Analyst Insight: Wheat a winner for harvest 2025 gross margins

Tuesday, 16 July 2024

Market commentary

- Global wheat prices declined again yesterday on harvest progression and pressure in the US and Russia. The USDA’s report on Friday predicted higher global production for the 2024/25 season on the back of an improved outlook in the US.

- As a result, UK feed wheat futures for Nov-24 dropped to a three-month low yesterday, closing at £190.55/t, down £4.45/t from Friday’s close. New crop futures (May-25) closed at £201.00/t, down £3.00/t over the same period.

- Rapeseed prices followed the wider oilseeds complex down yesterday. Paris rapeseed futures (Nov-24) closed at €471.00/t, down €8.75/t on Friday’s close. The May-25 contract also fell €8.75/t over the same period, to close at €474.50/t.

- Despite the USDA’s production cut on Friday, soybean prices faced pressure yesterday on favourable weather and a slower crushing demand pace in the US during June.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Wheat a winner for harvest 2025 gross margins

There have been many challenges for farmers as we head into harvest 2024, including unfavourable weather and of course, stubbornly high on-farm costs especially overheads. But today, we look away from harvest 2024, and ahead to harvest 2025 gross margins to consider whether wheat remains the most favourable option for autumn drilling, weather allowing, which unsurprisingly – it does.

Importantly with gross margin work, the results are based on assumptions and not specific to any one business. As such, results should be taken as an indication of how the profitability in different crops reacts to the changing market conditions and possible planting trends, rather than a forecast of financial returns for each cropping option.

Introducing the harvest 2025 picture

UK new-new crop feed wheat futures (Nov-25) averaged £199.66/t in June 2024. This is down 2% compared to last year’s average in June of new-new crop prices, when the Nov-24 contract averaged £203.74/t. Paris rapeseed futures for Nov-25 in June were up 3% compared to Nov-24 pricing in June 2023.

On the other side of the coin, despite some easing, input costs remain elevated. The fertiliser market appears to have settled following the turbulence after the outbreak of war in Ukraine, but remain above historic averages. In June 2024 the spot price for UK produced ammonium nitrate (AN) (34.5% N) averaged £333/t. This was down 56% compared to highs seen in June 2022 but remaining 12% above June 2021.

Within this analysis, we use June 2024 spot domestic UK AN 34.5%. For new season prices, we could see actual fertiliser costs differ from this. From quotes and comments collected from industry, seed price per hectare costs have risen across the seed types analysed on the year.

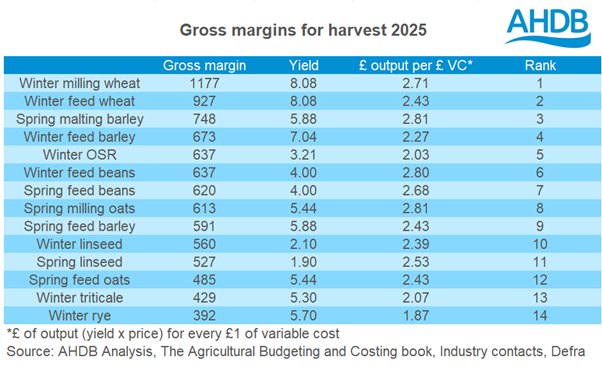

Harvest 2025 gross margins – wheat top of the crops

As expected, winter milling wheat and feed wheat came out as the top two performing crops of those analysed on a gross margin basis - with high yield potentials and considering current UK feed wheat pricing for Nov-25. Unsurprisingly, this looks to be a strong incentive to plant wheat for harvest 2025 weather allowing. As such, this indicates the likelihood of an increased area from the smaller harvest 2024 area, which was impacted by consistent rain at drilling for many.

Looking to milling wheat premiums, over the past few seasons (2021/22 to 2023/24) we have seen significant growth. This follows tightening availability from difficult weather conditions and considering increased costs (both fertiliser and from wet weather) to produce. In this analysis, we used a 5-year average (2019/20 to 2023/24) ex-farm premium. This season particularly has seen strong milling premiums. While we can expect to see this continue to an extent into next season (2024/25), it will be dependent on how EU wheat prices too. It is perhaps too early to expect these premium levels to continue ahead to harvest 2025 yet.

