UK wheat area to recover for harvest 2021? Grain Market Daily

Wednesday, 9 September 2020

Market Commentary

- UK Nov-20 feed wheat futures gained £1.95/t yesterday, closing at £172.75/t. This is its highest closing price since 29 May 2020. The contract is up a further £1.25/t this morning to be at £174.00 at 12:30pm.

- We released our preliminary Cereal Quality Survey results yesterday, which indicated a struggle to meet bread milling specifications for many wheat samples.

- In its crop conditions report released yesterday, the USDA indicated the US spring wheat harvest was 82% complete, behind the five year average of 87%. Planting of winter wheat was also underway at 5% complete, ahead of the five year average of 3%.

- Paris Nov-20 rapeseed futures closed marginally lower yesterday, down €0.50/t to €383.75/t. A watch point in Ukrainian weather is developing as conditions for winter rapeseed planting are currently unfavourable.

UK wheat area to recover for harvest 2021?

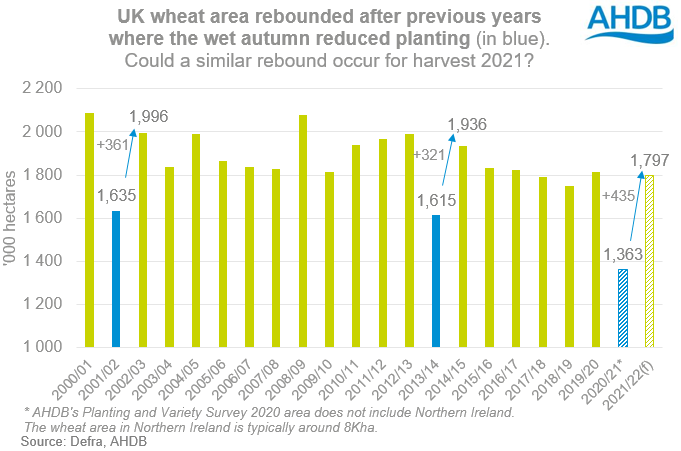

The GB wheat area for harvest 2020 is expected to be the lowest in over 40 years. The extremely wet weather last autumn significantly limited the area sown to all winter crops. However, current expectations are for the area planted to wheat for harvest in 2021 to rebound.

Nevertheless, the rebound may only be close to the average of the previous five years (2015-2019) of 1.802Mha. This could be the case if any “rebound” followed historical trends, as recorded after the wet autumns of 2001 and 2013 (more detail below).

While historical patterns are not a guarantee of what may happen, they can give us a starting point. There are also additional factors to consider that could amplify the size of any rebound e.g:

- The scrappage of the three-crop-rule for next season, meaning additional area is theoretically available

- Large area of uncropped arable land (see below)

- Ex-farm prices for feed barley and feed oats are at large discounts to wheat, which could deter some farmers from planting these crops.

Equally, there are considerations which might mute any wheat area increase e.g:

- Blackgrass - part of the reason the UK wheat area was under pressure through the 2010s was due to efforts to combat blackgrass and this hasn’t gone away.

- Rotational constraints, such as we saw for harvest 2014.

- Additionally, the greatly reduced rapeseed area in 2019/20, a break crop used to give a good entry for wheat, might impact planting decisions for 2020/21.

Winter cereal drilling will be of greater importance to many this season, wanting to get ahead of any potential weather delays. While the challenging drilling conditions of last autumn make these behaviours understandable, it should be remembered that most winter wheat varieties are bred for October planting. Repeated rainfall in the coming weeks could start to offer pressure on drilling schedules. The next harvest progress report on Friday will indicate how much is still left to cut.

The UK wheat area is expected to recover after dropping significantly to 1.36Mha for harvest 2020. If the UK saw a return to trend levels for 2021/22, statistical analysis[1] points to a rebound just under 1.8Mha. This analysis is more looking at a return to trend levels rather than an absolute estimation. A better planting season will be necessary to realise a sizeable rebound and if achieved, would help to ease concerns around future grain availability, especially in the post-Brexit environment. In addition, market sentiment of “less tight” supply could well provide a degree of pressure on long-term pricing, with spreads between old and new crop futures contracts potentially widening.

