Dairy profitability challenged by rising input costs

Wednesday, 13 October 2021

By Patty Clayton

It’s hard not to have noticed the relentless rise of farm input costs over the past year. While the spotlight was on escalating feed costs through most of this year, we are now seeing sizeable increases in energy and fertiliser prices, along with steady upward pressure on labour costs.

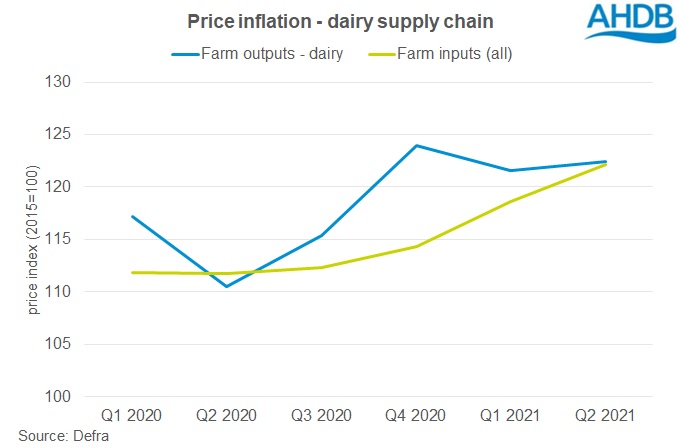

On the other hand, after the sharp dip in the spring of 2020, farmgate milk prices have been increasing, keeping the GB average milk prices above the 5-year average. However, growth in output prices has slowed in 2021, as can be seen by the relatively flat line measuring price changes in outputs. Meanwhile, the inflation rate for agricultural inputs has accelerated through 2021 putting pressure on margins.

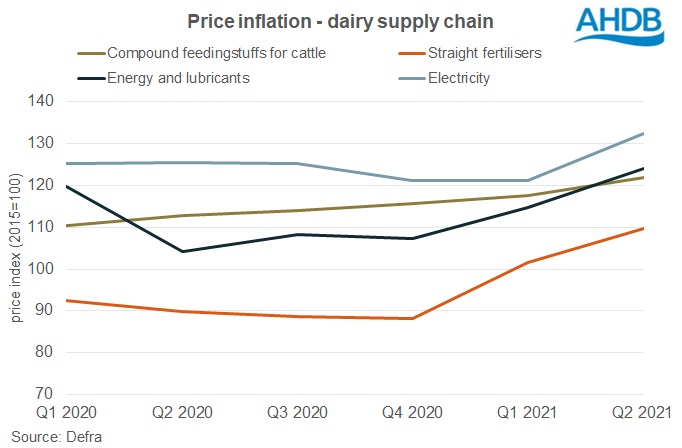

A breakdown of farm input prices shows that while feed price have been steadily increasing since the beginning of 2020, energy and fertiliser price increases have been the main drivers behind the recent inflationary moves.

Whether these rising costs will translate into reduced margins will depend on whether output prices continue to increase, and at a pace which keeps up with the input cost inflation. This will vary by farm, depending on the market they supply to and their exposure to rising costs. The latest cost of production estimates[1] show how those farms most exposed to feed prices have seen the biggest drop in margins over the past year.

Currently, the outlook for milk prices in the short term is stable, although with processors also facing rising input costs (including the cost of raw milk), increases to milk prices could be constrained unless these higher costs can be passed on to their customers. The recent price increases announced by buyers involved in the middle ground liquid market suggests this is starting to happen in some sectors. Reduced milk deliveries, both in the UK and in the key EU markets of France and Germany could lead to higher commodity prices, lending some support to farmgate milk prices.

Overall, there remains plenty of uncertainty over the extent to which prices will continue to rise, for both inputs and outputs, but little doubt that inflationary pressures will challenge margins as we head into the next year. At a farm level, it will be crucial to keep on top of budgets and to maximise the value of milk being produced to ride out the storm.

[1] These cover the 12 months to July 2021

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.