- Home

- News

- Do SFI uptake stats ease concerns about land removed from food production? Grain market daily

Do SFI uptake stats ease concerns about land removed from food production? Grain market daily

Wednesday, 22 May 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £220.85/t yesterday, down £0.15/t from Monday’s close

- While concerns over the Russian wheat crop continue to offer support, London feed wheat futures fell slightly yesterday due to sluggish EU wheat export demand and some technical resistance. Furthermore, sterling strengthened against the dollar, reaching a two-month high, supported yesterday by industry figures which show UK inflation has slowed down on the month

- Paris rapeseed futures (Nov-24) closed at €487.75/t yesterday, down €4.25/t from Monday’s close

- Recent frosts in Ukraine are not believed to have caused significant damage to the rapeseed crop, contrasting with speculation earlier in the week that yield had been impacted. Also, weakness in Malaysian palm oil exports, in addition to an anticipated increase in production, weighed on the vegetable oils complex

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Do SFI uptake stats ease concerns about land removed from food production?

Despite some unease regarding the amount of farming land entered into the Sustainable Farming Incentive (SFI), recent statistics suggest that this should not be a big concern.

Earlier this year, we highlighted in a blog post how there were questions being raised over the amount of productive farmland being entered into the SFI and the implications for food production.

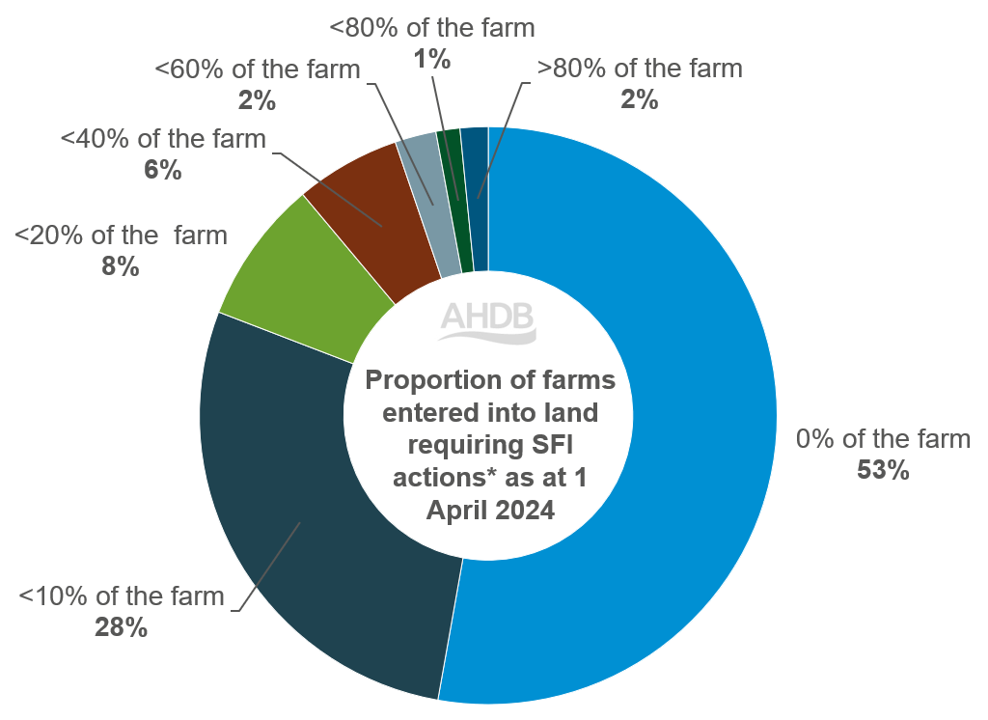

Statistics released by Defra on 3 May 2024 show that out of the 13,400 farms entered into SFI 2023 (as at 1 April 2024), 81% had entered less than 10% of their farmland into actions which require land (Figure 1).

Figure 1. Proportion of farms entered into SFI actions requiring land to be taken out of production as at 1 April 2024

Source: Defra

- AHL1 – Pollen and nectar flower mix

- AHL2 – Winter bird food on arable and horticultural land

- AHL3 – Grassy field corners or blocks

- AHL4 – 4 m to 12 m grass buffer strip on arable and horticultural land

- IGL1 – Take grassland field corners or blocks out of management

- IGL2 – Winter bird food on improved grassland

- IGL3 – 4 m to 12 m grass buffer strip on improved grassland

- IPM2 – Flower-rich grass margins, blocks, or in-field strips

Only 2% of farms had entered 80% or more of their farm. This correlates with conclusions from the SFI stacking analysis we carried out using AHDB virtual farms – it only makes financial sense to carry out these land-requiring actions on unproductive or marginal areas of the farm.

For example, the AHDB 455 ha virtual arable farm had 8% of its farmland entered into such actions, while the virtual beef and sheep farms had 11–14% of their grassland entered into such actions.

On 25 March 2024, Defra announced that certain land requiring SFI actions could total no more than 25% of a farm’s total farmland. Looking ahead, it is, therefore, increasingly unlikely that considerable proportions of farmland will be entered into these actions.

The SFI is intended to act as a buffer for farmers during challenging years but will do so to a lesser extent than the Basic Payment Scheme.

How does SFI uptake compare with Countryside Stewardship (CS)?

As of the 1 April 2024, there were 34,900 CS agreements in place and 13,900 SFI 2023 agreements. However, it should be noted that the CS scheme is far more established, so this is to be expected.

Additionally, farm businesses can enter land into both the SFI and CS as long as equivalent actions are not carried out on the same area of land.

Figure 2. Area entered into selected SFI and equivalent CS actions as at 1 April 2024

-2.png)

Source: Defra

- AHL1 – Pollen and nectar flower mix

- AHL2 – Winter bird food on arable and horticultural land

- AHL3 – Grassy field corners or blocks

- AHL4 – 4 m to 12 m grass buffer strip on arable and horticultural land

- IGL1 – Take grassland field corners or blocks out of management

- IGL2 – Winter bird food on improved grassland

- IGL3 – 4 m to 12 m grass buffer strip on improved grassland

- IPM2 – Flower-rich grass margins, blocks, or in-field strips

- NUM3 – Legume fallow

- SAM2 – Multi-species winter cover crops

- SAM3 – Herbal leys

Actions which proved the most popular tended to be those which can be easily implemented into current farming systems, as well as those which could provide benefits for cropping rotations.

Legume fallow (NUM3), winter cover crops (SAM2) and herbal leys (SAM3) proved the most popular SFI options requiring land. These actions were more popular than their equivalent CS options; for example, the area entered into SFI herbal leys (SAM3) totalled 175 Kha, compared with the CS equivalent (GS4) of 84.7 Kha.

The area entered for SFI winter cover crops (SAM2) was 124 Kha, whereas 70.7 Kha was entered into the equivalent CS action (SW6).

Although equivalent actions in the SFI and CS have the same aim and payment rates, they may differ in the manner they can be carried out, as well as any restrictions which may apply.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.