Arable Market Report – 15 July 2024

Monday, 15 July 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

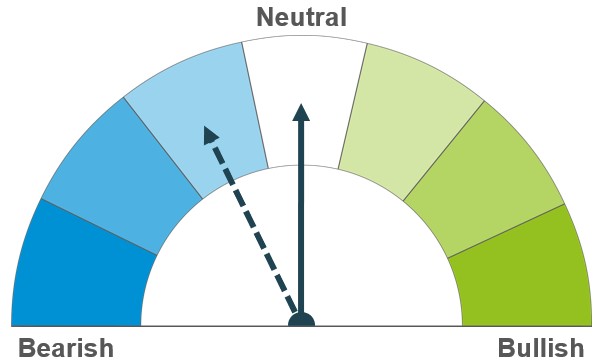

Improved global wheat stock forecasts could start to pressure the grain’s price premium over maize. Plus, unless yield results deteriorate as global wheat harvests progress, prices could come under pressure as confidence in estimates grows.

Global maize crops are projected to be enough to cover expected demand in 2024/25. However, weather conditions remain in focus as maize crops across the Northern Hemisphere go through their critical yield forming stages.

Reduced global barley prospects could support feed barley prices relative to other grains looking ahead. Crop fortunes, including harvest results, and demand levels need to be watched closely.

Global grain markets

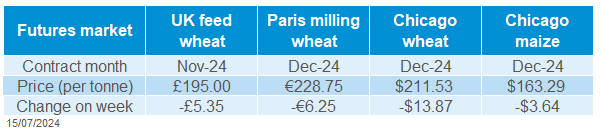

Global grain futures

Wheat prices fell last week as harvests progressed across the Northern Hemisphere, including in the US and Black Sea regions, and the USDA increased its global crop estimate.

The USDA added 5.4 Mt to its 2024/25 global wheat production estimate, now 796.2 Mt. The larger US area and better yields boosted US output by 3.6 Mt, but there were also smaller increases for Canada and Pakistan. Global stocks are now only expected to fall 3.8 Mt year-on-year, compared to 7.3 Mt last month.

European futures fell by less than US prices as heavy rain hampers crop prospects and delays harvesting in Western Europe. The French Ag Ministry pitched the French wheat crop (ex. Durum) down 15% to 29.7 Mt, and the smallest since 2020’s 29.2 Mt; some private estimates are lower still.

Optimism over US crop potential pressured Chicago maize futures last week. Reflecting this, speculative traders are back to large net-shorts. By 9 July, speculative traders held record large net-short positions in Chiago maize futures (CFTC). The market recovered some of the lost ground towards the end of the week, potentially aided by some short-covering. On Friday, the USDA added just 0.9 Mt to global 2024/25 maize stocks despite increasing the US crop by 6.1 Mt. Lower opening stocks and reduced EU and Russia crops offset the rise in US output.

The global barley picture is looking tighter. While global production is expected to grow 2.8 Mt year-on-year to 145.1 Mt, this is by far less than the 5.7 Mt forecast in June (USDA). With demand so far expected to stay stronger than in 2023/24, stocks could fall notably this season. Quality and yields are both in focus as winter barley harvests advance; the impact of persistent rain in western Europe is a particular watchpoint.

