Canadian wheat and barley areas fall: Grain market daily

Friday, 28 June 2024

Market commentary

- Global wheat prices rose yesterday due to a lower-than-expected Canadian wheat area (see below) and stronger than expected US export sales. This more than outweighed pressure from the increase in planting pace in Argentina after welcome rain. Traders positioning ahead of tonight’s key US area and quarterly stocks data was also a factor.

- Nov-24 UK feed wheat futures rose £1.45/t (0.7%) to £198.20/t.

- French winter barley harvesting is underway, with 1% cut by 24 June (FranceAgriMer). However, this is well behind the five-year average of 15% complete. Winter crop condition scores dipped slightly, though spring crop conditions were stable.

- Nov-24 Paris rapeseed futures gained €2.25/t yesterday to settle at €479.50/t, despite a dip in soyabean prices. There was support for rapeseed prices from short covering in Winnipeg canola futures as weather concerns offset the larger Canadian area. A small rise in palm oil futures may have also contributed.

Canadian wheat and barley areas fall

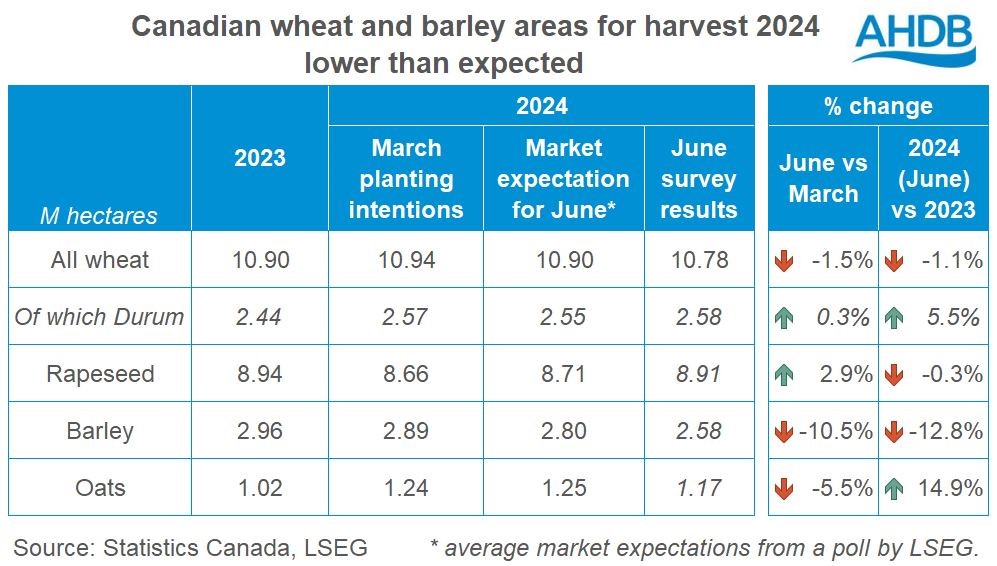

Canadian farmers planted less wheat and barley for harvest 2024 than they had intended in March, and than the market expected, supporting prices yesterday.

The market had expected the Canadian planted wheat and oat areas to be similar to the March survey of planting intentions (LSEG). LSEG also reported expectations for a small increase (+0.6%) to the canola (rapeseed) area compared to March’s intentions, with a decline for barley (-2.9%).

However, the survey results from Statistics Canada, released yesterday, were surprising. They showed Canadian farmers had planted 1.5% less wheat than they had intended in March, along with far less barley (-10.5%) and oats (-5.5%). The smaller than expected wheat area helped support global wheat prices (see above).

Let’s look at what these figures could mean for each crop:

Could wheat recovery be trimmed?

Canada is the world’s fourth largest exporter of wheat. The planted area is slightly smaller than 2023 so unless yields rise more than currently expected, this could reduce the predicted recovery in Canadian production. A smaller Canadian crop could further tighten global exportable supplies of wheat, depending on harvest results elsewhere.

However, so far, current crop conditions are generally good, though crops are behind typical development stages in some areas. LSEG expects the forecast for a cool and damp start to July to be favourable for yield prospects, though it will not help crops progress.

Canada’s also one the UK’s top suppliers of wheat, often high protein milling wheat. So, the fortunes of the Canadian crop can impact milling premiums here.

Extra pressure on yields now for barley and oats

While the Canadian barley area was already expected to dip year-on-year, the 2024 area is now much sharply lower, at a seven year low. So, even with a recovery in yields from last year’s drought affected levels, Canadian barley production looks set to fall in 2024. Depending on the extent of the recovery in yields and results elsewhere, this could reduce the expected global barley surplus in 2024. In turn, this could reduce the pressure on barley prices compared to other feed grains depending on what happens elsewhere.

Even before the latest data, Canadian oat supplies in 2024/25 already looked tight due to very low carry-over stocks from 2023/24 (Agriculture & Agri-Food Canada, AAFC). As a result of the smaller rise in planted area, yields will need to be well-above normal to maintain the current production forecast. Without such yields, this could tighten Canadian and so global oat supplies.

Rapeseed area stable year-on-year

Canada is the world’s top exporter of rapeseed (USDA). Yesterday, Statistics Canada reported a much larger change in the rapeseed area than the market had expected. The new data means the 2024 area is almost unchanged from 2023 levels and could support production from AAFC’s June figure of 18.1 Mt. However, other forecasters, such and the USDA and OilWorld.biz already include larger crop sizes for Canada, which could limit the impact of the new data.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.