Will rapeseed prices continue to drop in 2024? Grain market daily

Thursday, 4 January 2024

Market commentary

- UK feed wheat futures (May-24) closed at £193.55/t yesterday, down £1.05/t from Tuesday’s close. While new crop futures (Nov-24) closed at £206.15/t, down £0.85/t over the same period.

- The domestic market followed the global wheat market down yesterday. The Paris market was pressured by Black Sea grain as weaker export demand pulled grain prices down in Ukraine. Further to that, Russian wheat (11.5% protein) is estimated at $8 - $10 less per tonne discount to western Europe.

- Russia’s wheat production for 2024 harvest was increased to 86.8 Mt following improved growing conditions over this winter (LSEG).

- Paris rapeseed futures (May-24) closed at €437.25/t yesterday, up €4.00/t from Tuesday’s close. The new crop futures contract (Nov-24) closed at €440.75/t yesterday, up €5.00/t over the same period.

- There were gains in the vegetable oils market yesterday following improved palm oil demand from India. Also, higher crude oil prices from supply concerns as a result of continued conflict in the Middle East spilled over into oilseed markets.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Will rapeseed prices continue to drop in 2024?

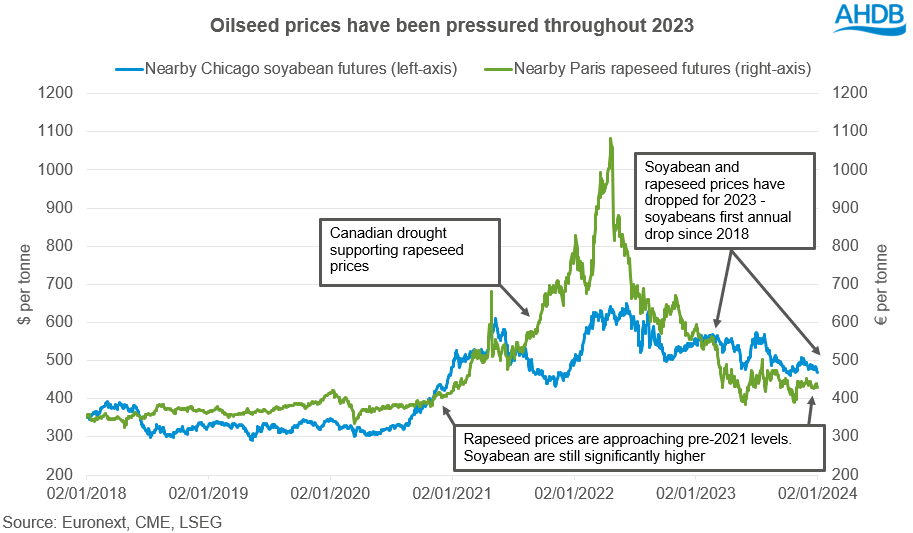

Nearby Chicago soyabean futures closed on the 29 December 2023 at $475.23/t, down 13% on the year. The year of 2023 marked the first annual drop on this date in nearby Chicago soyabean futures since 2018. This is despite robust global demand, the tightest US ending stocks since 2015/16 and the lingering El Niño weather event in the South Pacific, which has had implications for Brazil soyabean crop.

There has been pressure for nearby Paris rapeseed futures too, with the contract closing at €438.00/t on 29 December, down 25% on the year. The last two years have seen large drops for rapeseed, with boosted global rapeseed supply and falling soyabean prices.

Markets are at a very different point to last year where prices were factoring in the risks and unknowns around the Russia/Ukraine war. Although that still isn’t completely resolved, markets priced in that risk which has subsided as commodities have continued to flow out of the Black Sea region, though more slowly in recent months. Further to that, despite the turmoil of war, albeit reduced areas – Ukraine is continuing to produce agricultural commodities for global export.

Therefore, forecasting explicitly where prices could go into 2024 is a little trickier. This comes as rapeseed futures are approaching similar values pre-Russia/Ukraine war and the energy/cost of living crisis. However, soyabean prices are still historically high (see graph above).

Key market drivers:

- Rapeseed supplies could tighten into 2024/25 – Forward new crop pricing of rapeseed futures is sitting at a premium to soyabeans currently, indicating that there could be a tightening of supplies. We are potentially seeing area reductions in the EU, with prices significantly lower. However, Canada haven’t even started their sowing campaign yet for harvest 2024. Therefore, if a big Canadian area transpires a rapeseed premium could soon reduce.

- Large soyabean supplies – Despite talking about this El Niño weather event until blue in the face, Brazil is still going to produce a large amount of soyabeans going into 2024. Ag consultancies are lowering crop estimates from the dry weather – but note the soyabean crop is still looking to stand at 150 Mt+, these revisions have been priced into the market.

- US soyabean plantings could grow – US demand for soyabeans has grown exponentially from large biofuel demand, which has tightened their ending stocks. Planting intentions for new crop is approaching, just based on yesterday’s close the soya/maize price ratio is 2.29x for Chicago soyabean and maize futures (Nov-24). This sort of ratio historically shows that soyabeans could possibly be favoured, large US soyabean areas could possibly weigh on prices this spring.

Prices going into 2024 are not going to drop as much as they did in 2023, based on historical pricing, soyabean have a greater downward potential than rapeseed.

However, there is going to have to be either A) a dramatic shift in demand, i.e. China coming to the market and aggressively purchasing or B) a major weather event this spring in the US to offer any significant price support to the oilseeds complex.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.