Wheat resisting maize’s decline for now: Grain market daily

Tuesday, 2 July 2024

Market commentary

- Global wheat prices gained yesterday as speculative traders squared positions following technical signals. Following the global trend, Nov-24 UK feed wheat futures gained £3.30/t (1.7%) yesterday to settle at £199.30/t.

- The EU’s crop monitoring service (MARS) estimated the Russian wheat crop at 82.5 Mt yesterday, vs 93.6 Mt last year. The winter wheat area and yields are both pegged below the five-year average, while spring prospects are above average if down from 2023’s high levels.

- Prices across the oilseed complex rose yesterday, following predictions that China could import a record volume of soyabeans in July. Buying by speculative traders, worries about palm oil production and an uptick in crude oil prices were all factors. Crude oil prices rose due to higher summer demand and the ongoing impact of OPEC+ production cuts. Nov-24 Paris rapeseed futures gained €10.00/t yesterday to settle at €496.00/t (approx. £420.50/t).

- After the market closed, the USDA reported that 3% of US soyabeans were ‘setting pods’ by 1 July. This marks the start of the yield critical growth stages, though seed number per pod and seed size can still compensate for stress at this stage. The percentage of crops rated good / excellent remained at 67%.

Wheat resisting maize’s decline for now

Wheat prices have held relatively stable over the past week, while global maize prices have declined.

Prices for maize are continuing to be pressured by the larger than expected US maize area (read more in yesterday’s Market Report). The ongoing Brazilian Safrinha crop harvest is also bringing more supplies to the market short-term. Harvesting was 48% complete by 30 June, well ahead of last year’s pace (Conab).

Last week, Chicago Dec-24 maize futures lost $12.79/t to $165.55/t and edged slightly lower ($0.10/t) yesterday. Signs of stronger US demand helped temper losses yesterday; 3% more maize was used to produce ethanol in May compared to May 2023.

After the market closed, the USDA reported 67% of the US maize crop was in a good or excellent condition. This was down 2 percentage points from the prior week following recent flooding and was slightly more than the market had expected (LSEG).

The report also showed that 11% of the US crop is now in its critical reproductive phase, “silking”, ahead of average (6%). Hot and/or dry weather during this development stage can cause notable yield losses, while cooler and/or/damp conditions can support yields.

The weather forecast shows rain through the week ahead with cooler temperatures for much of the key growing areas. The outlook is generally positive though the location of the rain will be important; it’s needed in parts of Illinois, while western parts of the ‘corn belt’ could use some warmth and drier conditions. Benign weather could bring more pressure to maize prices, while adverse weather could offer some support to prices.

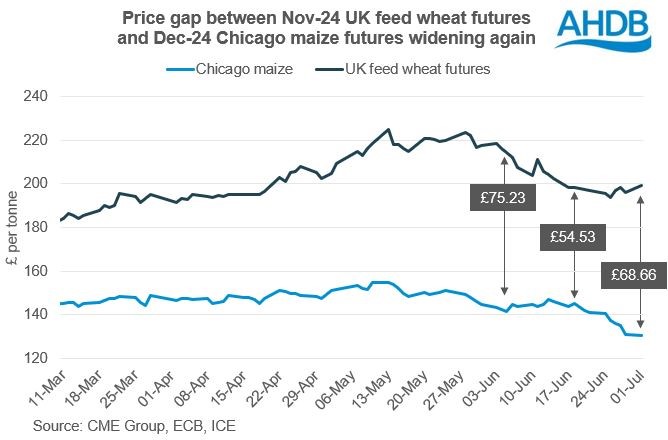

In contrast, wheat prices have so far resisted the latest pressure from maize and extended the price gap between the grains.

The price gap between Dec-24 Chicago wheat and maize futures prices was back to over $59/t yesterday, from a recent low of just under $40/t. UK feed wheat futures are also holding a wider gap. The Nov-24 UK futures contract is over £68/t above the Dec-24 maize futures. While below the recent peak in early-June of over £75/t, these are still some of the widest gaps for new harvest prices since mid-2022, when the war in Ukraine was starkly supporting wheat prices.

Wider gaps have been reported, especially earlier in 2022 and mid-2018 but the duration varied. The longer the price gap is wider, the greater the risk of wheat losing more animal feed demand to maize. The International Grains Council already forecasts feed usage of wheat globally to fall 9.2 Mt in 2024/25, with maize picking up most of it. So, if maize prices continue to slip, wheat prices could lose strength to resist, unless there’s news to support wheat such as poorer than expected harvest results.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.