The Australian effect: Grain market daily

Tuesday, 2 November 2021

Market commentary

- May-22 UK feed wheat futures continued to climb yesterday (+£2.50/t) to close at £226.50/t. This follows the wider global grains picture.

- US maize and soyabean harvests were slowed by rain last week. The maize crop was 74% harvested and the soyabean 79% on Sunday. Both came in below analyst expectations.

- Stratégie Grains increased its 2021/22 EU sunseed production forecast by over 200Kt to 10.16Mt. They also revised the EU rapeseed estimate down to 16.97Mt, whilst reducing imports of the crop too. Lowered imports are said to be down to the availability of rapeseed.

The Australian effect

Australia’s harvest is underway. There is a lot of talk about reliance on Aussie crops this year, across the world. With wheat supplies short, the world needs a decent Australian crop to aid supply through to harvest 2022. The UK is tracking world markets and therefore any impact Australian crops have on global supply, will in turn impact UK prices.

According to USDA data, 2021/22 global wheat stocks are 35% of annual demand (stocks-to-use), the lowest since 2015/16. Currently, the USDA estimate Australian wheat production at 31.5Mt, the third highest on record. This comes in below the ABARES forecast of 32.6Mt, the second largest on record. Crop size is a way off being confirmed but early yields suggest Australia is on track for near record production.

Supply of wheat from elsewhere in the world has tightened. The Canadian crop, a key exporter, is the smallest since 2007/08. There are also reduced exports from the US and Russia too. Usually, the US is the third largest and Russia the largest wheat exporter.

Because of this tightness, reliance on Australian exports is greater than usual for global supplies. Sources suggest that Australian ports are getting booked up for the coming months, assuming a good crop from the current harvest.

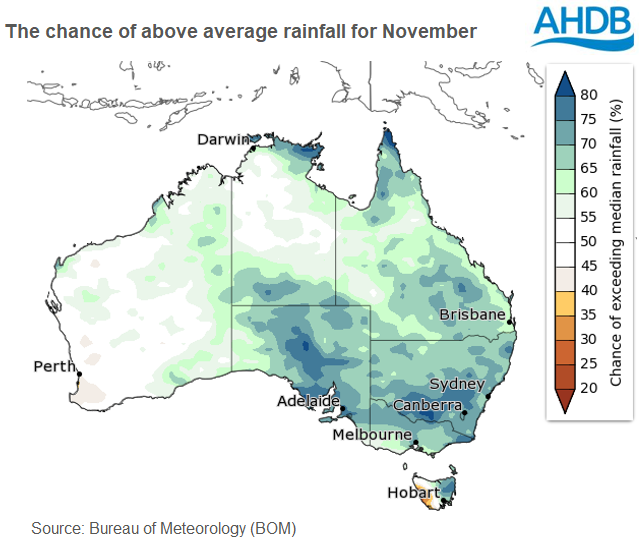

However, a La Niña weather event is predicted for November, which tends to bring above-average spring/summer rainfall for Australia (ABARES). Increased rainfall could affect both harvest (short-term) and boat loading in the longer-term.

This said, the current outlook for November rainfall shows the East of Australia is most likely to be affected. Whilst the East is important for production, Western Australia is the largest exporting state and forecasts suggest better weather.

So, weather effects will be one to keep an eye on but even with a bumper crop, freight rates will likely keep prices elevated. Sea freight rates and charges are up between 300-375% from pre-COVID levels, according to an Australian Dairy Products Federation spokeswoman. If this continues, grain prices could remain supported regardless of a large Australian wheat crop. But, if wheat yields or quality are affected by potential wet weather there could be a double whammy for global wheat prices. There is however, a question around how much further markets could lift. There are record South American maize crops on the cards, while demand could be curbed if prices were to increase much further.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.