The UK wheat area has been on a downward trend since the 2011/12 season, falling slightly to average around the 1.8Mha level. During this time, the UK barley and oat area has been on the increase, partly due to measures to combat blackgrass and potentially better margins.

The three-crop-rule, introduced in 2015, has also appeared to have kept wheat areas relatively steady. With the scrappage confirmed for the three-crop-rule for next season, additional area is then theoretically available, potentially adding to an increase in the wheat area.

Similarly, UK wheat yields are projected to recover from a poorer current harvest (in the absence of any severe weather conditions and weed/pest damage). The slight decline in UK wheat area since 2011/12 has been partly offset by an increase in average yields achieved over the last ten years. Better technological advancements and varieties available have supported a rise in average yields. Of course there have been exceptions to this e.g. in 2018 and 2020, due to detrimental weather conditions.

[1] Using a reverse RA trend model

Wet weather during the autumn planting windows meant sharply smaller wheat areas were also planted for harvest in 2001 and 2013. The UK wheat area rebounded in the following years, with year on year increases of 361Kha in 2002 and 321Kha in 2014.

While there were other factors that contributed to the rebound of the wheat area in 2002 and 2014, the ability to get on the land to autumn drill following a year when that was challenging was a significant motivation. Should we see the same pattern again, then we may see the UK wheat area for 2021 increase by potentially almost a quarter.

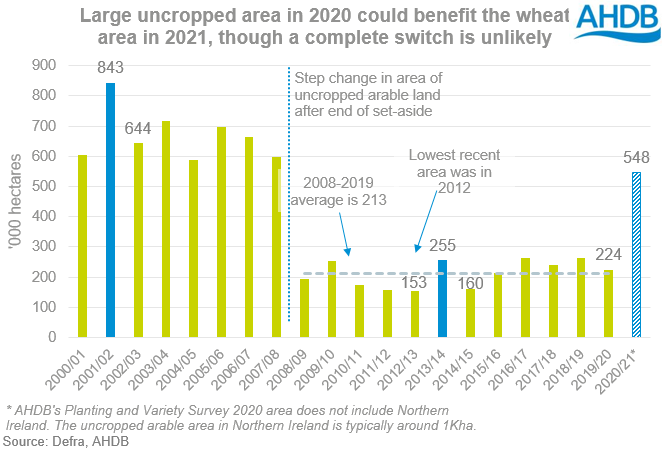

AHDB’s Planting and Variety Survey, pegged the uncropped arable area at c.548Kha for 2020, the highest since set-aside ended in 2007. While some of this area would have been planned fallow, we know that a high degree of the land was “forced” into fallow, following growers either unable to get their winter crops drilled or by ripping out failed rapeseed crops. So, it is fair to assume that a proportion of this area, but not all, could be sown with winter wheat for harvest 2021.

The lowest uncropped arable area recorded since the end of set-aside was 153Kha in 2012. If the uncropped area fell to a similar level in 20/21, it would mean close to 400Kha available. The removal of the three-crop rule means a lower uncropped arable area may be possible for 20/21, but it’s unlikely to disappear completely. However, we must consider that if the uncropped area is replanted to 2021, not all of this would necessarily be to winter wheat.

So what could this mean?

A recovery in the UK wheat area will look to calm concerns around domestic wheat availability and already UK Nov-21 wheat futures are at a discount of around £20.0/t to Nov-20 prices. Of course next year’s harvest is still many months away, and much can change over the coming months that may further allay or exacerbate these concerns. These sentiments could play out in pressure or support for Nov-21 prices.

What next?

The financial return each crop potentially can produce on a whole farm basis is more important than ever with Single Farm Payments beginning their phased reduction. Tomorrow, we will be examining potential gross margins for next season, moving to cover total costs of production in-depth on Friday. This analysis should provide better insight of the potential outcomes for planting wheat, and how that will compare to similar crops at a nationwide level.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.