Where next for fertiliser prices? Analyst's Insight

Thursday, 11 February 2021

Market commentary

- UK feed wheat futures closed lower again yesterday. The May-21 feed wheat futures contract ended the day at £199.65/t, a fall of £3.25/t. The UK market tracked movements in global markets, with the fall made larger by the continued strength of sterling.

- With dry weather persisting in South America, reports from Buenos Aires Grain Exchange and Conab published later today will give a South American supply update and be important for maize price direction. That said, demand seems to be king at present.

- The Chicago maize market continued to be weaker in overnight trading. With growth in Chinese corn stocks in Tuesday’s USDA supply and demand estimate, and the cancellation of a 132Kt export sale to an unknown destination, Chicago maize prices (May-21) are down 5.6% (down $12.40/t to $208.85, Refinitiv) since Monday night.

Where next for fertiliser prices?

While grain prices have been rising so too have the values of inputs. Last week, Alex looked at the path ahead for oil and red diesel; today, we are looking at what lies in wait for fertiliser prices.

Throughout January and into early February, we have seen some sharp increases in the value of fertiliser. Repeatedly we have seen terms withdrawn for ammonia nitrate, coming back at much higher levels.

Often quoted when prices rise, is the increased cost of inputs. And it is true; there will undoubtedly be a link between the value of energy and the value of fertiliser. But, the link isn’t the strongest, with other factors at play.

What has happened in energy markets?

Since the start of the year, we have seen a distinct firming in the value of energy. This has been seen in natural gas prices, where nearby Henry Hub natural gas futures have reached their highest levels for this time of year since 2017.

The path ahead for energy markets seems equally firm. Cold snaps in Asia, the UK and US will have increased the demand for gas as a heating fuel, supporting markets further. Moreover, the US Energy Information Administration’s short-term energy outlook, published earlier this month, highlighted growth going forward in US natural gas consumption, and so prices.

So energy will have some impact going forward, and will support fertiliser prices. But, we also need to look beyond it. Looking at some historical relationships between fertiliser prices and fundamentals in the grain market may give us a further steer of where prices go from here.

Maize prices driving fert markets?

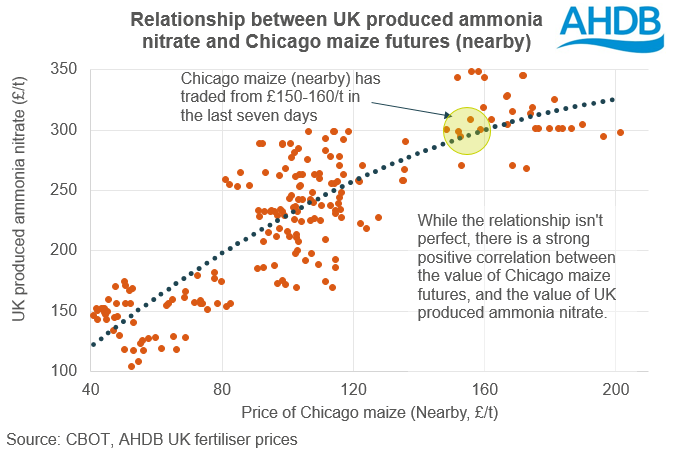

Looking back over the past 17 years, there is a strong correlation between value of Chicago maize futures (nearby, in sterling) and the value of UK produced ammonia nitrate. This is not overly surprising if we use maize prices as a proxy for the supply and demand situation globally.

High prices prompt increased interest in planting, which in turn prompts increased demand for fertiliser, supporting fertiliser prices.

The relationship is not perfect, and we have to accept that there will always be other drivers that make forecasting futures direction a challenge. In 2008 we saw such a situation, where external drivers i.e. a global energy boom, pushing fertiliser prices up against the trend. However, if we assume the trend holds this year it is entirely plausible that, given the strength in maize prices, we could see ammonia nitrate values push back up to, and potentially beyond, £300/t.

What do we need to be wary of?

With grain prices on the up, the suggestion is that fertiliser prices will also rise. As we move towards next season, we know that it is highly unlikely that we will see the same level of prices as we are currently showing for UK grain. UK planted areas are up and crops are developing well in Europe. As such we could be in a situation with lower income and higher input costs.

The future direction of fertiliser will very much depend on planted areas and prices as we look ahead. The US fight for acres, between corn and soyabeans, will determine a lot of the demand in the US for fertiliser. There is an “okay” relationship between soyabean markets, but with a higher nitrogen requirement the relationship between maize and fertiliser is stronger.

An entirely plausible strong maize acreage, could also lead to firm fertiliser prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.