New crop price support from US maize area risk: Analyst's Insight

Thursday, 4 November 2021

Market commentary

- After rising every day since 21 October, May-21 UK feed wheat futures fell £2.10/t yesterday to £225.00/t. Nov-22 futures declined £1.50/t to £196.00/t.

- Wheat prices fell due to profit-taking in global markets, plus a fall in crude oil prices. Nearby Brent crude oil prices fell to $81.99/barrel yesterday, the lowest level since 7 October ahead of an OPEC+ meeting this afternoon. If sustained, lower crude oil prices could reduce global demand for ethanol and biodiesel and so the grains and vegetable oils used to make them.

- May-22 Paris rapeseed futures fell €4.75/t to €674.00/t yesterday, or approx. £572/t. The Nov-22 price fell €2.25/t to €580.50/t, or approx. £493/t. (Refintiv).

- UK cereal usage statistics for September 2021 are now available. Click here for animal feed and here for human and industrial.

New crop price support from US maize area risk

Yesterday’s Grain market daily looked at what could change the market sentiment for Nov-22 wheat futures. The threat of a smaller US maize area in 2022 is one of the factors supporting new crop UK wheat prices.

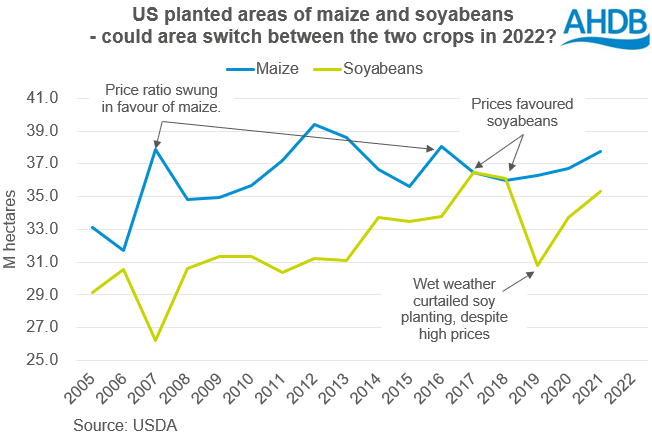

Due to the recent global fertiliser issues, early industry projections suggest the next US maize area (2022/23 marketing year) could be relatively static or fall if US farmers favour soyabeans.

The first official indication will come tomorrow (5 Nov) from the early release of tables from the USDA’s Baseline forecasts. These forecasts are based on the USDA’s October World Agricultural Supply and Demand Report, plus economic outlooks and look forward to 2031. This is followed by a survey of planting intentions, usually out on 31 March 2022 and official area data in June 2022.

Why does this matter? The US maize crop accounts for 17% of global grain production (2016/17 – 2020/21 average, USDA). As a result, Chicago maize futures often act as a ‘floor’ to global futures markets. Our relationship to the Chicago maize price varies, but a rise in this ‘floor’ price, will often trigger a rise in UK prices (or vice versa).

Risk from rising fertiliser prices

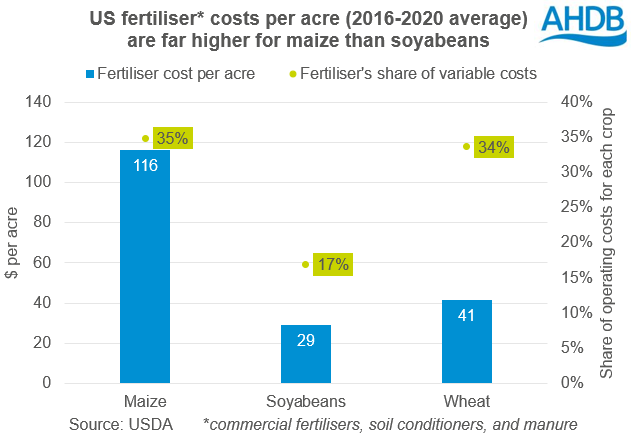

Fertiliser (including manure and soil conditioners) is a large part of the variable costs when growing maize in the US. The fertiliser costs are far higher for maize than soyabeans.

Fertiliser prices have been rising in the US, like the rest of the world. So, the concern is that US farmers will cut back their maize areas in favour of soyabeans.

Initial USDA forecasts made in June suggested a 5% year-on-year in total fertiliser costs for both the 2022 maize and soyabean crops. However, in dollar terms the rise was steeper for maize than soyabeans; $6.1 vs $1.6 per acre.

But since June prices have risen considerably. For example, in Illinois the cost of Urea rose 60% between 17 June and 21 October, while the cost of Anhydrous Nitrogen rose 54% (USDA). Taking this into account we know that cash costs will rise more for maize than soyabeans. The next cost of production forecasts are due in December.

Price ratio to offset?

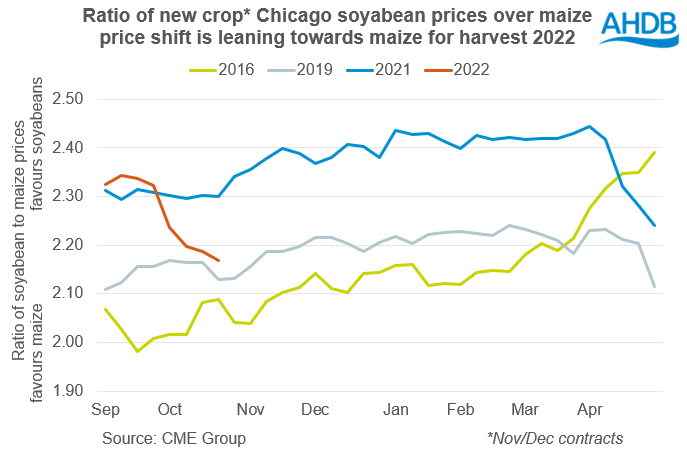

Maize and soyabeans are the two main cash crops in the US, and in many areas grown on the same fields. So, the relative price and costs of the two crops are important to deciding which crop to grow. It typically costs around 2.4 times as much to grow a tonne of soyabeans as a tonne of maize (2011-2020 average, USDA). This is due to the lower yields of soyabeans, compared to maize.

So, when soyabean prices are around 2.4 times (or more) those of maize, there is more incentive to grow soyabeans. On the flip side, a lower price ratio favours maize.

Recently, soyabean prices have fallen due to the good planting progress in South America. Meanwhile, US maize prices are up on a few weeks ago. This is due to a combination of the worries about the 2022 area, delays harvesting the 2021 crop and stronger demand from the ethanol sector. Because of this, the price ratio, at 2.1, is currently favouring maize.

US farmers will make their cropping decisions over the next few months, ahead of the maize planting window opening starting in March. If maize prices remain high compared to those for soyabeans (a lower price ratio), this could offset some of the concerns about high fertiliser costs for growing maize. The reward could be worth the higher initial outlay.

The upshot?

The concern about what US maize area will be planted in 2022 is currently a supportive factor for markets. Whether this concern translates into lower area forecasts later this autumn and reduced planting intentions next spring will be important.

If the US maize area is static or rises (contrary to expectations), some bullish support could be removed from the market. A decline in US maize prices for harvest 2022 will translate into potential lower 2022 wheat prices, including in the UK. However, between now and then we have a lot of data and weather, which could change the sentiment and decisions.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.