reducing a further 0.6% on the year to sit at 86.7 million head as of January 2025.

- Reduced supply continues to support domestic beef prices across the United States. In the week ending 7 February 2025, the five-area deadweight steer average was $7.19 /kg, up 87 cents (14%) on the year.

- Australia became the biggest supplier of United States beef imports in 2024.

- Tight US supplies coupled with strong demand on the global market are likely to lend support to UK prices, despite limited direct trading relationships between the UK and US.

Supply

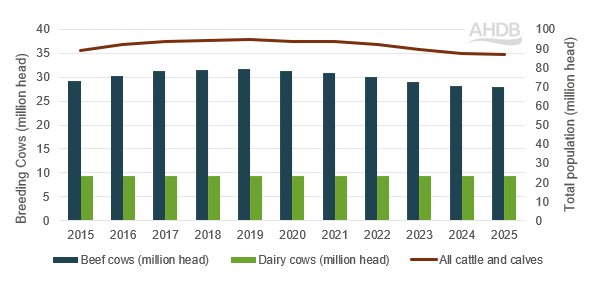

The beef herd in the United States has been in consistent decline since 2019, standing at 86.7 million head in the January 2025 inventory, down 0.6% on the year and down by 9% from 2019.

USA January cattle inventories

Source: USDA

The reasons for this long term contraction in supply are multiple; it is in part caused by the destocking phase of the cattle cycle, and also in part due to rising input costs and droughts forcing ‘cattle-calf’ operations to contract thus reducing the cattle available for feed-lots.

In their February 2025 outlook, the USDA reported that the ratio of beef heifer replacements to the previous year’s calf crop was continuing to fall as historically high beef prices encourage heifers onto the feeder market. This would suggest that the tightness in supply is likely to persist.

Production

In spite of this smaller herd going into 2025, US beef production is projected to remain relatively strong, supported mostly by significantly increased carcase weights as producers chase the high beef prices.

The number of calves available for beef production are also higher than anticipated levels and are predicted to support production in the third and fourth quarters of 2025.

However, these factors have not overcome the overall trend of declining cattle numbers, and as such, the USDA expect 2025 production levels to be 2% down on 2024 levels to 12 million tonnes.

Prices

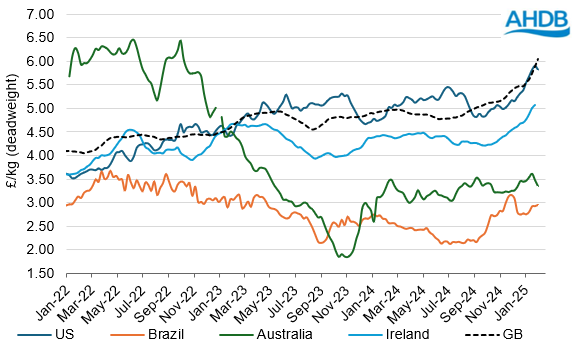

With these lower production levels US prices are expected to remain elevated throughout 2025. In the week ending 7 February 2025, the five-area deadweight steer average was $7.19 /kg (£5.59/kg) up 87 cents (14%) on the year.

This is significant for beef producers across the world as the strength of the US market has been a major driver of global prices over the past two years.

Deadweight global cattle prices (£/kg)

Source: AHDB, INAC, Consorcio de Exportadores de Carnes Argentinas, Informe Ganadero Argentina

Trade

Imports

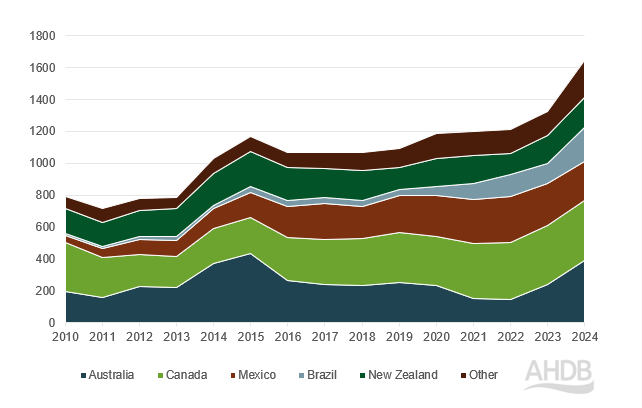

Despite being home to the world’s largest fed-cattle industry, the US is a net importer of beef. In 2024, the US imported 1.64 million tonnes of beef, with the largest proportion (24%) originating from Australia, a 6% year-on-year growth in volume terms. This was followed closely by Canada, Mexico and Brazil supplying 23%,15% and 13% of imported beef volumes respectively.

Indeed, as North American herds continue to decline, the Australian herd is rebuilding and has identified the USA as a key beef market for a variety of products including exports of frozen, grassfed, and manufacturing beef.

USA Beef imports by origin

Source: TDM LLC

The US market has only been re-open to beef from the United Kingdom since 2020, when BSE restrictions were lifted. Since then, UK exports to the US have increased modestly, totalling 2,000 tonnes in 2024 with a value of £10.1 million, with import tariffs on UK beef likely to restrict significant growth.

Exports.

The US exported approximately 1.2 million tonnes of fresh, frozen, processed and offal beef in 2024, valuing over £8 billion, representing a 0.4% reduction in volumes from 2023. The primary destinations for this product are Japan, South Korea, Mexico and China, with these 4 countries representing 68% of the US beef export market. The United Kingdom imported only 300 tonnes of beef (fresh, frozen and processed) from the US in 2024.

Future

Consumer demand for all categories of beef is expected to remain very strong across the US in the coming months, supporting global prices whilst supplies remain tight.

Whether or not US herd numbers have reached their lowest remains to be seen but will affect the entire global beef industry in terms of global export flows and supplies. The USDA forecasts a 7% decrease in export volumes in 2025 to 1.3 million tonnes and an increase in import volumes of 3% to 2.2 million tonnes year on year, reflective of the tightness in supplies.

Moving forward, these tight US supplies coupled with strong demand on the global market are likely to lend support to UK prices, despite limited direct trading relationships between the UK and US.

The developing political situation under the new United States administration also stands to impact global markets and will continue to be monitored closely.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.