A look at alternative break crops for UK production: Grain Market Daily

Wednesday, 17 February 2021

Market Commentary

- Yesterday, US wheat futures (nearby) closed up 3.26% to $241.59/t (£173.79/t) from Friday amid ongoing concerns for the US wheat crop. There are worries that the freezing temperatures have hit close to winter kill levels, especially on fields with limited snow cover. US markets were closed on Monday for a public holiday.

- This gain wasn’t felt too strongly in May-21 UK feed wheat futures which closed at £203.85/t yesterday, £0.35/t up on the day. The Nov-21 contract increased £0.75/t to £168.35/t. Similarly, Nov-22 futures rose by £0.75/t to £158.10/t.

- The bitterly cold weather felt across the UK and the EU last week was unlikely cold enough to cause crop damage, according to Stratégie Grains. Snow cover was reportedly sufficient enough to insulate fields in the worse hit regions. EU-27 soft wheat production is expected to rebound to 129.6Mt for 2021/22 from 119.2Mt in 2020/21, according to Stratégie Grains.

Alternative break crops for UK production

This week has been a focus on alternative cropping options that can help provide returns for farm businesses. Yesterday was a look at pulses, whilst today will be alternative oilseeds, namely linseed and domestic soyabeans.

The oilseed rape area has been declining each season since 2011/12 with the exception of the rise in 2018/19. Our Early Bird Survey (EBS) intentions point to an 18% decline to 312Kha in 2021/22, down 58.7% from 2011/12. The ‘other oilseeds’ intended area is expected to increase 18%.

Break crops form an integral part of conventional crop rotations, and so an increase in alternatives from OSR is occurring. Information from Premium Crops and Soya-UK has enabled a domestic picture to be built around these crops, given the lesser data coverage by Defra.

Fundamentals

Linseed is split into two types of varieties; winter and spring, these come with different seed colours and oil content. Spring linseed is grown for its slightly higher omega-3 content than winter varieties, with total acreage estimated at 20Kha in 2019/20.

The introduction of new winter varieties has increased winter planted area from a couple thousand hectares to an estimated 14Kha planted in autumn 2020. Spring varieties are usually planted from mid-March to April, with intentions reportedly at a similar level to 2019/20, bringing total intended area to 34Kha. Some growers have opted for winter linseed to replace winter OSR in rotations, whilst spring acreages are relatively stable.

Domestic soyabeans are grown across southern England where the warmer climate conditions are favourable. The area began as trials in 2014, with the acreage now just over 2Kha. The UK crop is similar to the US crop, planted in April and harvested in late September. However, the main difference is the non-GM nature of UK soyabeans, which are classed as Hard Identity Preserved (Hard I.P.) beans.

Typical markets

This Hard I.P. classification grants access to human consumption markets, providing a premium over the standard livestock feed market. A large volume of the domestic soyabean crop is milled in the UK, for soya flour which is incorporated into a wide range of bakery and other food products. The high protein nature of the flour is desired for certain products. Imports of Hard I.P. Canadian soyabeans meet the majority of this established demand route however, given the low domestic production level. Imports would likely decline should domestic production increase. Equine feed is also a market for domestic soya, opted for its high protein and digestibility.

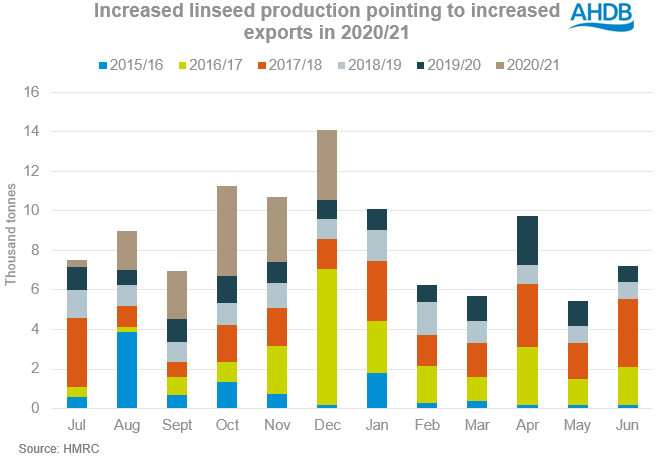

Linseed is primarily exported for whole inclusion into animal feed, favoured for its high omega-3 content. This also makes linseed a health food option for human consumption in the UK. Exports of linseed in the season to December have already hit 16.1Kt, 72% ahead of the five year average for this period. Belgium, France and the Netherlands are our main importers. The UK has imported 6.1Kt of linseed in the season to December, with 69% from Belgium. Trade data does not provide the option to differentiate whether this is oil or whole seed however. The EU-exit deadline and expected logistical delays may have had an impact on trade this season in the run up to January, though tariffs were expected to remain at zero.

The low planted area for both crops means contracts are offered to growers. These are based on market conditions for oilseeds, and then also specific demand levels for the crop from the end-markets. It is important to consider these as an option as free market tonnage could provide lower than expected returns.

The global rally in oilseeds and vegetable oils has enabled an increase in domestic soyabean contract values. The Hard I.P. classification requirement for soya flour accounts for a very small volume of global soyabeans, meaning a premium is achievable for such volumes.

This rally has partially filtered through to linseed markets too. Linseed is desired for its higher omega-3 properties than other vegetable oil equivalents. Sunflower oil is a competing market which has benefitted from the global rally in vegetable oils. Crude sunflower oil export values (FOB – Chornomorsk) have increased 71% this season.

To conclude

Should the declining planted area trend in rapeseed continue, and pest pressure remains a key issue, then increases to alternative break crops will occur. Blackgrass too is a problem for growers, with cultural control methods such as alternative cropping favoured. Margins will also look to the state of the global oilseed market, with the current rally providing increases.

Growers should be encouraged to look towards market conditions and proximity to end market as a foundation when deciding rotations. Knowing your end-market is key with buy-back contracts an option for gross margin security. My colleague James will be examining gross margins for alternative crops in tomorrow’s analyst insight.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.