WASDE leaves us waiting on weather: Grain market daily

Friday, 11 June 2021

Market commentary

- UK feed wheat futures continued their month of mixed movements yesterday. The Nov-21 contract fell by £1.50/t, to £175.45/t. The Nov-21 price is down further this morning following an uneventful WASDE for grain markets (read more below)

- French soft wheat (good or excellent rating up 1 percentage point [pp]) and spring barley (good to excellent up 2pp) crop conditions continued to improve in the week to 7 June. The condition of spring barley and maize was unchanged

- The AHDB Planting and Variety Survey provides the only pre-harvest planting view of grain and oilseed crops. Play a part in creating accurate data for your industry by completing the planting survey form. Five minutes of your time can provide huge value to our great industry

WASDE leaves us waiting on weather

Yesterday saw the release of two key reports, both of which had the potential to cause increased volatility. In truth, neither report had much impact. The reports were the USDA world supply and demand estimates (WASDE) and the Brazilian crop production report from Conab.

The key watch points going into both reports were;

- Brazilian Safrinha maize production.

- US maize and soyabean production.

- Chinese grain demand.

- Russian wheat production.

For grains, the USDA report was uneventful. As a result, we are likely to remain dependent on weather impacts globally if we are to see further support.

Brazilian production

Both reports made large cuts to Brazilian maize output. However, the cuts did not go far enough to spark fresh gains in prices. The USDA cut Brazilian maize output in 2020/21 by 3.5Mt, to 98.5Mt. Conab cut Brazilian production by more than the USDA, pegging production at 96.4Mt, down 10.0Mt.

Despite the size of the cuts, Brazilian output in both reports remains ahead of a swathe of private forecasters’ views. For example, StoneX peg Brazilian production at 89.7Mt.

Weather in Brazil as the crop develops will continue to be key to price direction going forward. If it remains dry and forecasts fall, we could still see more support for prices.

US maize and soya production

There were no great surprises as far as 2021 US maize and soyabean production is concerned. The USDA stuck with its figures from the March acreage report for area, and trend yields. The next area update is due at the end of the month. Last year the USDA did not amend the WASDE yield figures until the August WASDE.

In the meantime, we will have to keep watching USDA crop condition scores in the weekly crop progress reports, for an indication of US crop size. Similarly, US weather will be an important watch point over the coming months.

Chinese grain demand

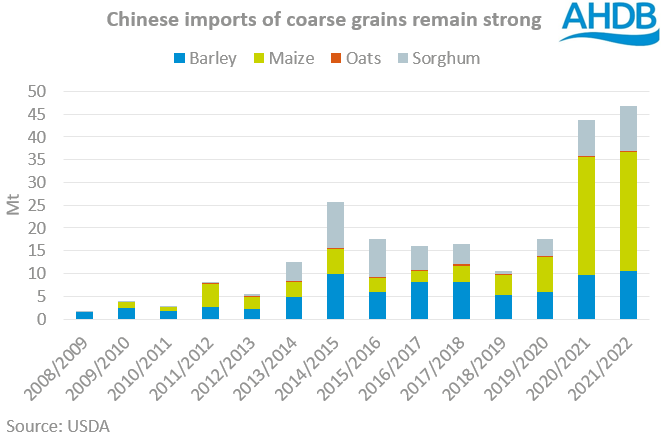

China has been an even bigger influencer of grain prices than normal, over the past year. The nation has been buying commodities at a record pace, in a bid to shore up stocks and feed its growing pig herd.

Chinese imports of coarse grains in 2021/22 were upped by just 0.6Mt, to 46.9Mt. Earlier this week Megan highlighted the volume of grain China has already purchased, we will continue to track this progress.

Russian wheat production

2021/22 Russian wheat production was upped by 1.0Mt, to 86.0Mt in the latest WASDE, the highest on record. The USDA cited “widespread spring rainfall boosting yields”. Crucially though, there is still disparity in the Russian crop numbers, not just between the USDA and other forecasters, but also between the USDA figures.

In May, the USDA Foreign Agriculture Service (FAS) published an estimate of production 77.5Mt, lower than that in the May WASDE.

Yesterday, the USDA kept Russian exports unchanged at 40Mt, up 1.5Mt year-on-year. Meanwhile, last week SovEcon peg wheat exports at 36.6Mt, down 1.1Mt year-on-year.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.