Red diesel prices to rise this year? Grain Market Daily

Tuesday, 2 February 2021

Market Commentary

- UK May-21 wheat futures closed at £205.45/t yesterday, down £2.30/t from Friday. The decline was less so in new crop futures (Nov-21) which closed at £166.50/t, down £0.70/t from Friday. The Nov-22 contract closed at £157.25/t yesterday.

- Egyptian state grain buyer (GASC) has set a tender to buy an unspecified volume of wheat for March shipment. Offers released this afternoon show Russian origin takes the cheapest price at $311.40/t (FOB + freight). GASC cancelled its previous wheat tender in January due to a low volume of offers and high prices.

- Brazil’s harvest of its 2020/21 soyabean crop is the slowest since 2010/11 due to planting delays and current rains. An estimated 1.9% of the crop had been harvested as of Jan 28, versus 8.9% last season. As a result, an estimated 1.5% of the second (safrinha) maize crop had been planted as of Jan 28, the slowest pace since 2013.

Red diesel prices to rise this year?

Crude oil prices fell in 2020, hit by the large drop in demand caused by the coronavirus pandemic. The decline in the number of daily vehicular journeys globally pushed down the need for fuel. Though crude oil production cuts by OPEC members followed, crude oil stocks increased and prices fell.

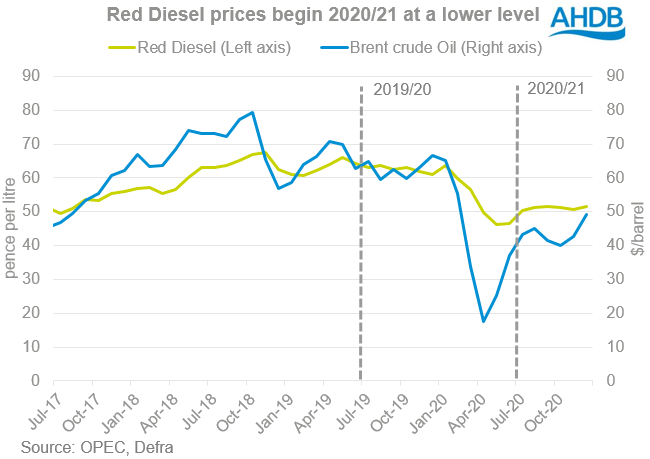

The fall in red diesel prices

We began to see declines to red diesel prices in February 2020, as news of coronavirus outbreaks developed. These declines were created through the collapse in crude oil prices. Brent crude oil fell to an average of $17.66/bbl in April, down from a January 2020 average of $65.10/bbl. Prices have since recovered, quoted at $57.62/bbl this morning (11am).

The decline in red diesel prices helped lower fuel input costs in the latter part of the 2019/20 season. Average fuel input costs for winter wheat are estimated at £52.82 per hectare for 2019/20, down from £54.51/ha in 2018/19.

If we look at the current season so far (July – December 2020), red diesel has averaged 51.12ppl, down from 62.53ppl for the same period last season. Though lower prices for the period this season, could pressure a decline in per hectare fuel costs this season.

If crude oil prices remain around current levels, we could expect fuel input costs for 2020/21 to trend below last season.

Looking ahead at crude oil prices

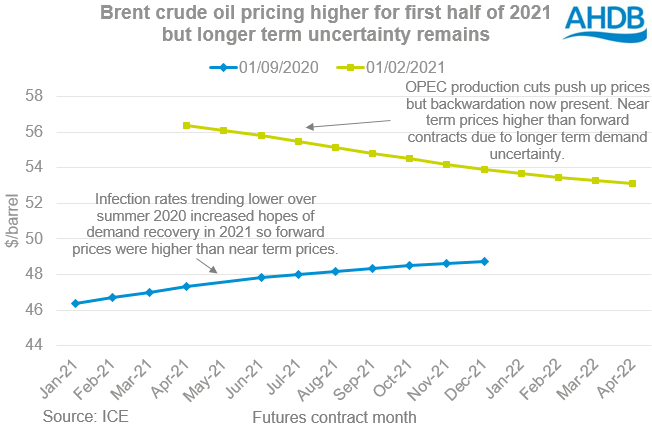

Brent crude oil markets have moved into ‘backwardation’. This occurs when the current price is higher than the subsequent futures contracts and suggests there is near-term demand but longer term is still very uncertain.

Vaccination programmes are now in place but delays easing lockdown measures mean pressure on crude oil prices over the longer term. Rising infection rates in late 2020 resulted in a slower drawdown of the large crude oil stocks. The new US government and potential changes to OPEC production levels are also factors to consider for market sentiment moving forward.

A recovery in fuel demand is expected this calendar year with oil production and consumption forecast to increase through 2022 according to the US Energy Information Administration (EIA). Brent prices are forecast to average $53/bbl over the next two years by the US EIA.

The impact on 2020/21 costs

Fuel input costs are likely to decline against last season, in part due to the lower red diesel prices in July – December 2020.

Crude oil demand is forecast to pick up in 2021 but current infection rates and present lockdown measures create uncertainty. As a result, it is unlikely crude oil prices will recover enough to push average red diesel prices higher than those for 2019/20.

Whilst fuel prices are a smaller part of a typical farm business costs, they still have an effect on the cost of production for each crop. Our FarmBench tool will help you monitor your own farm business costs and is free to use.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.