Could the good start for US maize weigh on markets? Grain market daily

Tuesday, 4 June 2024

Market commentary

- UK feed wheat futures edged higher yesterday; the Nov-24 contract gained £0.90/t to close at £218.35/t.

- This was despite the global wheat market slipping lower due to profit-taking by speculative traders. However, price falls were limited by uncertainty over Russian crop outlooks. Some rain has fallen in Southern Russia, but Central Russia remains largely dry, and the forecasts are variable.

- Nov-24 Paris rapeseed futures fell €7.50/t to €488.00/t, amid prices generally declining across the oilseeds complex. Chicago soyabean futures fell as the market expected US planting progress to remain above average. Good weather for planting canola (rapeseed) in Canada weighed on Winnipeg canola futures.

- The Australian government expects the country to produce 10% more wheat, and 7% more barley in 2024/25 than 2023/24. This follows expanded areas and favourable growing conditions in eastern areas. However, Australia’s canola (rapeseed) output will shrink 5% year-on-year after dry weather in Western and South Australia.

Could the good start for US maize weigh on markets?

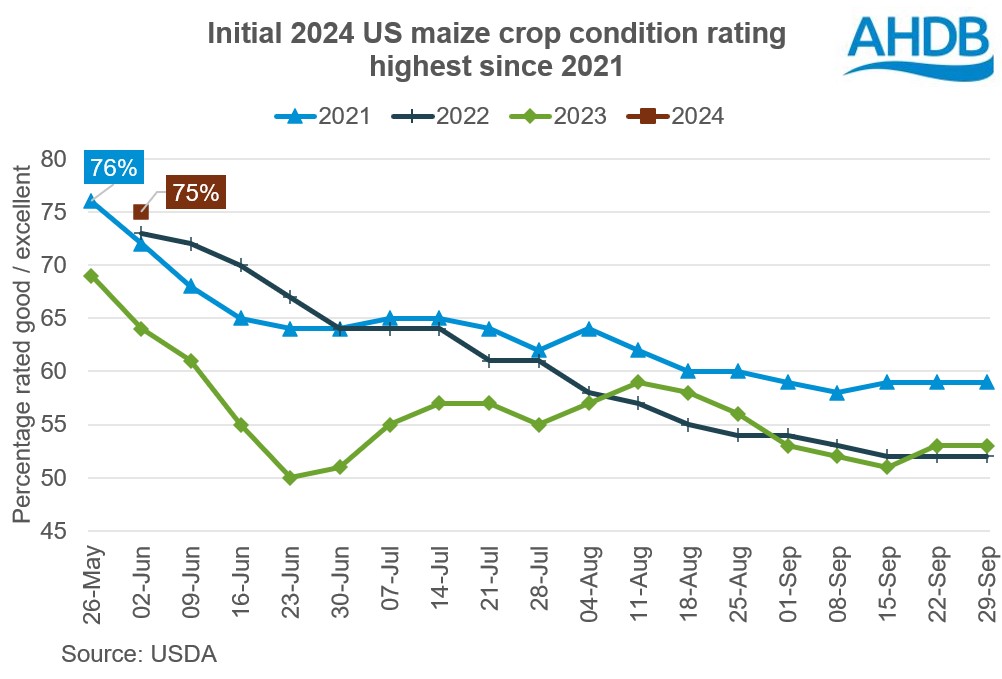

US 2024 maize crops are off to a good start reported the USDA last night. After the markets closed, the USDA reported that 75% of US maize was rated as in good /excellent condition as of 2 June. This is the USDA’s first assessment of the 2024 maize crop’s condition. It is notably higher than both last year’s first rating when 64% was classed as good/excellent and the average market expectation of 70% (LSEG). This is also the highest initial rating since 2021.

Maize planting remains ahead of the five-year average pace despite recent wet weather. With 91% of the anticipated area now planted, this supports expectations that US farmers will be able to plant all their intended crops. The recent wet weather across the key growing areas will be supportive for crops continuing their positive start. More rain is forecast for this week.

US maize production is forecast to decline 3% year-on-year to 377.5 Mt (USDA) due to a smaller planted area after soyabean prices looked more attractive through the winter. Nonetheless, the crop is still a key part of global grain supply and demand. US maize is predicted to account for 31% of global maize production and 16% of total global grain production in 2024/25 (USDA).

The key months for US maize crops are still ahead, as weather conditions in July and early August are critical for US maize crop yields. But this is still positive news for US maize crops and could pull global maize prices lower, at least short-term. A fall in global maize prices could in turn pressure wider feed grain prices, including feed wheat, though this would depend on wider news from the global wheat market.

However, harvest results from the 2023/24 Brazilian Safrinha maize crops could also impact maize prices. There’s still a wide range of estimates for the crop following a heatwave in some areas earlier in the year, and recent flooding for southern areas. 4% of the crop was harvested by 2 June (Conab).

Positive news for other US crops

- Spring wheat crops were also in better shape than the market had expected (LSEG). The USDA reported that 74% was in a good/excellent condition in its first assessment of the 2024 crop. This is up from last year’s 64% and the average market expectation of 69%. Planting is now 94% complete.

- Soyabean planting is also still ahead of average, despite recent wet weather. 78% of soyabean crops were planted by 2 June, and the USDA plans to release its first assessment of crop conditions next week.

- Winter wheat crop ratings also edged higher, though harvest is underway (6% complete by 2 June). Nationally, 49% of winter wheat is rated as good excellent, up from 48% last week.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.