New crop wheat prices could pose an opportunity for domestic growers: Grain market daily

Wednesday, 3 November 2021

Market commentary

- UK wheat futures (May-22) closed yesterday at £227.10/t, gaining £0.60/t on Monday’s close. The Nov-21 contract also gained (£1.90/t) over the same period, to close at £218.35/t. Although the number of open contracts is dwindling as Nov-21 nears the end of trade.

- However, new crop UK wheat futures (Nov-22) closed at £197.50/t, down £0.50/t from Monday’s close which was a contract high.

- Old crop Paris wheat futures (Dec-21) closed yesterday at a contract high of €292.75/t.

- Short-term support comes from slightly declining conditions of US winter crops (below expectation) at a time of short supply, combined with strong international demand for grains.

New crop wheat prices could pose an opportunity for domestic growers

Global wheat prices are still buoyed by global demand. Along with rising Russian floating tax on wheat exports and global tight supplies.

Domestic prices, as mentioned in the market commentary, are supported. But, how long can this last?

Northern hemisphere 2021 wheat production is now clearer. Therefore, the market now turns its focus on the final stages of crop development from Argentina and Australian harvest. These two nations are expected to be responsible for 19% of 2021/22 global wheat exports.

Although beyond this, what could happen? Domestic growers have had two successive years of high prices off the back of global fundamentals. But, with Nov-22 closing yesterday at £197.50/t does this pose a potential opportunity to ease squeezed gross margins from high input costs for harvest-22?

Could we see a repeat of 2012?

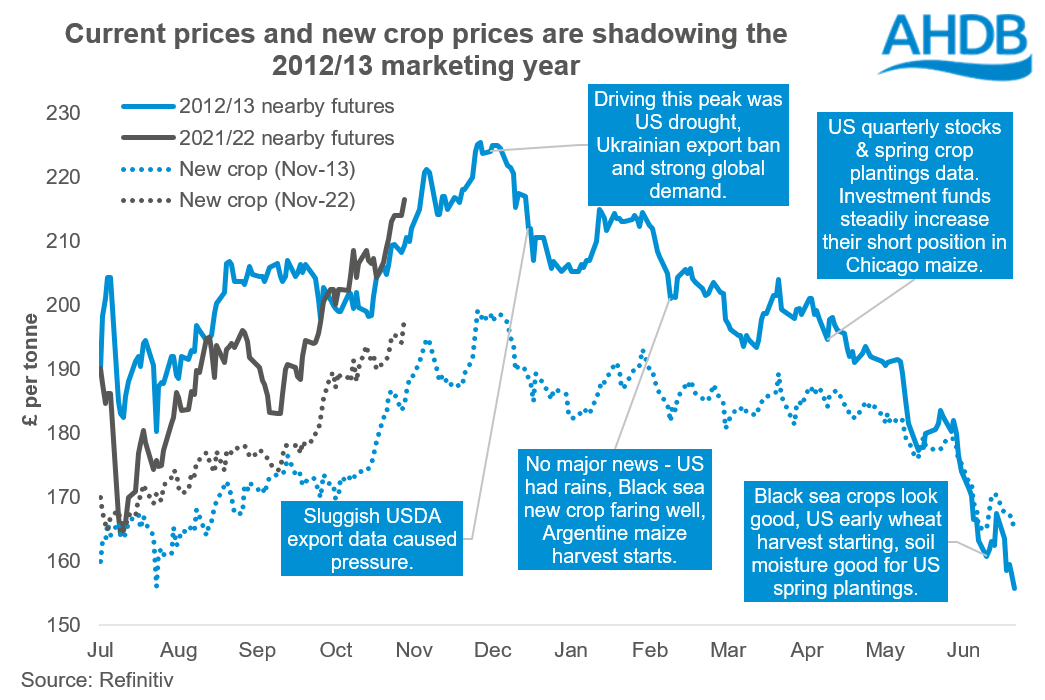

Current (nearby) and new crop (Nov-22) wheat prices are nearing the highs experienced in 2012. In 2012, nearby and new crop (Nov-13) UK wheat futures peaked at £225.45/t & £199.00/t, respectively, on 29 November 2012. But, from this point prices started to trail off.

Market drivers around this peak in 2012/13 included export restrictions from the Black Sea (Ukraine), strong global demand and drought in the US impacting winter wheat crop development. These are all similar drivers to those seen currently.

The bullish support in 2012/13 eased in December 2012 as global supply & demand was revised. US wheat stocks were revised up, despite previous data expecting a drop year-on-year. World maize production was also estimated higher than initially expected. At the same time, rain and snow eased US drought concerns.

Market sentiment can change

Between now and harvest-22 there is a lot that could change the supply & demand outlook. South American plantings and winter wheat development in the US, Black Sea and EU could all impact new crop prices in the coming months.

As 2012 showed, high new crop values may not last forever. A lot could change in the next 12 months, but current high prices may allow farmers to mitigate and manage risk when marketing their 2022 crop.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.