Spring malting barley looking attractive

Following on from wheat, results show spring malting barley as an attractive planting option for harvest 2025. Straw has not been accounted for in this gross margin work, and with supported straw price levels for many areas, this also could contribute to the outlook for profitability.

Malting barley premiums have also seen growth in recent seasons, with strong demand plus weather challenges creating challenges for availability. With weather challenges and elevated costs, the risk to businesses not making specification is heightened. Again, we used a five-year-average in this analysis, which is a premium of £0.35/t from UK feed wheat futures for ex-farm malting barley. For 2023/24, the premium averaged over £35/t. But, spring barley saw a notable increase in area for harvest 2024 with rises in the share of malting, brewing and distilling varieties. Whether premiums will continue for this season (2024/25) will depend on UK quality data and wider EU supply news as harvest commences. But again, it is perhaps too early to assume recent large premiums for harvest 2025.

Changes for break crops

Looking to break crops, winter feed beans have crept up in line with winter oilseed rape (OSR) in the rankings, considering the relative pricing of the two crops, plus large nitrogen costs for OSR eroding the gross margin picture. This is despite the Paris rapeseed Nov-25 contract in June 2024 averaging 3% higher than the new-new crop contract (Nov-24 contract) in June 2023. Despite previously being a popular crop for many UK arable farmers, OSR has seen area declines over the past few years, due to increasing costs and variable yields from ongoing pest pressure. With many farmers concerned about the viability of OSR due to pest pressure, winter linseed could provide an alternative with it being sown in the autumn (Aug-Oct), though all crops come with their own challenges.

Concluding comments

Unsurprisingly, wheat remains top of the rankings. In particular milling wheat gross margins look strong considering premium levels, though this comes with its own challenges associated with meeting specification, especially considering weather. Comparing to harvest 2023 gross margin predictions, using a full fertiliser application rate, harvest 2025 for many crops looks healthier. But it’s important to remember many of the cost challenges now on-farm are within overhead costs.

Selecting cropping options remains an ongoing challenge, particularly with alternative SFI options, cost volatility and difficult weather. It is essential to consider cropping margins and profitability over a longer period of time for example 3 to 5 years when making decisions, as done here, considering that SFI agreements are for a number of years. Looking to recent analysis, this showed us that from a financial perspective it is only worth replacing a break crop like OSR with an SFI action if they are prone to consistent crop failure.

The latest analysis on SFI 2024 is available here on the AHDB website. This area is something we will be monitoring closely and producing more analysis on going forward. Additionally, AHDB’s recent analysis found that many farmers are still opting for conventional farming systems, instead of SFI actions.

For help assessing your farm performance currently, Farmbench is a useful tool available from the AHDB. For more information, click here.

- OSR price does not include oil bonuses.

- Straw output not included in the calculation.

- Winter rye and winter triticale are priced as feed grains.

- Premium and discounts for major crop types are calculated as 5-year average (2019/20 to 2023/24) of Corn Returns ex-farm values to nearby UK feed wheat futures close.

- Minor crop pricing which is not available through Corn Returns have been calculated using an average of industry quotes for harvest 2025.

- Seed prices are an average of industry quotes for harvest 2025.

- Crop protection costs and sundries have been calculated using the ABC budgeting and costings book.

- Winter OSR, winter rye and winter triticale prices are for hybrid seed.

- Yield calculated using Defra five-year average (2019-2023) or ABC budgeting and costing book where applicable.

- Grain prices are calculated using Nov-25 UK feed wheat futures, recent four-week average to 12 July.

- Rapeseed prices are calculated using Nov-25 Paris rapeseed futures, recent four-week average to 12 July.

- Fertiliser prices are the June 2024 average from AHDB GB fertiliser prices:

- UK produced AN 34.5% = £333/t

- Muriate of Potash (MOP) = £365/t

- Triple Super Phosphate (TSP) = £449/t

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.