Ag inflation outweighing high cereal and oilseed prices? Grain market daily

Friday, 29 October 2021

Market commentary

- UK wheat futures (Nov-21) closed yesterday at £213.95/t, gaining £0.95/t on Wednesday’s close. Over this same period, the May-22 and Nov-22 contract gained £0.45/t to close at £221.95/t & £195.40/t, respectively.

- Although the Paris milling wheat (Dec-21) contract was pressured yesterday, the UK managed to gain as sterling weakened by 0.39% against the Euro, closing yesterday at £1 = €1.1798.

- The Chicago wheat market gained yesterday, driven by tight global supplies and strong export demand. Further to that, supporting the general grains complex are the delays to US maize harvest.

Ag inflation outweighing high cereal and oilseed prices?

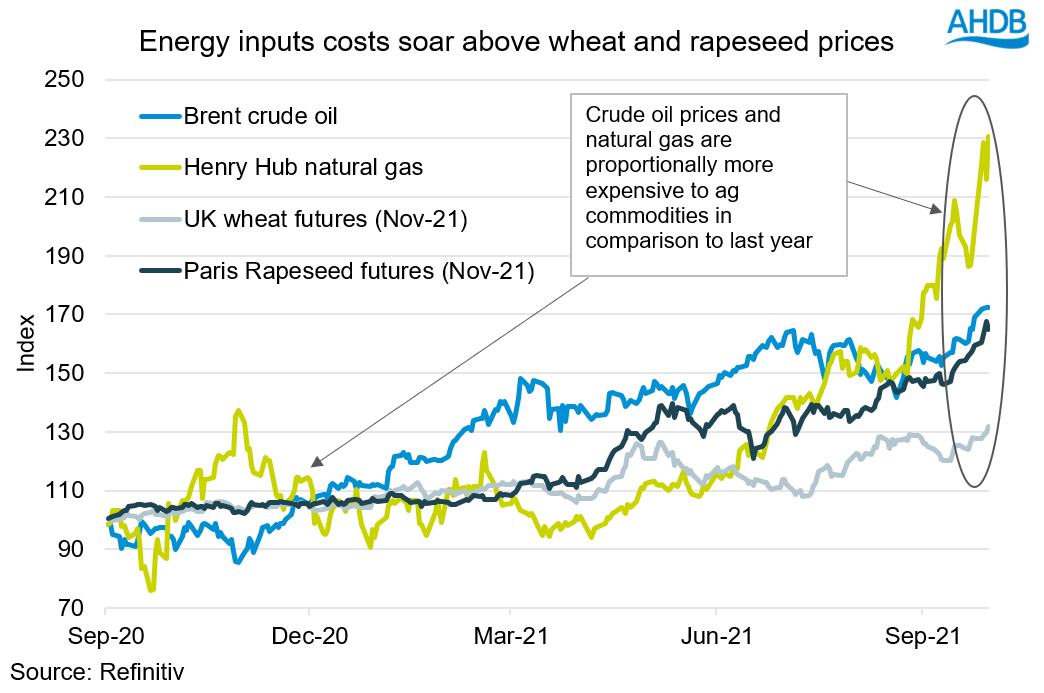

The latest Aginflation index data from Anglia Farmers (AF) has estimated farming inputs costs for a cereal & oilseed rape farm enterprise increased by 19.34%, between 1 September 2020 to 30th September 2021. A large driver of this inflationary increase is fuel and fertilisers.

Over same period mentioned, red diesel prices have risen from 46.8p to 67.12p per litre (Boiler Juice) and nearby natural gas prices (Henry Hub) by 131%, which has impacted the price of fertiliser.

Out of all enterprises AF analysed, Cereals & OSR inflation (Sep ’20-Sep’21) is the second lowest, behind sugar beet at 16.93%. A dairy enterprise is the highest, at 25.59% and latest analysis from the AHDB dairy team show that rising input costs are challenging profitability.

Rising costs with rising prices?

AF inflation analysis impacts input costs for the 2021 harvest. So what have prices done in that time?

In the last year (Sep ‘20 – Sep ‘21), wheat futures (Nov-21) have risen by £48.60/t and Paris rapeseed futures (Nov-21) by £216.45/t.

However, when these energy, and cereal and oilseed commodity prices are indexed over the last year, the increases have not been proportional, as fuel and natural gas prices have soared.

Supply & demand factors have driven the increases in wheat and rapeseed, including Chinese purchasing, Russian export tax intervention and global exportable wheat crops not being as high as expected in Canada, Russia & US.

Inflation to only get worse?

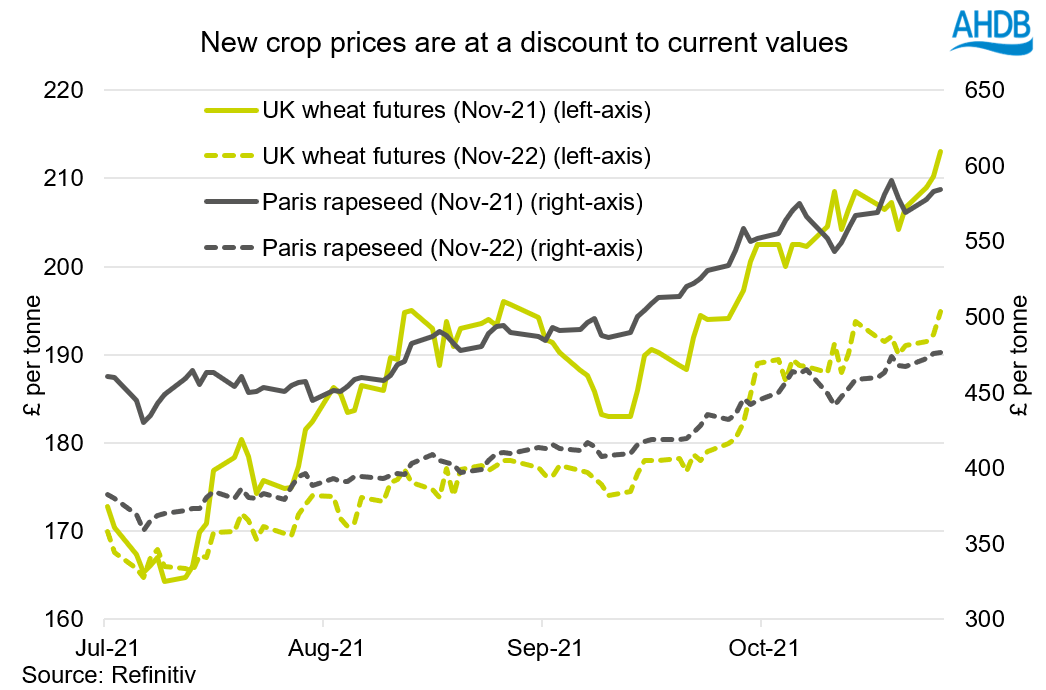

The current spot high prices of wheat and rapeseed prices (mentioned above) will be sheltering some of the impacts of inflation. However, this could have greater implications for a cereal & oilseed enterprise for the 2022/23 marketing year.

The strong energy & natural gas prices will be contributing to inflationary input costs for harvest ‘22. But, new crop prices are a fraction of the current spot highs.

Based on yesterday close, UK wheat and Paris rapeseed Nov-22 futures are at a £18.55/t and £107.58/t discount to current nearby prices, as the graph above displays.

With higher current input costs, it key to manage and mitigate price volatility and risk when considering marketing strategies for the 22/23 marketing year.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.