UK focus

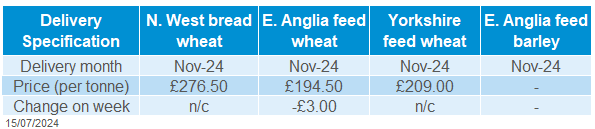

Delivered cereals

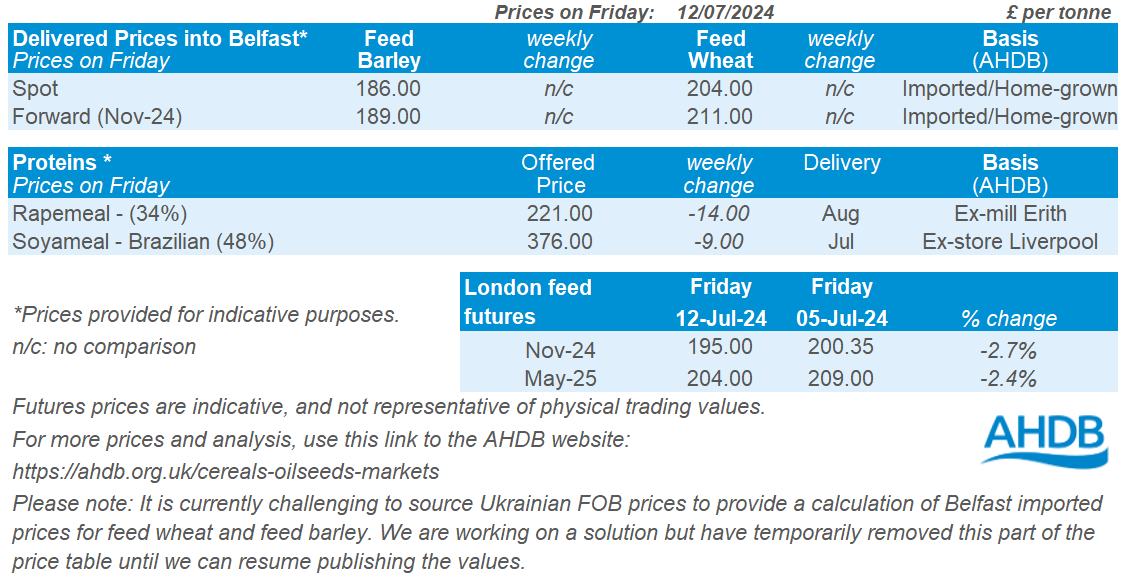

Nov-24 UK feed wheat futures lost £5.35/t last week to settle at £195.00/t on Friday. This is a similar loss proportionally to the Dec-24 Paris milling wheat futures (both down 2.7%). Cuts to European crop estimates offered some support compared to US prices last week, despite both the pound and euro rising against the US dollar.

Delivered prices for both bread and feed wheat followed the futures market lower last week (Thursday – Thursday). On 11 July, feed wheat delivered in East Anglia in November was £194.50/t, down £3.00/t from 4 July. Over the same period bread wheat delivered in the North West during harvest was also down £3.00/t at £271.50/t. Bread wheat premiums remain firm as we await the wheat harvest.

Harvest results could influence the UK’s price relationships to the global markets for malting, milling and feed grains. AHDB will issue its first estimates of GB progress and harvest insights on Friday 2 August; look out for highlights in Grain market daily.

Oilseeds

Rapeseed

Soyabeans

Improved soyabean crop conditions and the rise of rapeseed production forecasts in the northern hemisphere weighs. However the global oilseed balance remains tight, keeping prices relatively supported.

Crop conditions improve in the US, however upcoming weather conditions during the pod setting stage remain key for yield prospects. No change for the 2024 Brazilian soyabean crop suggests ample global supply longer-term.

Global oilseed markets

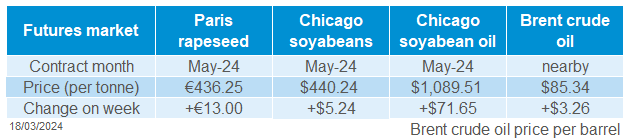

Global oilseed futures

Global oilseed markets were pressured last week (Friday – Friday), as Chicago soyabean futures (Nov-24) closed at $391.41/t, falling $23.70/t. Improved soyabean conditions and weakness in the vegetable oils complex weighed on oilseed markets. However some short covering ahead of the USDA’s WASDE on Friday limited bearish pressure towards the end of the week.

The US soyabean crop continues to develop faster than the five-year average, and crop conditions scores improved on the week. The proportion of the crop rated good to excellent was raised by one percentage point to 68%, contrary to the average analyst expectation of no change. This exceeds the five-year average for this time of year by 9 percentage points. The crop has improved following more favourable weather conditions, as the percentage of soyabeans in drought area falls one percentage point on the week to 8%.

Malaysian palm oil stocks reached a four-month high earlier last week largely attributed to a greater decline in exports in comparison to production, weighing on the vegetable oils complex. Malaysian palm oil futures (Sep-24) fell 3% over the course of the week (Friday to Friday).

Soyabeans and rapeseed markets were more subdued towards the latter half of last week with some short covering ahead of the USDA’s WASDE report. The July report casts bearish pressure on soyabeans, with world ending stocks slightly heavier than the average analyst estimate, at 128 Mt.

Some weakness in the US dollar in response to greater speculation of interest rate cuts may also have offered some partial support to Chicago soyabeans futures last week.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures were pressured on the week (Friday to Friday), as the Nov-24 contract fell €34.75/t to close at €479.75/t. The market returned to values below the 20-day moving average, as favourable weather in Canada supports canola production and weakness in the soyabean market weighed on the oilseed complex.

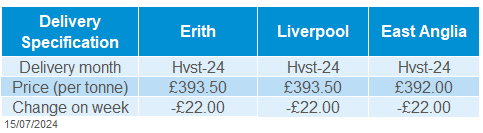

Rapeseed delivered into Erith for August delivery was quoted at £393.50/t on Friday, falling £22.00/t on the week. Also, delivery into Erith for November was quoted at £404.00/t, down £22.50/t on the week.

In July’s WASDE report, global rapeseed production rose following increases in Canada by 400 Kt to 20,000 Kt and in the EU by 150 Kt to 18,900 Kt. Despite a rise in global domestic consumption, the greater rise in global production lifts endings stocks by 260 Kt to 7,760 Kt.

For the 2023/24 marketing year, the European Commission has released the final report regarding imports and exports for cereals and oilseeds. Rapeseed imports into the EU for the marketing year reached 5.68 Mt, down 24% from the last marketing year, while exports were down 13% over the same period at 476 Kt.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.