Harvest ‘22 gross margins drop off for barley: Analyst's Insight

Thursday, 18 February 2021

Market Commentary

- May-21 UK feed wheat futures took a breather yesterday after four days of gains, closing down £1.85/t at £202.00/t. Nov-21 futures also lost ground, closing £0.70/t lower, at £167.65/t.

- Chicago wheat futures closed significantly lower yesterday, following their recent weather led rally. The May-21 contract ended the day $4.96/t lower, at $238.08/t.

- Chicago maize futures gained marginally yesterday. Support for maize prices, and so other feed grains, will likely depend on China’s buying habits after the Chinese New Year holiday.

Harvest ‘22 gross margins drop off for barley

As we continue through our alternative crops week, it is important to look at how gross margins shape up both for spring crops for harvest 2021 and all crops for harvest 2022.

Values for small area crops, such as soya and linseed, are included in these margins. It is important to note that the size of these markets may preclude higher margins, if there is a large increase in area.

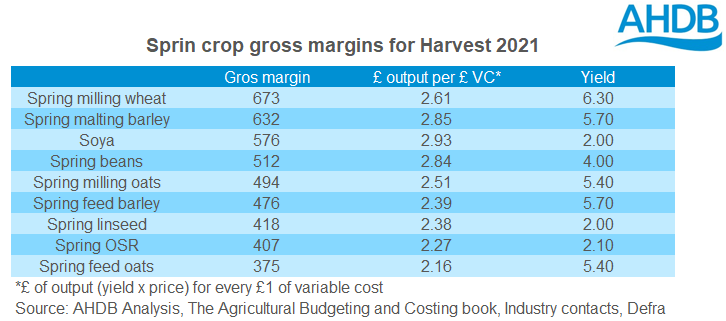

Spring crops for harvest 2021

Unsurprisingly given the high prices at present, spring wheat delivers the highest margin. This suggests that we could see a strong year for spring wheat. However, this will depend on the availability of seed.

Spring malting barley is also favourable, using a historic basis of malting barley to feed wheat futures. However, we may see premiums continue to be affected by the impact of COVID-19 on the hospitality sector. If we see prolonged closure of pubs then demand for barley in the brewing sector may also decline longer term, eroding premiums and limiting margins for malting barley.

Some of the alternative break crops also perform well. But, we need to consider that the size of those markets could affect the ability to achieve those premiums.

Lower input break crops could well see an increase in area, as declining BPS payments create uncertainty and there is potential for an increased focus on environmental impact. Spring beans in particular, with a zero nitrogen input, have a very strong return on variable costs.

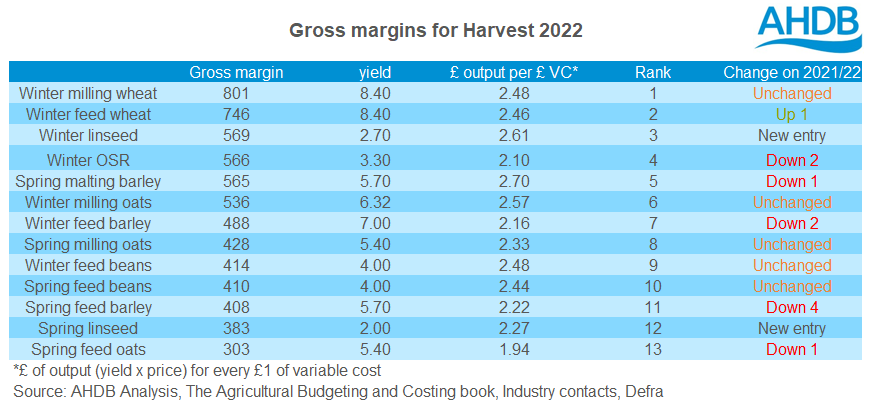

Harvest 2022

The margins for harvest 2022 are more hypothetical at this stage. Limited trade on Nov-22 feed wheat and Nov-22 Paris rapeseed futures, prevents us from truly benchmarking using these. However, using bid values we can draw an indication of where we may see areas go.

Unsurprisingly, winter wheat areas look set to remain strong. The ranking of winter milling wheat is unchanged on the margins we produced last year (read here) for harvest 2021.

Oilseed rape still appears to be a favourable break crop. The margin for oilseed rape, is down two places on the year, with winter linseed moving into third. Strong oilseed rape prices, based on the Nov-22 Paris rapeseed contract, are driving strong margins. Of course, we cannot ignore the impact of Cabbage Stem Flea Beetle. Despite a strong margin, pest pressure may once again limit rapeseed plantings.

Following strong barley areas in recent years, the average basis for feed barley (ex-farm Nov) to feed wheat futures has fallen considerably. The basis moved from £17/t under futures in 2015-2019 to £24/t under futures in 2016-2020. The reduction in basis potentially reduces the attractiveness, and so acreage, of the crop for 2022 harvest.

A note on input costs

Seed costs for cereals have been modelled on the historic relationship between the price of grain in preceding season and the price of seed for the year of planting. While the relationship isn’t perfect it gives an indication of the kind of costs we may expect to see.

With a weaker relationship between oilseed rape price and cost of seed in the following season, historic seed values have been carried forward. The same is true for soya and linseed, owing to reduced availability of information.

Nitrogen costs have been modelled using the relationship discussed in last week’s Analyst’s Insight. Potash and phosphate costs for 2022/23 are given as the three year average.

As we move through next season we will revisit the margins for 2022 harvest, and update them with the most recent information.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.