Milling wheat premiums easing? Grain market daily

Thursday, 27 June 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £196.75/t yesterday, up £2.80/t from Tuesday’s close. The May-25 contract gained £3.15/t over the same period, ending the session at £205.10/t.

- Domestic wheat futures followed global wheat markets up yesterday, on the back of bargain buying, as well as concerns over Northern Hemisphere weather. A forecast heatwave in parts of Europe, and flooding concerns in parts of the US are raising concerns over crop conditions. However, the rapidly progressing US winter wheat harvest and improved Russian weather limited any major gains (LSEG).

- Nov-24 Paris rapeseed futures climbed €8.50/t yesterday, closing at €477.25/t.

- Despite losses in the US soyabean market, European rapeseed prices followed Canadian canola and US soya oil up on the back of gains from bargain buying. Later today, Statistics Canada is due to release its latest acreage report. In a Reuters pre-report poll, analysts on average expect the Canola area to sit at 8.71 Mha, up from 8.66 Mha in March.

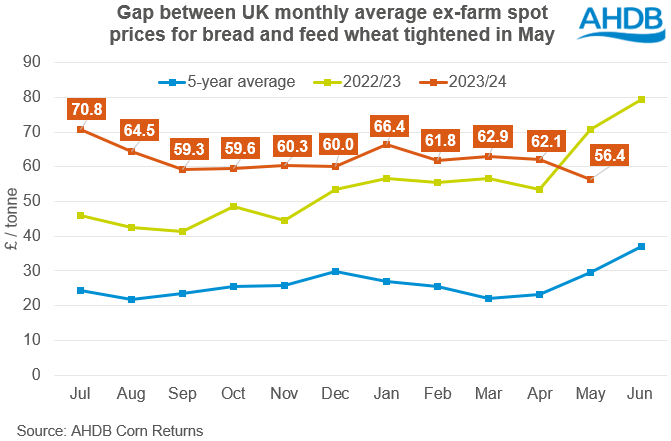

Milling wheat premiums easing?

The gap between the UK monthly average ex-farm spot prices for bread and feed wheat fell to £56.40/t in May. This is down from £62.10/t in April, and £70.60/t a year earlier (May 23). However, this still remains historically high in comparison to the five-year average for May of £29.50/t.

More recently though, milling premiums look to have edged higher again. In the week ending 20 June 2024 (latest data), UK spot ex-farm bread milling wheat averaged £64.80/t more than feed wheat.

Delivered prices, which include haulage costs and more, for new crop bread wheat are also still at a firm premium to feed wheat futures. Bread wheat to be delivered into the North West in November was quoted at £279.50/t on last Thursday, at an £82.05/t premium to Nov-24 futures. This is higher than the same time last year, when bread wheat for November 2023 delivery was at a £70.50/t premium.

So, what can we expect moving forward?

As has been well reported, milling premiums have been firm as of late due to the limited availability of domestic milling grade wheat. On top of this, despite the cost-of-living crisis, overall flour demand has remained firm. As such, in AHDB’s May UK supply and demand estimates, wheat demand by flour millers was forecast up slightly on the year.

Due to the limited domestic supply, and subsequent higher domestic prices, it’s expected that flour millers have used and will continue to use a higher proportion of imported wheat this season and next. This season to date (Jul-Apr), wheat imports (incl. durum) have totalled 1.836 Mt, up 64.6% on the year, and up 25.4% on the five-year average. In the latest AHDB UK supply and demand estimates, full season imports for 2023/24 were estimated at 2.175 Mt.

While we do not yet have trade data available for May, it’s likely the continued firm import pace of competitively priced wheat weighed on the domestic milling premium. It is also important to note that in May feed grain prices rose notably, which could have meant feed wheat prices were supported relative to bread wheat.

Where next?

Premiums will likely stay historically high due to short domestic supply. At the same time, to an extent, a heavier flow of milling wheat imports will continue as we head into the new season due to expectations of a small 2024 UK crop. With this volume of imports needed, it is unlikely in the short-term that premiums will go back to where they were at the end of last season, when bread wheat held firm despite feed wheat dropping off.

The volume of imports moving forward will depend slightly on the comparative price of imported wheat. As such, domestic premiums could be pressured further moving forward if imported bread wheat prices decline. With the majority of imports coming from Germany and Canada, it will be important to keep an eye on conditions in these countries over the next few weeks.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.