US area battle could impact new-season prices: Grain market daily

Tuesday, 6 February 2024

Market commentary

- This week began as last week ended with downward pressure on grain prices. May-24 UK feed wheat futures fell another £1.80/t to close at £173.50/t, while the Nov-24 contract lost £1.10/t to £192.00/t. The gap between old and new crop contracts is now £18.50/t, equating to just over £3.00/t per month, which could incentivise some to carry stock into the new season

- Strong competition for exports, plus re-positioning by traders ahead of this week’s data releases, weighed on global grain futures. A rebound in the strength of the US dollar, after last week’s decision by the US Federal Reserve to hold US interest rates, also weighed on US and, hence, global prices

- On Thursday (8 Feb), the USDA releases its next supply and demand forecasts (5pm GMT), while Statistics Canada reports quarterly stock levels and Conab estimates Brazilian crop sizes

- May-24 Paris rapeseed futures lost €1.75/t to €414.25/t, while the Nov-24 contract fell €1.25/t to €418.25/t. After the Paris market had closed, technical trading pushed up Chicago soya bean prices, though the advancing Brazilian harvest capped gains. Conab reports the Brazilian harvest was 14% complete as of 3 February vs 9% a week earlier

US area battle could impact new season prices

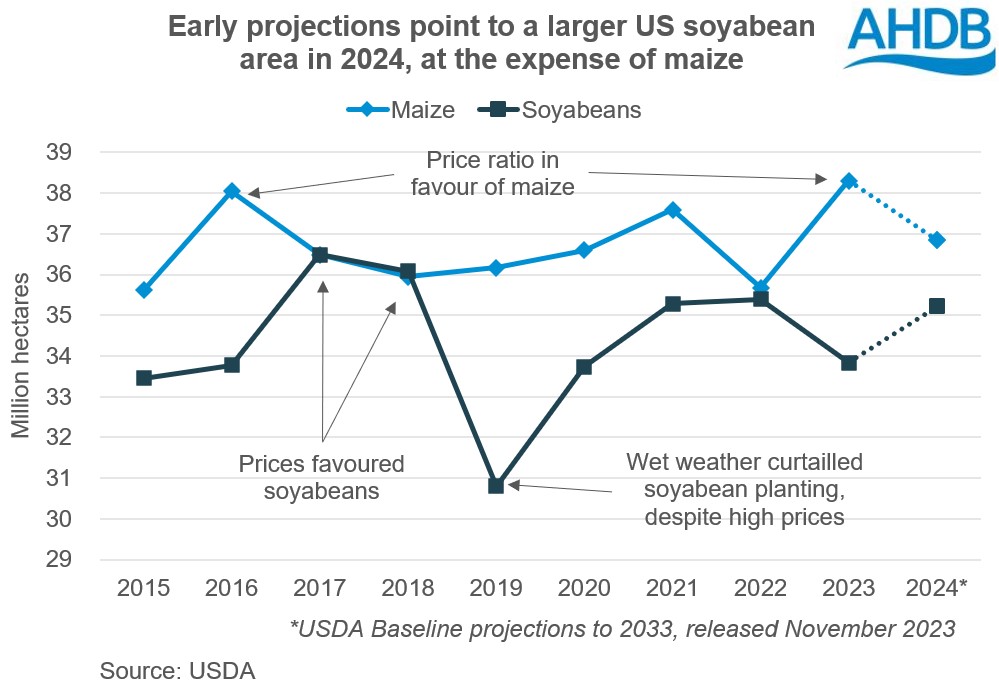

Current prices point to a larger US soya bean area for harvest 2024, at the expense of maize. Given the USA supplies around 20% of global oilseeds and 19% of global grains (five-year average), the US areas will have knock-on implications for prices.

US farmers are currently finalising planting plans for harvest 2024, often referred to as the ‘fight for dirt’ in the United States. The areas are dominated by maize, and soya beans. Maize planting typically gets underway in March and the window to register for crop insurance closes in mid-March. Soya bean planting typically begins in April. The relative price and profitability of maize and soya beans are important factors for planting decisions.

