Rapeseed could ease if palm oil and sunflower supplies rise: Analyst's Insight

Thursday, 17 June 2021

Market commentary

- Nov-21 UK feed wheat futures gained £1.30/t yesterday to £172.00/t and the Nov-22 contract rose £1.15/t to 165.70/t. Global grain markets stabilised yesterday after prices fell earlier in the week due to US improved weather forecasts.

- Nov-21 Paris rapeseed futures fell €9.75/t yesterday to €493.50/t due to a fall in vegetable oil prices and improved weather for Canadian canola crops. Meanwhile, the Nov-22 contract only fell €1.25/t to €421.75/t.

- Vegetable oil prices have fallen due to reports that the US government is considering exempting US oil refiners from biofuel mandates (see Monday’s Market Report). If this is confirmed it would reduce demand for soy oil in the US.

Rapeseed could ease if palm oil and sunflower supplies rise

A key factor in pushing up rapeseed prices in 2020/21 was insufficient vegetable oil production to meet demand. This had two causes:

- Smaller sunflower seed crops following challenging weather in Ukraine, Russia, and parts of the EU-27. The global crop shrank by 9% in 2020/21.

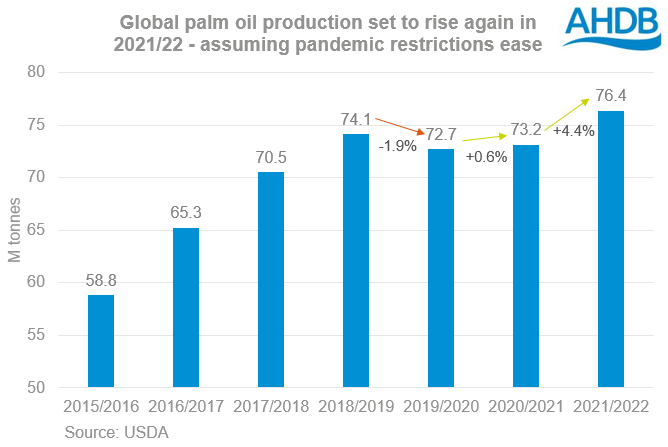

- Palm oil production continued to be constrained. Measures to combat COVID-19 caused labour shortages in the top two producing countries in 2019/20. This reduced palm oil production by 2% from 2019/20 levels. The ongoing pandemic measures, along with heavy rain in the early part of 2021, meant global production only recovered by 1% in 2020/21.

Meanwhile, global demand for vegetable oils continued to grow. This pushed up global veg oil prices and created more crush demand for rapeseed. It kept global rapeseed supplies tight despite bigger Australian and Indian crops.

Bigger crops on the way

Current forecasts show bigger supplies of rapeseed and sunflower seed in 2021/22, along with a recovery in palm oil output. If confirmed, these could be enough to move the market back into surplus and enable some stock rebuilding and could dent prices once crops are harvested.

The global rapeseed crop is expected to be 2.6Mt bigger next season at 74.0Mt (USDA). This is dependent on bigger Canadian (+1.5Mt), EU-27 (+1.0Mt) and Ukrainian (+250Kt) crops. UkrAgoConsult report Ukrainian crops are looking well, but in Canada and the EU, conditions are not ideal. What’s more, even this bigger crop could be finely balanced with demand. Global demand is forecast to rise 1% to 73.9Mt.

The USDA predicts the global sunflower seed crop to rise by 5.2Mt to 54.9Mt in the coming season. This is largely due to bigger crops in Ukraine (+2.6Mt) and the EU-27 (+1.2Mt). While there is still a long way to go until harvest, crops are off to a good start.

A bigger global soyabean crop is predicted for 2021/22, up 21.5Mt from 2020/21 (USDA). While the oil content of soyabeans is much lower than that of rapeseed and sunflower seed, it still makes a sizeable contribution to vegetable oil supplies and dominates meal supplies. So higher soy supplies could also pressure rapeseed prices. The US crop is expected to be 7.3Mt larger than 2020/21 and the next key bit of data to confirming this is the US planted area, out on 30 June.

