Market Report – 14 June 2021

Monday, 14 June 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

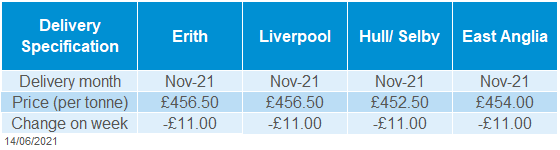

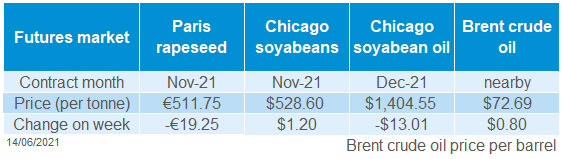

Rapeseed prices followed the direction of the wider oilseed complex last week. Paris rapeseed futures (Nov-21) fell by €19.25/t, to close at €511.75/t. UK delivered rapeseed (Erith, Nov-21) followed a similar trend, down £11.00/t Friday-Friday, at £456.50/t.

Pressure from the vegetable oil complex outweighed what continues to be a tight market. That said, Thursday’s USDA report did make upward revisions to EU rapeseed, to 17.2Mt (+600Kt), and Australian rapeseed (+200Kt).

Another region that will be watched closely is Canada. Canadian rapeseed is currently being planted, however, a crop progress report from Statistics Canada last week suggested that crop conditions are broadly average to lower than the 1987-2020 average. Key regions in Canada remain dry.

Wheat

Global 2021/22 supply looks ample, with rising production forecasts for the EU, Russia, the Black Sea, and US. US dry weather continues to cause supply concerns, though not yet quantified.

Global grain markets

Maize

June’s WASDE brought little change to the 2021/22 supply and demand balance, with strong Chinese demand for coarse grains. US weather remains a key factor driving supply concern.

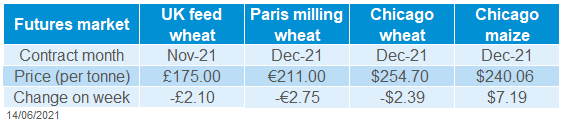

Global grain futures

Barley

Barley prices could not be published this week due to data validation. Going forward, barley prices are expected to follow the direction of other feed grain prices, especially maize.

UK focus

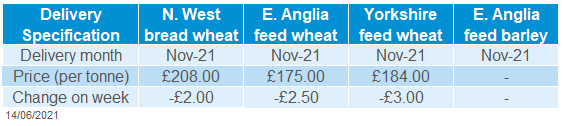

Delivered cereals

Global grain movements were mixed last week. Chicago maize futures (Dec 21) gained $7.19/t on the week, to close at $240.06/t on Friday. Conversely, global wheat futures took small falls on the week for both the Paris and Chicago contracts, on new-crop supply rises.

The latest WASDE boasted no surprises to the grain markets, as James discussed on Friday. For 2020/21 maize, Brazilian production was reduced 3.5Mt to 98.5Mt. US demand was increased for 2020/21 on account of bioethanol demand. That said, suggestions that refiners may be granted relief from the biofuel blending requirements cooled values. 2021/22 global maize production was left unchanged for now. Global wheat production was raised 5.5Mt to 794.4Mt due to increases in crop size in the EU, US, Russia, and Ukraine.

The Conab report on old-crop Brazilian maize production failed to stimulate strength, cutting production by 10.0Mt to 96.4Mt. This is below the USDA’s revised figure, but above current trade estimations. Buenos Aires Grains Exchange increased Argentina’s 2020/21 maize production 2Mt to 48Mt last week (WASDE remained at 47Mt).

Arguably, despite other news, maize markets found support through dry US weather. This week, the outlook for the Midwest looks cooler, but some areas remain in extreme drought.

In Europe, 2021/22 grain production was increased by Stratégie Grains last week, with rises also reflected in the June WASDE. Gains were made to soft wheat (+1.5Mt), barley (+0.2Mt) and maize (+0.1Mt) on favourable late spring weather conditions. Europe’s wheat harvest is expected to be late, but large.

Russia’s agricultural consultancy SovEcon raised their wheat production forecasted 1.5Mt to 82.4Mt on Friday due to improved weather and crop condition, although below the USDA’s 86Mt forecast.

Oilseeds

UK feed wheat futures (Nov-21) closed at £175.00/t on Friday, down £2.10/t on the week. UK futures were led by global wheat contracts last week, falling on increased supply forecasts.

The UK’s new crop wheat production was pegged last week by the WASDE as 14.1Mt. Meanwhile, Stratégie Grains forecast UK soft wheat production at 14.8Mt for 2021/22.

Following futures markets, delivered values were also knocked back for both old-crop and new-crop. Feed wheat into East Anglia (Nov-21) was quoted £2.50/t down, to £175.00/t (Thurs-Thurs), £0.50/t below the Nov-21 futures. Group 1 milling into North West (Nov-21) fell £2.00/t, to £208.00/t (Thurs-Thurs). No feed barley prices have been quoted this week due to data validation.

Rapeseed

The supply and demand for rapeseed remains tight, and weather between now and harvest will be key for forward price direction. Canadian growing regions currently look dry.

Global oilseed markets

Soyabeans

While stocks position eased in the latest USDA report, oilseed markets remain tight. US biofuel policy will be a key watch point for markets going forward, as will US crop conditions.

Global oilseed futures

Rapeseed focus

UK delivered oilseed prices

Global oilseed markets were under pressure last week, despite small gains in Chicago soyabeans (Nov-21), as support for vegetable oils waned. The value of Chicago soyabean oil (Dec-21) dropped $13.01/t, to $1404.55/t, Friday-Friday. Soya oil has been an increasingly large contributor to the price movements of soyabeans and so the oilseed complex in recent months.

Weakness in soya oil and soyabeans followed a somewhat bearish outlook for 2021/22 oilseeds in the latest USDA supply and demand estimates (WASDE), released last Thursday. Global supply of oilseeds is expected to increase by 1.96Mt, to 734.40Mt. As a result, global oilseed stocks are seen at 106.30Mt, up 1.66mt on the month. The increases in supply were largely driven by an upward revision to soyabean opening stocks.

One key source of pressure for the US soya oil market has been concerns over demand from the biofuel sector. The high value of renewable fuel credits (RINS), combined with the high value of vegetable oils is heaping financial pressure onto biofuel blenders in the US. Any policy changes which ease blending mandates in the biofuel sector in the US will likely add further pressure to soyabeans (Refinitiv).

Palm oil followed the wider vegetable oil complex lower, although a recovery in buying from India will have been welcome news.

Looking ahead, as well as policy and demand, weather will continue to be key. This is particularly true for the US crop. Rain has been lacking in some key states, and tonight’s crop condition report from the USDA will be watched closely.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.