New crop rapeseed at a premium to old: Grain market daily

Wednesday, 20 December 2023

Market commentary

- UK feed wheat futures (May-24) closed yesterday at £194.75/t, gaining £0.60/t on Monday’s close. New crop futures (Nov-24) closed at £207.15/t, gaining £0.60/t over the same period too.

- The Chicago wheat market gained on a technical bounce, while the Paris wheat market was pressured as the euro strengthened against the US dollar. There were also ample offers from Russian wheat in the Egyptian tender, which continues to add concerns to the EU export campaign.

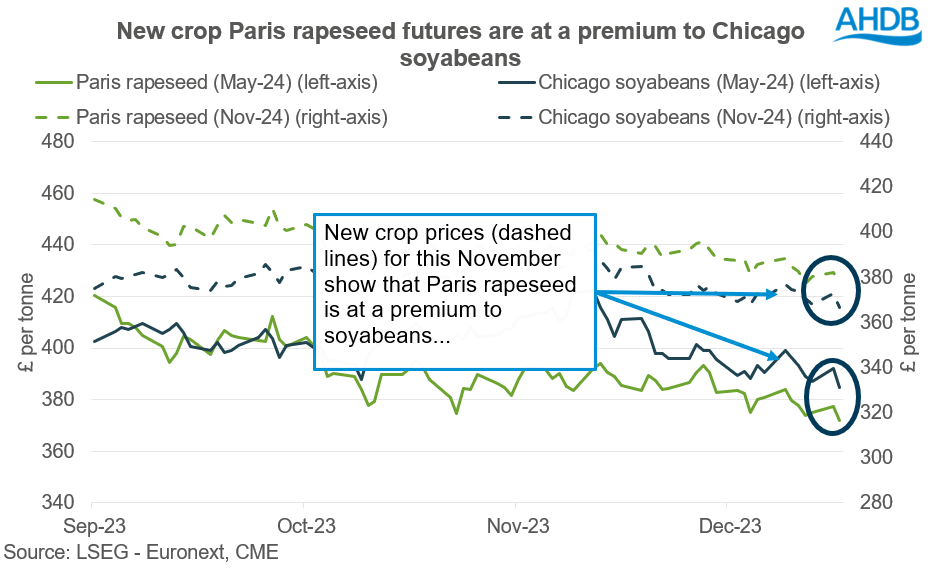

- Paris rapeseed futures (May-24) closed yesterday at €431.75/t, down €5.75/t on Monday’s close. New crop futures (Nov-24) closed at €437.50/t, down €5.50/t over the same period. This followed pressure in Chicago soyabeans which were down due to forecast rains in Brazil, which will aid the crop development of their newly planted soyabeans.

New crop rapeseed at a premium to old

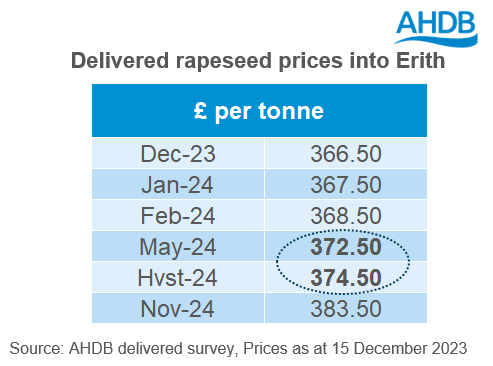

Over the last couple of weeks in the AHDB delivered survey we have been able to publish new crop rapeseed prices for harvest-24.

For example, last week delivered rapeseed (into Erith, Hvst-24) was quoted at £374.50/t, a positive carry from old crop prices with delivered rapeseed for the same location in May-24 being quoted at £372.50/t.

The new crop domestic rapeseed market’s pricing is being heavily influenced by this current marketing year, with harvest prices only just ahead of May-24 prices. New crop Paris rapeseed futures are also at a premium to new crop too (as noted in the market commentary).

As we enter the second half of the 2023/24 marketing year these new crop prospects will start to come into focus, and growing conditions and planting progression of oilseed crops notably in the EU will start to heavily influence these new crop prices.

Changing dynamics in the oilseed market

For this marketing year, soyabean prices have been at a premium to rapeseed prices. This is due to multiple reasons such as large US and Chinese demand, combined with the recent El Niño weather problems impacting Brazil’s growing cycle.

However, the pricing of these two relative commodities seems to have changed when analysing the new crop futures markets. New crop Paris rapeseed futures (Nov-24) are currently trading at a premium to Chicago soyabean futures (Nov-24).

Although these oilseeds will be trading within a range of each other to gain demand, this is an early indication that going into the 2024/25 marketing year, we could see tighter rapeseed supplies.

Despite there being an increase in the French OSR area as noted in Monday’s market report (Agreste, the Ministry of Agriculture and Food for France). Total EU OSR area is expected to drop for harvest 2024. There are drops to key producers such as Germany, whose winter rapeseed planted area for the 2024 harvest is expected to be cut by between 4% and 7% (UFOP). Within the EU a driver in reduced area is from rapeseed prices dropping sharply and disappointing harvest 2023 yields, very similar to the situation in the UK.

However, this potential reduction in EU supply does not explicitly mean rapeseed prices are going to keep rising, as the supply and demand of other oilseeds needs to be considered. For example, if large US soyabean plantings happen next spring this could keep the oilseed market pressured, and rapeseed will be pressured with it, especially if there isn’t a major weather event.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.