Analyst’s Insight: Harvest 2022 gross margins – is rapeseed going to make a comeback?

Thursday, 22 July 2021

Market commentary

- UK feed wheat futures (Nov-21) dropped back £1.90/t yesterday to close at £178.50/t.

- This followed similar small falls on other global wheat and maize contracts. Concern for US and Russia yields from dry and hot weather continues, though no ‘new’ news meant the market traded technically and fell.

- Chicago nearby soy oil fell 2.3% yesterday, following news US crude stockpiles rose last week, breaking an eight-week decline.

- Severe and heavy rainfall in the Henan province of China caused flooding and destruction on Tuesday. Henan looks to be the key Chinese wheat producing province, producing an average of 27% (2015-2019). Spring wheat should be at ear emergence now, though the extent of damage to crops is not yet clear.

Harvest 2022 gross margins – is rapeseed going to make a comeback?

As 2021/22 harvest begins, many growers are making, or have already made, cropping decisions for 2022/23.

In February, James produced the first gross margins calculations for harvest 2022. Today, we are releasing updated figures. With considerably more trade on the Nov-22 UK feed wheat and Nov-22 Paris rapeseed futures in recent months we have a better indication of price direction.

The aim of these figures is not to indicate exactly how much profit can be made by each crop, because variable costs will differ by farm. It is more of a support for decision making, as well as giving an indication of what the UK planted area may look like too.

As the funding for the basic payment scheme will start to reduce this year, value for money from your crops may be key. Through calculating the output for every £1 of variable cost spent, this can help indicate which crops could return more for your money, and well as help work out what crops may work best for your budget and risk appetite going forward.

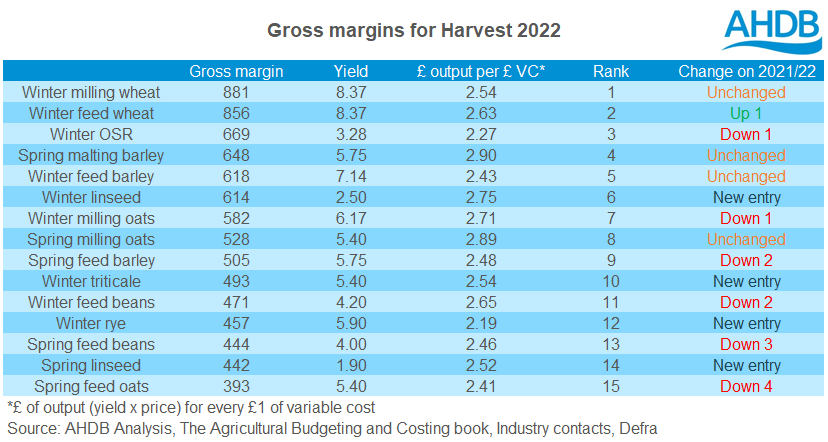

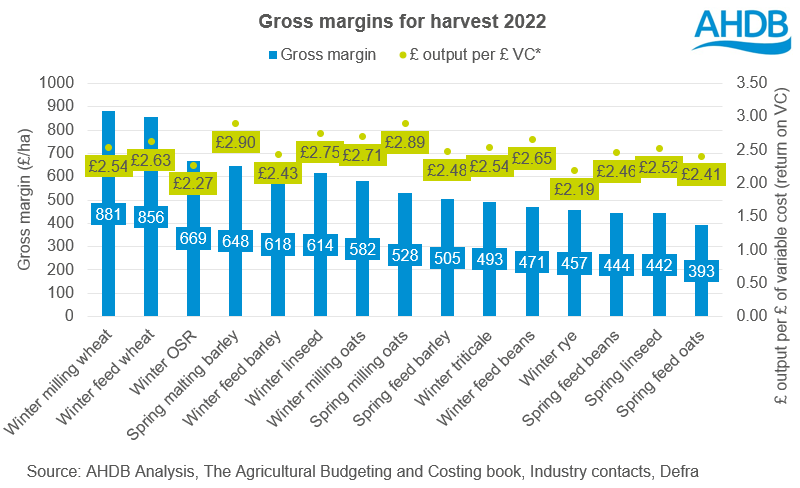

How do gross margins for harvest 2022 compare to 2021?

