Arable Market Report – 08 July 2024

Monday, 8 July 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

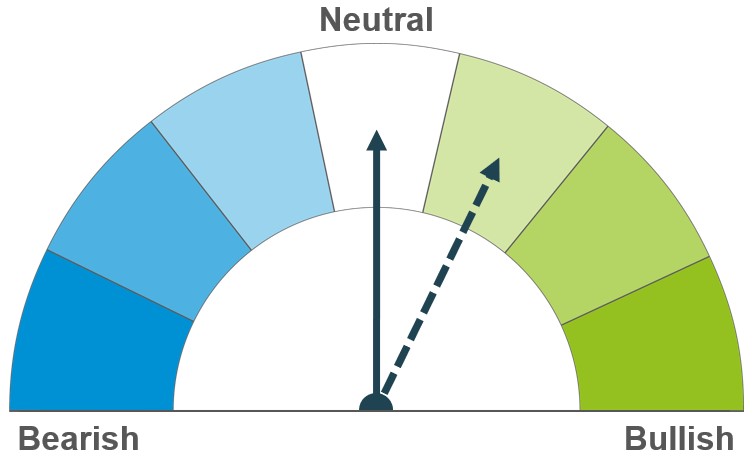

Crop harvests in the Northern Hemisphere are moving quickly, bringing new supplies onto the market. Expectation of smaller crops globally this year still persist however demand is also expected to remain high.

The second maize harvest in Brazil and crop conditions in the US and the Black Sea remain key focus in the short term. More US acreage than expected (reported last week) remains a factor for markets as it suggests there will be plenty of global supplies in the longer term.

Global barley supplies are expected to increase annually in 2024/25. Feed barley prices are projected to align with trends in the broader grains market, although harvest outcomes in key producing countries may also play a role.

Global grain markets

Global grain futures

After declining prices through much of June, global wheat markets saw a gain last week (Friday-Friday), driven mainly by increase in US export demand, partly due to the rapid harvest. The Dec-24 Chicago wheat and Paris milling wheat contracts were up 2.8% and 1.5% respectively over the week. Chicago maize also rose on concerns over dry, hot weather disrupting the US crop during its crucial growing period. Specifically, the Dec-24 contract was slightly up 0.8% on the week.

The US winter wheat harvest is progressing quickly, at 54% complete as at week ending 30 June (USDA), well ahead of the five-year average of 39% for this point in the season. Meanwhile, 67% of the US maize crop was in a good or excellent condition. This was down 2% from the prior week following recent flooding and was slightly more than the market had expected.

Russian consultancy, SovEcon revised up its forecast for the Russian 2024/25 wheat crop from 80.7 Mt to 84.1 Mt due to favourable weather condition and high yields in the South. Last month, the agency had lowered Russian wheat crop forecast to 80.7 Mt from 82.1 Mt due to damage caused by May frosts. Any further adjustments to the production figure will be a watchpoint over the coming weeks.

According to Agribusiness consultancy, AgRural farmers in Brazil have harvested 65% of the Brazilian second maize crop in key southern regions of the country as at Thursday. Globally this crop is counted as part of the 2023/24 crop year. This was up from 49% in the previous week and 26% at a similar time last year. Brazil is a major producer of maize globally and the second or “safrinha” maize crop makes up about 75% of the country’s total production annually.

