New-season fertiliser prices to start high: Grain market daily

Wednesday, 9 June 2021

Market Commentary

- UK feed wheat futures (Nov-21) gained £0.55/t yesterday, to close at £179.45/t the highest value since mid-May. The Nov-22 contract gained £1.45/t yesterday, to close at £170.00/t. Marginal gains were seen across Chicago grain markets, though Paris milling wheat saw a small fall.

- US maize condition in the north-western belt caused small gains yesterday.

- For soyabeans, Chicago futures (Nov-21) gained $6.24/t yesterday on the back of dry and hot US Midwest weather. Argentinian soyabean crushing in April reportedly achieved a 6-year high of, with 4.2Mt of soyabeans crushed.

- After liaising with industry and AHDB, Defra Survey Branch have revised the English on-farm stocks survey date to 30th June 2021, with a publication date of 26th August 2021. The AHDB will mirror these dates for the Merchants, Ports and Co-ops survey to ensure a joined-up approach for capturing data on the final day of the month/season.

New-season fertiliser prices to start high

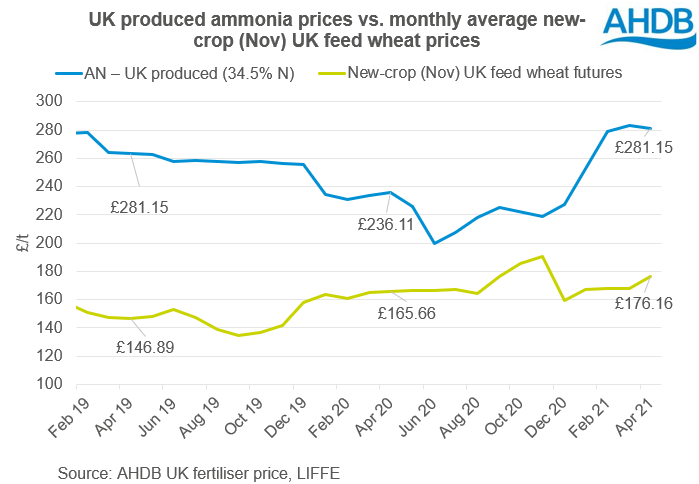

At the start of June, we find ourselves at a key point in the fertiliser market, with new season terms being released. In the run up to the new season values we have seen vastly elevated prices for ammonium nitrate (AN). Values of both domestic and imported AN continued to be strong in March and April, as we moved through a period of strong input prices.

Strong input prices are liable to influence the new terms offered now. We have seen natural gas and crude oil prices in May well ahead of last year. Nearby brent crude futures in May were 109% ahead of 2020. Similarly, the value of another key input in the AN process, natural gas, has seen prices 64% ahead of last year’s levels, in May.

Alongside firm input prices, high output prices also show a key link with the value of AN. In May, nearby Chicago maize futures averaged $274.56/t, $130.46/t ahead of the average of the previous three seasons. Moreover, nearby maize futures in May were 119% ahead of 2020.

Is this set to continue into new season?

All these drivers point, unsurprisingly, to the likelihood of a high new season AN price.

For output prices, recent fundamentals have been supporting new-crop (2021/22) grains prices. Weather has been driving supply concerns across the US and South America, met with a strong start to Chinese purchasing for 2021/22. The May USDA world agricultural supply and demand estimates (WASDE) forecast China to import 26Mt of maize 2021/22, though already 12.1Mt has been booked of US maize and 6-7Mt of Ukraine maize (as at 25 May). The next USDA WASDE forecasts are due tomorrow.

While nitrogen prices have been high of late, phosphate prices have rocketed. Both Diammonium and Triple-Super Phosphate (DAP and TSP), have hit their highest point since 2011. While output prices are high, it is more important than ever to pay close attention to the value of inputs. Monitoring inputs can help to ensure profitability. By calculating costs of production per tonne, you can forecast the market price needed for a profit, useful when considering your marketing strategy.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.