Arable Market Report - 01 July 2024

Monday, 1 July 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

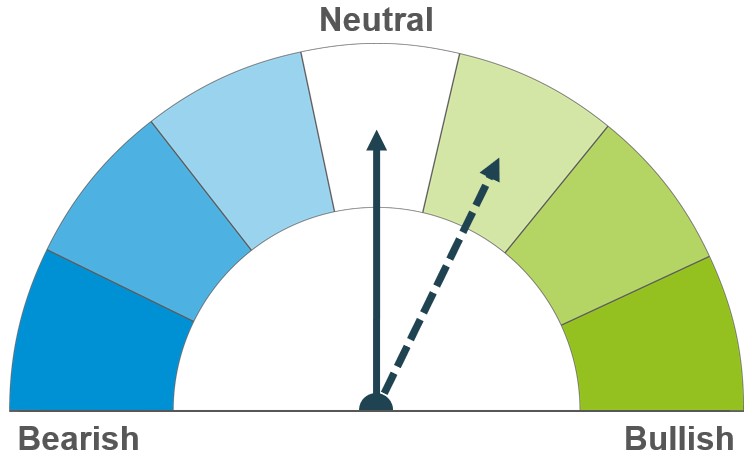

Northern Hemisphere crops remain in focus as harvest progresses. Global demand is also a driver to watch out for, as expectations of smaller crops year-on-year in key exporting countries remain.

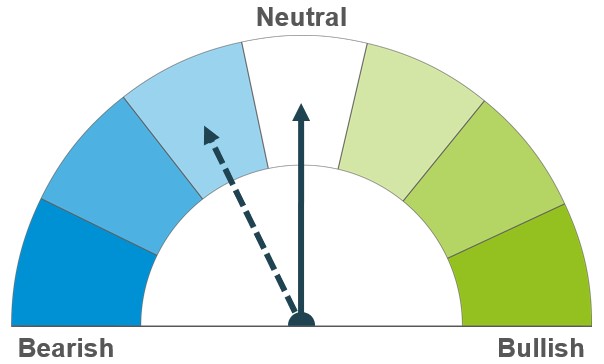

Crop conditions in the US maize belt and the Black Sea are a key factor at the moment. A greater-than-expected US acreage contributes to the longer-term expectation of plentiful global supplies.

An expected yearly climb in global barley supplies persists. Barley prices will likely continue to follow movement in the wider grains complex, though harvest results could also influence.

Global grain markets

Global grain futures

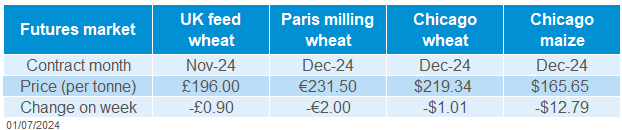

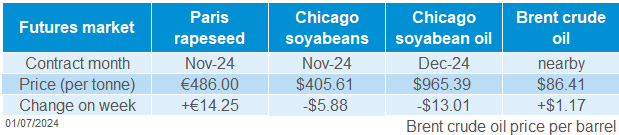

Global wheat markets were overall pressured slightly last week (Friday to Friday). The Dec-24 Chicago wheat and Paris milling wheat contracts were down 0.5% and 0.9% respectively. Chicago maize was weighed on more by the USDA’s latest acreage report, with the Dec-24 contract down 7.2% on the week. Grain markets moved relatively sideways for most of the week, as traders awaited data releases at the end of the week.

On Thursday, Statistics Canada released its latest acreage report. The data showed that Canadian farmers had planted 1.5% less wheat and 10.5% less barley for harvest 2024 than they had intended in March. The oat area was also down 5.5% on what was expected in March. With Canada being one of the UK’s top suppliers of wheat, often high protein milling wheat, the fortunes of the Canadian crop can impact milling premiums.

On Friday, the USDA also released its latest acreage report, as well as its quarterly stocks data. It was expected by analysts that US maize plantings would be increased to 36.58 Mha in Friday’s report. However, the US maize area was pegged at 37.02 Mha. This is down 3% on the year, though represents the eight biggest area since 1944. Despite forecasts of a global decline in wheat stocks over 2023/24 and again in 2024/25, US wheat stocks at the end of 2023/24 were estimated up 23% on the year at 19.1 Mt.

Pressure in global wheat markets as of late has triggered some bargain buying. The USDA reported net US wheat export sales in the week ending 20 June at 667.2 Kt, above trade estimates of 200-600 Kt. This morning, the General Food Security Authority (GFSA) in Saudi Arabia purchased 235 Kt of hard wheat in an international tender. Global wheat demand remains something to monitor with a tight global supply and demand balance.