UK focus

Delivered cereals

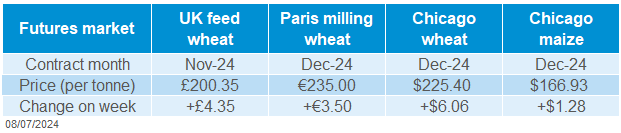

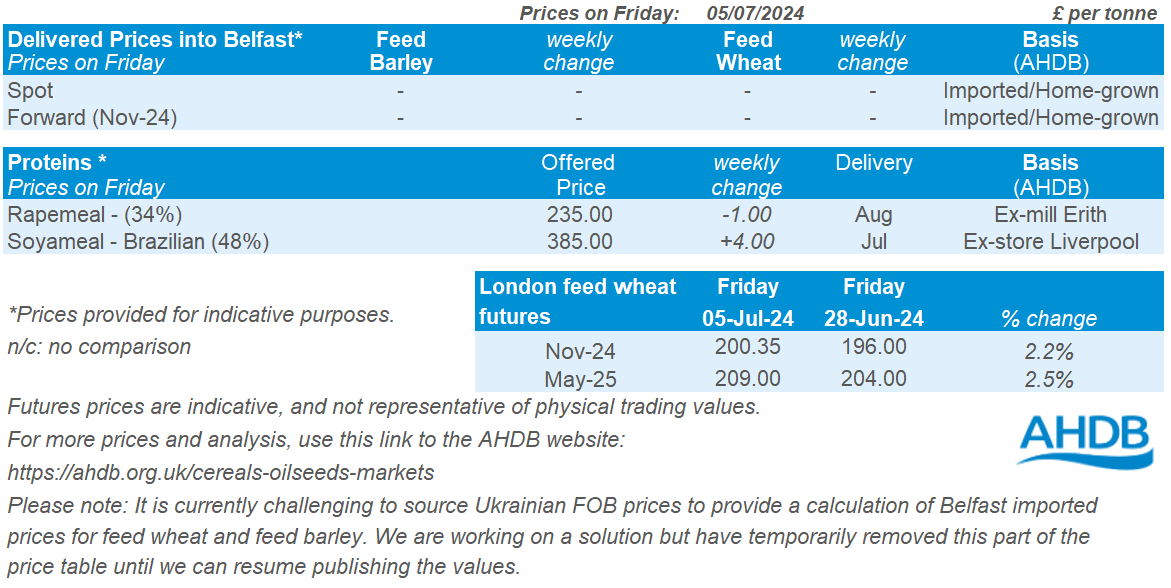

Domestic wheat futures followed global price movement up last week. Nov-24 UK feed wheat futures closed on Friday at £200.35/t, up £4.35/t on the week. The May-25 contract rose £5.00/t over the same period, ending Friday’s session at £209.00/t.

Domestic delivered feed wheat prices followed futures up Thursday - Thursday. Feed wheat delivered into East Anglia for November delivery was quoted at £197.50/t on Thursday, up £1.00/t on the week. Delivered bread wheat into North-West for harvest delivery was quoted at £274.50/t on the week with no price comparison.

In the latest UK human and industrial cereal usage, flour millers processed a total of 5.7 Mt of wheat from July 2023 to May 2024, up by 3.4% from the previous year. This total consists of 4.6 Mt domestically milled wheat and 1.1 Mt of imported wheat. Flour production reached 4.5 Mt, a slight rise of 1.9% compared to previous year’s figure.

In May 2024, GB animal feed usage increased by 2.5% compared to April but saw a slight year-on-year decrease of 0.3%. However, there were year-on-year rises in cattle and calf feed production, compounds for breeding sheep and pig growing compounds. Read more analysis on this here.

The results of AHDB’s Planting and Variety Survey were released on Friday, providing cereal area estimates for the upcoming harvest. Based on the data, the UK wheat area is estimated to reach 1,560 Kha in 2024, down 9% from last year. This is the second smallest area since 1981, after 2020. The total barley area is also up 6%, with the oat area up 9% due to a rise in spring cropping. Crop conditions also improved between the end of May and the start of July, but they remain well below last year’s levels. Read more here.

Oilseeds

Rapeseed

Soyabeans

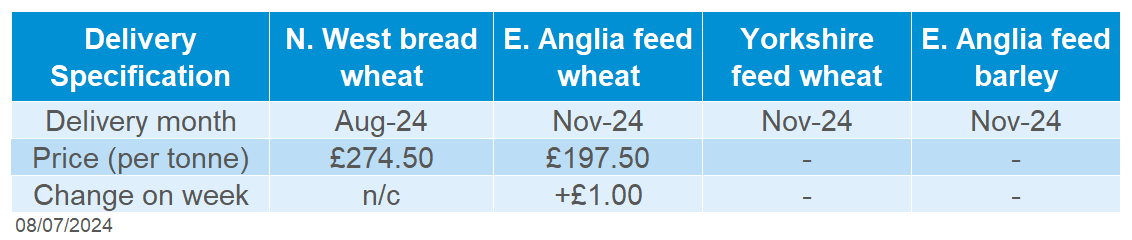

Concerns regarding production following poor early harvest reports in Eastern Europe supported the rise in rapeseed prices last week, in addition to considerable strength in soyabean oil futures. Future harvest results will need to be watched closely.

Ample production forecasts continue to weigh longer-term. But, as the US soyabean crop transitions into its next growth stages, weather remains a key watchpoint.