It is perhaps not surprising that milling wheat tops the table, unchanged ranking from earlier 2022 gross margin estimations and last year. We have seen support for the average milling premium to futures price over the past two seasons. This year (2021/22) may be no exception with concerns surrounding the global availability of high protein wheat, especially from Canada, which is a key origin for UK milling wheat imports. With winter feed wheat ranked number 2 too, wheat continues to look favourable, and area will likely remain up. This assumes good autumn weather.

Spring feed barley and feed oats have dropped down the list for harvest 2022. This is due to a growing discount over previous seasons to feed wheat and some new entries. The two new crops from February included are winter rye and winter triticale. Both priced as feed grains and are considered lower-cost break crops. Winter triticale specifically presents a good return on costs.

Winter oilseed rape continues to be the most favourable break crop on gross margins and is ranked third overall. It ranks one place higher than February’s harvest 2022 gross margins but one place below last year.

Perhaps most importantly, in my opinion, which crop returns more pounds per £1 spent on variable costs? Spring malting barley and spring milling oats offer comparatively good returns on cost. With some farmers to see a squeeze on direct payments, some may choose lower cost alternative crops like oats once again.

Break crop areas – will rapeseed re-bound?

Rapeseed gross margins look favourable once again this year. In previous years, attractive margins were not enough to result in an area rebound. But will this year be different?

Many other break crops perform more efficiently, giving higher returns from variable costs than rapeseed. Winter linseed performed the best and arguably, some farmers are starting to consider linseed as an option. Though it is important to remember, the linseed market may preclude higher margins if there is a large increase in area.

Winter feed beans also provide a good alternative winter break crop, meeting winter oilseed rape on output per £1 variable cost spent. The pulses market can be variable at times, though the crops require lower inputs and benefit fields though nitrogen fixing.

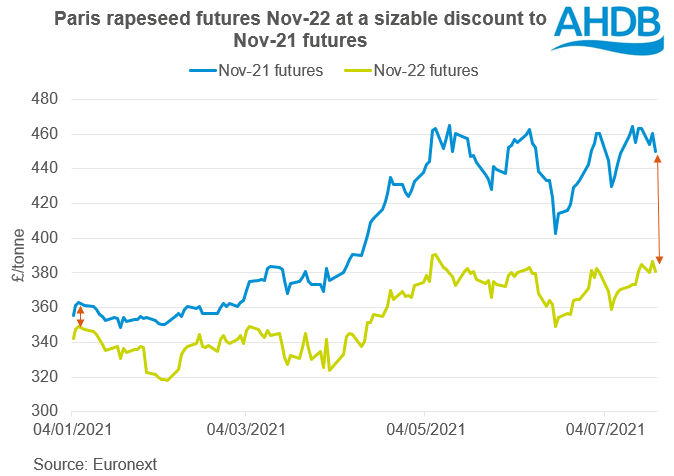

Looking at rapeseed prices, the Nov-22 futures contract is trading at a substantial discount to Nov-21. EU demand and supply remains tight for rapeseed this season, with additional support from recent Canadian supply concerns. However, global oilseed supply is forecasted up this season overall and long-term demand for vegetable oil is still under review.

Finally, the same issues remain for farmers that contributed to the decline in area previously. Cabbage stem flea beetle (CSFB) continues to impact on yields. If planting time sees very dry weather, growers may not want to risk CSFB outbreaks.

In practice it will likely be a combination of all these factors that affects planted area. We may see some increased area on favourable gross margins. But with ongoing pest pressures and farmers starting to explore other alternative crops, the rebound may be smaller than some hope.

For help assessing how your farm performance currently, Farmbench is useful tool available from the AHDB. To see how crops have performed over the last four years, follow this link to gross margins by crop type.

For information on price direction for crops too, make sure to subscribe to Grain Market Daily’s and Market Report from our team.

Notes on calculations

- OSR price does not include oil bonuses.

- Winter rye and winter triticale are priced as feed grains.

- Premiums and discounts calculated as 5-year averages (2016/17 – 2021/22).

- Cereals seed costs are modelled on the historic relationship between the price of grain in the preceding season and the price of seed for the year of planting.

- With a weaker relationship between oilseed rape prices and cost of seed in the following season, historic seed values have been carried forward.

- Nitrogen costs have been modelled using the relationship discussed in James’s Analyst Insight in February. Potash and phosphate costs for 2022/23 are given as the three-year average up to recent data.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.