Speculative traders back to bearish bets: Grain market daily

Tuesday, 9 July 2024

Market commentary

- Global grain prices fell yesterday on the advancing Russian and US wheat harvests, and with optimism towards US maize crop conditions. Selling by speculative traders was also likely a factor with LSEG suggesting notable selling across the Chicago futures markets. UK feed wheat futures for Nov-24 fell £4.70/t to close at £195.65/t.

- Rapeseed prices lost much of the gains made last week, when crop concerns and short covering supported prices (see more in yesterday’s Market Report). The Nov-24 Paris rapeseed contract fell €13.00/t to settle at €501.50/t. There was also a fall in Chicago soyabean futures in expectation of good crop conditions in the USDA report.

- After the markets closed, the USDA reported improvements in both US maize and soyabean condition scores, despite heavy storms. As of 7 July, 68% of both crops were rated as good or excellent, up from 67% a week earlier with more crops reaching their reproductive stages. The market had expected unchanged ratings according to a poll by LSEG. The US winter wheat harvest also reached 63% complete.

Speculative traders back to bearish bets

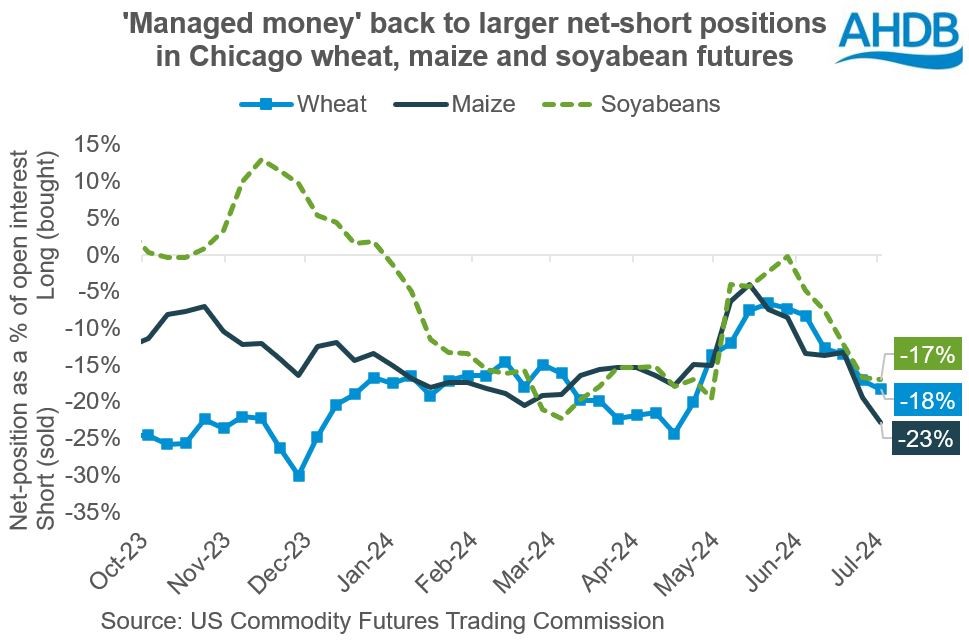

Speculative traders are, once again, holding net-short positions, which can be used to profit from falling prices, across most key grain and oilseed futures markets. This is after buying into these markets through May.

By early July, speculative traders held large net-short positions in Chicago maize and soyabeans and Chicago wheat, plus a small net-short in Paris wheat. Investment funds had also sharply reduced the size of their net-long Paris rapeseed futures.

The change in positions reflects declines in prices through June, on the back of easing concerns over global grain and oilseed supplies compared to the start of June.

Wheat prices fell through June as Russian weather improved and then production forecasts stabilised or even recovered. The improved outlook for Russian crops has weighed on prices, together with a rapid US wheat harvest bringing new supplies to the market. Chicago wheat futures fell 17%, while Paris wheat futures fell 13%.

Chicago maize prices fell 10% since the start of June, as planting progressed well and crops got off to a good start. The USDA showed a larger than expected planted area on 28 June. A good start for US soyabean crops also weighed on Chicago soyabean prices during June, with the Nov-24 contract losing 7%.

However, holding net-shorts can lead to short-covering by speculative traders if prices rise i.e. adjusting positions to minimise loses. As seen last week in soyabean oil and rapeseed futures, short covering can further add to the upward momentum in markets. Though, this only occurs if prices rise.

Looking ahead

Despite the positions held by speculative traders, over the longer-term, the outlook for prices is determined by the market fundamentals i.e. supply and demand.

Uncertainty over the outlook for wheat markets remains, however, with some crop estimates cut further but other upgraded recently.

Stocks in key exporting countries are already low and predicted to decline further, meaning there’s a limited cushion to any supply issues.

Unfavourably hot weather is expected in Russian spring wheat growing areas this week, while ongoing harvests will also give more insights into potential crop sizes. The Russian crop number will be amongst the figures watched in the USDA’s next estimates of world supply and demand on Friday (out 5pm BST).

For maize, and to a lesser extent soyabeans, the US weather outlook for the coming weeks will have a notable influence over prices.

There’s a strong relationship between the average temperature across the ‘Corn Belt’ in July and how final US maize yields compare to the long-term trend.

Cooler temperatures in July are linked to higher maize yields, while higher temperatures are linked to lower yields. For soyabeans, conditions in August have more influence. So far in July, temperatures have been cooler than average, but are expected to turn more seasonal this week.

With an uncertain wheat outlook and a higher dependence on US maize yields for total global grain supply, monitoring the weather and harvest results remains particularly important.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.