Global oilseed markets

Global oilseed futures

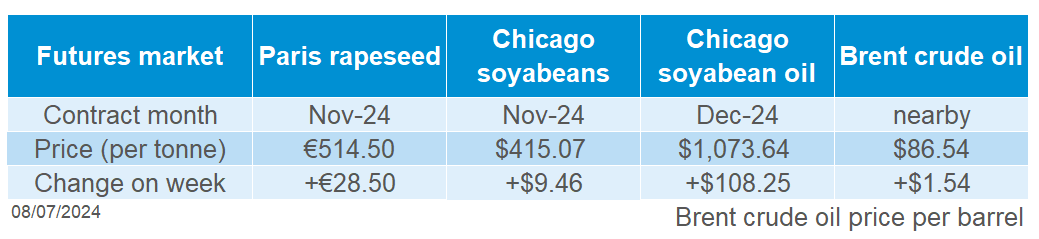

Global oilseeds markets were supported over the week (Friday to Friday). Chicago soyabean futures (Nov-24) rose by $9.46/t to close at $415.07/t on Friday; the contract rose on each trading day. US markets were closed on Thursday for a public holiday (Independence Day). Chinese bargain buying of US soyabeans, weather concerns for key soyabean producing regions in the US, and a rally in soyabean oil futures supported the oilseeds complex.

Analysts forecast Chinese purchasing of US soyabeans to rise significantly in July with estimates of 12 – 13 Mt, exceeding the country’s approximated demand of 10 Mt (LSEG). This follows soyabean prices hitting a near nine-week low on 28 June, as well as the potential for changes to US trade policy due to the upcoming elections.

With the US soyabean planting campaign complete, market focus is drawn to the blooming and pod setting stages reported 20% and 3% complete respectively last Monday. While US soyabean conditions scored 67% good or excellent, current stages of the crop’s development are more sensitive to weather conditions. Some weather forecasts for later July and early August predict dryness and high temperatures causing concern for pod setting.

Argentina’s soyabean harvest is largely complete. The country’s soyabean production for 2023/24 totalled 50.5 Mt, the largest harvest since 2019. It is also more than double last year’s production of 23.0 Mt, which was significantly hampered by the La Niña weather event (Buenos Aires Grain Exchange).

Recent strength in Chicago soyabean oil futures has also contributed to the appreciation of oilseed futures. Soyabean oil futures were supported by China potentially increasing tariffs on Indonesian goods (e.g. palm oil) in response to an announced change to Indonesian trade policy, as well as increased biofuel production capacity in the US. These gains resulted in a considerable short squeeze and consequential buy backs, also driving the rally.

Rapeseed focus

UK delivered oilseed prices

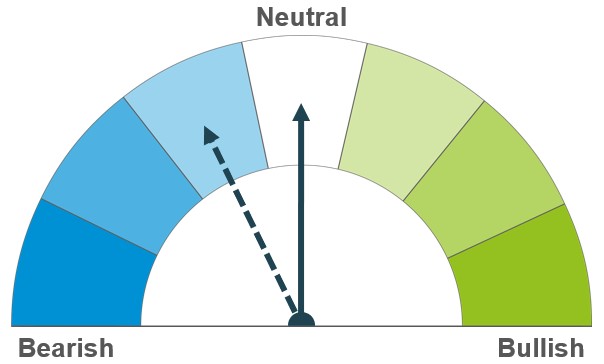

Paris rapeseed futures gained on the week (Friday to Friday), as the Nov-24 contract rose by €28.50/t to close at €514.50/t. Early harvest results from key producers in Europe have been below market expectations, which supported prices. Strength in Chicago soyabean oil futures also buoyed the vegetable oils complex.

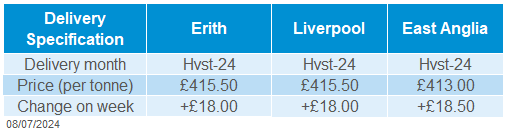

Rapeseed delivered into Erith for August delivery was quoted at £415.50/t on Friday, rising £18.00/t on the week. Also, delivery into Erith for November was quoted at £426.50/t, gaining £19.00/t on the week.

In the latest AHDB crop development report, 54% of winter OSR was rated good or excellent. While this is a five percentage point improvement from the previous report, it remains behind this time last year of 63% good or excellent.

Also published on Friday, AHDB’s Planting and Variety Survey estimates the oilseed rape area for Great Britain at 307 Kha. This is 21% down from last year and the second lowest area for over two decades.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.