UK focus

Delivered cereals

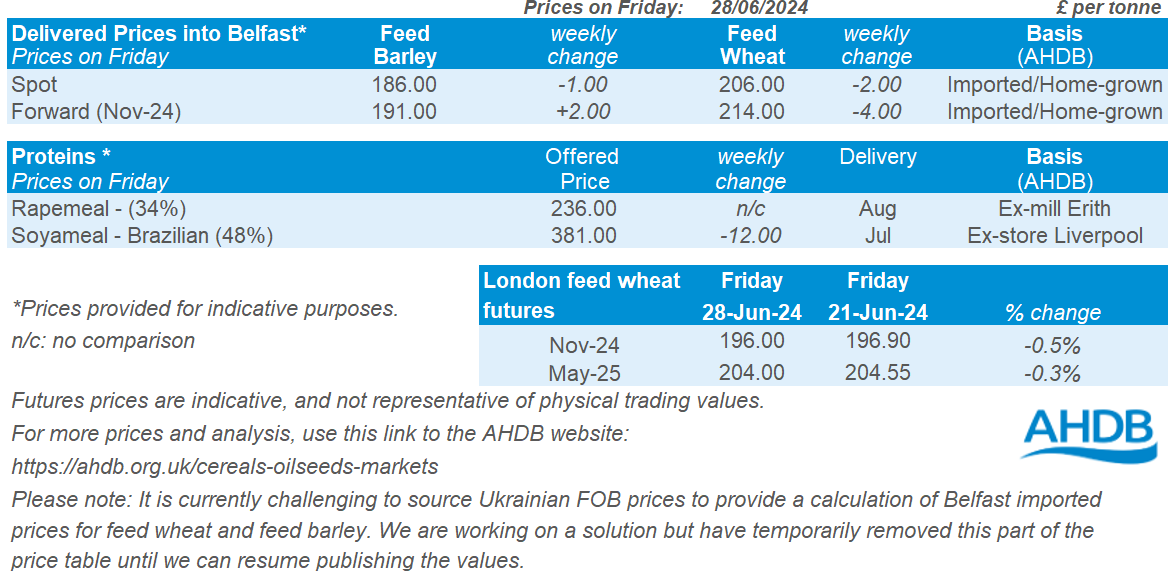

Domestic wheat futures followed global price movement down slightly last week. Nov-24 UK feed wheat futures closed on Friday at £196.00/t, down £0.90/t on the week. The May-25 contract fell £0.55/t over the same period, ending Friday’s session at £204.00/t.

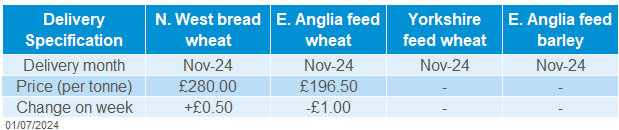

Domestic delivered feed wheat prices followed futures down. Feed wheat delivered into East Anglia for harvest delivery was quoted at £187.50/t on Thursday, down £2.50/t on the week. However, delivered bread wheat gained on the week. Bread wheat delivered into the North West for November was quoted at £280.00/t, up £0.50/t on the week.

Domestic milling wheat premiums remain historically high due to short UK supply. However, premiums moving forwards will of course depend on the price, and as such volume, of imported wheat. Read more analysis on this here.

Oilseeds

Rapeseed

Soyabeans

Rapeseed prices continue to be impacted by the broader vegetable oil markets. Forecasts indicate a decline in global rapeseed stocks, though support will likely be weighed on by pressure in soyabean markets.

Current demand is driven by the strong US crush. However, the expectation of ample supply continues to impact both the short and long-term outlooks.

Global oilseed markets

Global oilseed futures

Chicago soybean futures have faced continued bearish pressure over the past five weeks (Friday-Friday). The market has been influenced by the expectation of ample supply in the long run, which has outweighed firm crushing demand in the US. The Nov-24 contract dropped by 1.43% on the week to end at $405.61/t on Friday.

The USDA reported last week that planting of soybeans in the US is nearing completion, with 97% of the crop planted as at 23 June. This was up from 93% on the week and in line with the five-year average of 95% at this time in the season. However, crop condition declined slightly with the proportion of the crop rated good or excellent at 67%, relative to 70% the week before. The flooding situation in the US and impact on crop condition is a key watch point for markets this week.

The USDA reported the US soyabean area for 2024 at 34.8 Mha on Friday. This was a slightly smaller area than the 35.0 Mha farmers had intended in March and the 35.1 Mha the market had expected (LSEG). However, it is still 3% larger than 2023.

In Argentina, the depreciation of the peso in the unofficial market led farmers to hold on to their soyabean stocks, resulting in a considerable 45% drop in sales in June compared to May (LSEG). As a major exporter of soyabeans, global availability will be a watchpoint over the coming weeks.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures gained on the week (Friday-Friday) buoyed by expectations of a smaller global harvest. The Nov-24 contract gained €14.25/t over the week to close at €486.00/t. The contract reached a weekly low of €468.75/t on Tuesday, but then climbed until Friday.

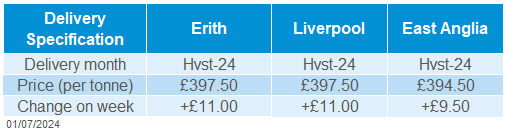

UK delivered prices followed suit as rapeseed delivered into Erith for harvest delivery was quoted at £397.50/t, gaining £11.00/t Friday – Friday. Delivered rapeseed into East Anglia for the same period was quoted £394.50/t, up £9.50/t on the week.

LSEG raised its forecast for Canada's 2024/25 rapeseed production by 1% on Wednesday last week to 18.4 Mt. This is due to favourable cool and wet weather expected in early July, which should help replenish soil moisture levels, particularly in Manitoba. However, this forecast remains lower than the USDA's estimate of 19.6 Mt.

Statistics Canada reported a much larger change in the Canadian canola (rapeseed) area than the market had expected on Thursday. Latest figures show area planted to rapeseed at 8.91 Mha for 2024, now up 0.34% from 2023. This was also higher than the 8.71 Mha that analysts on average had expected.

Stratégie Grains revised the EU’s 2024 rapeseed harvest estimate down to 17.80 Mt, a slight decrease from the 17.94 Mt projected in May. This new forecast is also 10.6% lower than last year’s harvest. The variation is attributed to less favourable growing conditions in Germany, Romania, and the Baltic countries during May and June.

Please note: The dials have been updated to correctly show a neutral outlook for rapeseed, and a bearish outlook for soyabeans for the next 2 – 6 months.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.