Analyst Insight: Wheat top of the crops - 2021 Gross margins

Thursday, 10 September 2020

Market commentary

- UK feed wheat futures (Nov-20) continued their sterling led rally yesterday, closing at £174.40/t, a jump of £1.65/t on the day. Wednesday-to-Wednesday the contract is up £5.15/t. The recent rally has gone against the trends seen in global wheat markets, with Chicago wheat futures (Dec-20) closing yesterday at $199.51/t, after losing since the beginning of the month.

- Sterling has been the predominant driver of UK markets, falling 2.64% against the dollar, Wednesday-to-Wednesday. The decline comes amidst political uncertainty in the UK. With key Brexit deadlines looming, the UKs credit rating was downgraded yesterday by credit rating agency Fitch.

Wheat top of the crops - 2021 Gross margins

In yesterday’s Grain Market Daily, Helen and Alex looked at the potential for an increase in the wheat area for harvest 2021. Looking at a combination of the uncropped land at harvest 2020, and also the trends in wheat area, they concluded that a large rebound in the wheat area is more than likely.

Today’s article puts a different spin on the same topic, looking at the gross margins for harvest 2021 and considering whether the financial returns for growing wheat make it a favourable option for drilling this autumn.

As ever with our gross margin work, the results are based on a number of assumptions and are not specific to any one business or region in the UK. Subsequently the results of the margin work should be taken as an indication of possible trends in plantings, rather than a forecast of financial returns for each cropping option.

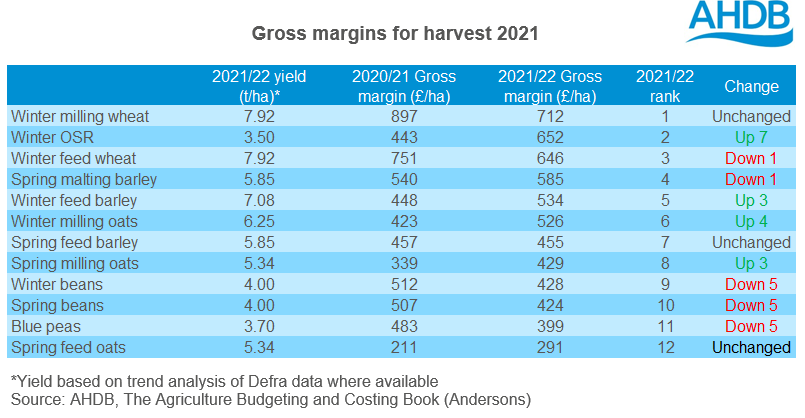

Winter milling wheat returns the top crop (of those looked at) on a gross margin basis, with feed wheat dropping one place to third. This would suggest that there is, unsurprisingly, a strong incentive to plant wheat for harvest 2021, and ups the likelihood of an increased area.

The margins also highlight that there is still a strong incentive to plant oilseed rape for harvest 2021, although as we know pest pressures and a reduced arsenal with which to combat them has reduced the attractiveness of the crop in recent years.

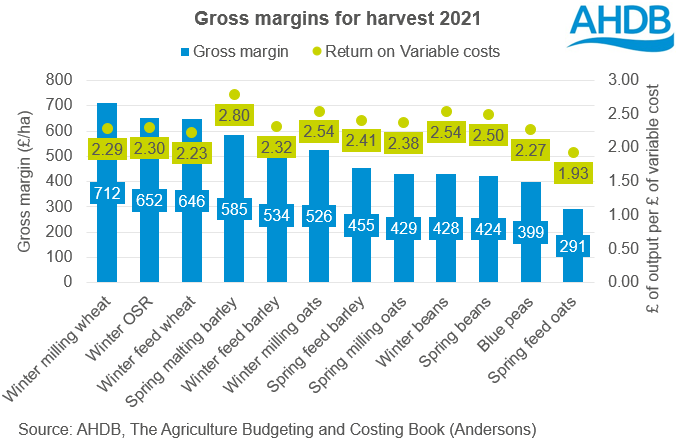

One thing that we do need to bear in mind, particularly as we move towards the loss of the Basic Payments Scheme, is the likelihood for an increased focus on return for capital invested, rather than purely on the highest financial return.

Looking at the margins on the basis of pound of output per pound of variable cost spent, moves milling wheat down to ninth spot, whilst feed wheat drops to eleventh. This reflects the high cost of inputs, in particular nitrogen, used in growing the crop.

Predictably, crops with a lower nitrogen requirement such as spring malting and feed barley, spring milling oats and pulses perform more favourably on a return for capital employed basis. As such, we could see an increased attractiveness for planting these crops when financial pressures increase.

As we move ever closer to challenging times it is important to consider your margins on a multi-tiered level, spending time considering cost of production as well as grain marketing in order to maximise business performance.

For information on price direction and trends for cereals and oilseeds, be sure to sign up to our Grain Market Daily and Market Report publications.

Farmbench

What is key and an essential factor of being in the top 25% but also to be able to aim for that group is recording and monitoring your enterprise performance. If you aren’t already doing this, then AHDB can help. Farmbench is a web-based programme that allows you to enter your physical and financial figures for your arable and livestock enterprises. The tool provides reports on how your enterprises have performed and compare to other similar enterprises.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.