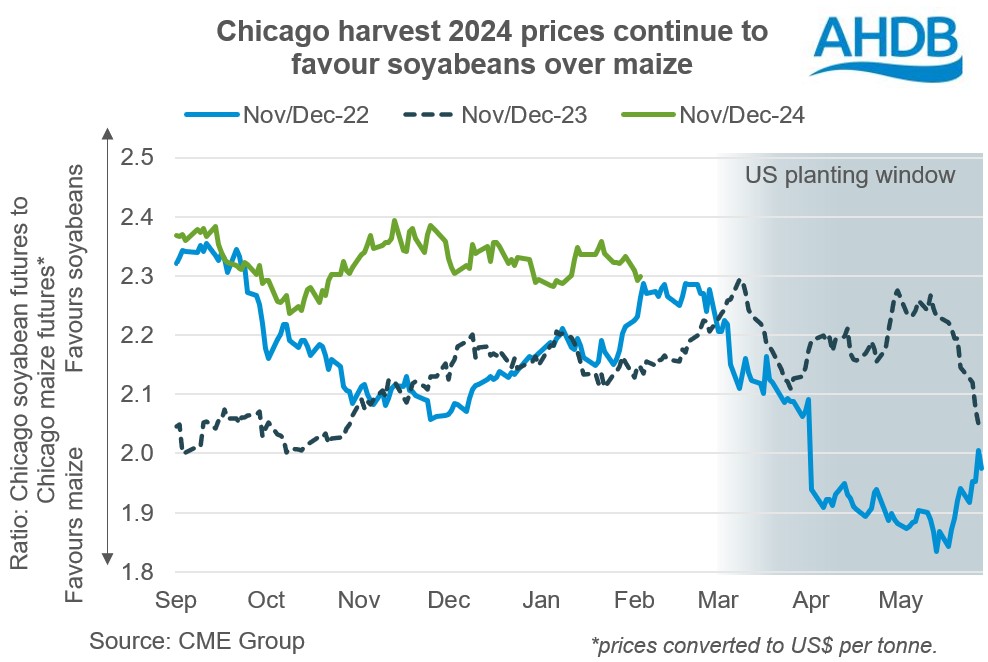

In 2024, the USDA forecasts it will costs around 2.3 times more per tonne to grow soya beans than maize, largely due to the yield differences between the two crops. This means if Chicago soya bean prices are roughly more than 2.3 times those of maize, it would make soyabeans more attractive. Vice versa, lower price ratios make maize more attractive.

Most planting decisions are made in the autumn and winter; though farmers may tweak decisions if prices move notably. Weather can still have a considerable bearing on the final area, such as in 2019 when wet weather limited the soyabean area despite high prices.

Yesterday, new crop (Nov–24) Chicago soyabean futures for Nov-24 closed at $432.34/tonne – 2.3 times the price of new crop Chicago maize futures. The Dec–24 Chicago maize futures contract closed at $188.09/tonne. This points to soya beans looking more attractive and suggests there could be a rise in soyabean plantings for harvest 2024.

A year ago, the ratio between Nov–23 Chicago soyabean futures and Dec–23 Chicago maize futures was 2.14. For harvest 2023, the US soya bean area fell 4% year-on-year, while maize plantings rose 7%.

Less maize, more soya beans in 2024?

Early projections point to more soyabean acres and less maize in 2024. In its 10-year baseline projections, released in November, the USDA indicated a 4% year-on-year rise in the soyabean area in 2024. The USDA projections also included a 4% fall in the maize area and a 3% drop in wheat plantings.

If confirmed, a larger US soyabean area, subject to yields, could mean a larger crop in 2024/25. Forecasts for record South American soyabean production have been weighing on global oilseed prices, including rapeseed. So, the potential for an even larger US soyabean crop than in 2023 could add further pressure.

On the flip side, for maize a smaller US area would mean higher yields are needed to support production. However, US maize stocks at the end of 2023/24 are forecast to be the heaviest since 2018/19, which is likely to offset some falls in output. That said, confirmation of a smaller US maize (and wheat) area could help temper some of the bearish tone currently being seen in grain prices.

We’ll hear more about prospects for US crop areas in 2024 at next week’s USDA Outlook Forum, on 15 and 16 February. This will be followed by the results of the annual survey of planting intentions by the USDA on 28 March, called ‘prospective plantings’.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.