OilWorld (www.OilWorld.biz) predicts that global palm oil production will rise 5.0% in 2021/22 to 80.6Mt. However, this depends on COVID rates falling and palm oil plantations being able to get the labour they need. The palm oil marketing year runs from October to September. Markets could face pressure if production rises towards the end of the year.

Stocks of rapeseed and sunflower seed are very low, so the market is very sensitive to any threat to yields. This is arguably keeping a fair amount risk premium in the market. The risk is if good crops are harvested, prices could come under more pressure.

Appetite destruction?

The world needs even more vegetable oil in 2021/22. The USDA forecasts consumption to rise by 4.1% to 213.0Mt, with more needed for both food and industrial uses.

But, there are a few things which could reduce this demand:

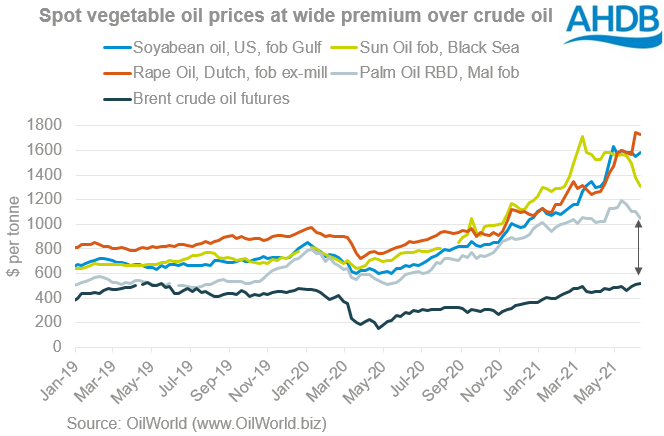

Many countries require biofuel, including biodiesel made from vegetable oils, to be blended into their road transport fuels. The volume or percentage of biodiesel required each year is set through mandates. Vegetable oil prices are currently very high compared to crude oil prices, making it more expensive to meet these mandates.

So far, many countries have kept their mandates in place. Nevertheless, if the premium remains high, more countries might start to consider offering temporary exemptions from the mandates. Other countries may postpone planned increases to mandates.

Both would reduce demand for biodiesel, and so vegetable oil, from what is currently expected. For example, there are reports that the US government is considering exemptions. These reports caused soyabean oil futures prices fall sharply earlier in the week, pulling rapeseed prices down too.

India is the world’s largest importer of vegetable oils. Imports by India slumped earlier this year as the country struggled with a severe wave of COVID-19 infections (Refinitiv). Restrictions on restaurants and more reduced vegetable oil imports, especially for palm oil.

Infections are in decline again. However, how the country recovers from this wave and when restrictions are loosened will affect the country’s import demand.

Brent crude oil futures yesterday hit their highest since April 2019 at $74.39/barrel. Good vaccination rates in some countries improved the global economic outlook. The International Energy Agency raised its forecasts for the amount of crude oil required this year as a result. But, global crude oil production has so far not increased at the same rate as demand.

The market currently expects crude oil production to catch up with demand later in 2021, as forward crude oil prices are lower than spot prices. Lower crude oil prices mean even less incentive to use biodiesel made from expensive vegetable oils.

Lower vegetable oil demand, would reduce vegetable prices and so likely the crush margins for oilseeds. This would in turn reduce demand for oilseeds, including rapeseed, leading to lower prices. But, until there is evidence that these will occur, the forecasts continue to point to a rise in vegetable oil demand next season.

Final thoughts

Rapeseed prices could face pressure from higher palm oil, sunflower seed and soyabean production later this year, with global output set to rise in 2021/22. There is a lot of uncertainty at present around demand and the world economic recovery from COVID-19.

The forecasts point to vegetable oil production slightly exceeding demand in 2021/22. Yet with a small surplus expected, and low stocks globally, it seems likely that there will still be underlying support in the market.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.