Funds buy on weather worries: Analyst Insight

Tuesday, 21 May 2024

Market commentary

- Nov-24 UK feed wheat futures rose £6.25/t yesterday to settle at £221.00/t from Friday’s close.

- Weather concerns in major producing countries, including top supplier Russia, continue to influence wheat price direction globally. In its latest US crop progress report, the USDA dropped the country’s winter wheat good-excellent crop condition rating marginally by 1% relative to last week (LSEG).

- Paris rapeseed futures (Nov-24) closed yesterday’s session at €492.00/t, up €5.25/t.

- The European rapeseed prices were well supported by strong soyabean and soyabean oil prices. Concerns over crop losses in Brazil following recent heavy rains and flooding in southern regions of the country also lent support to the market.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB

Funds buy on weather worries

Speculative traders, including investment funds, have been buying grain and oilseed futures. This has likely contributed to the rises in prices over recent weeks and again yesterday.

Changing positions

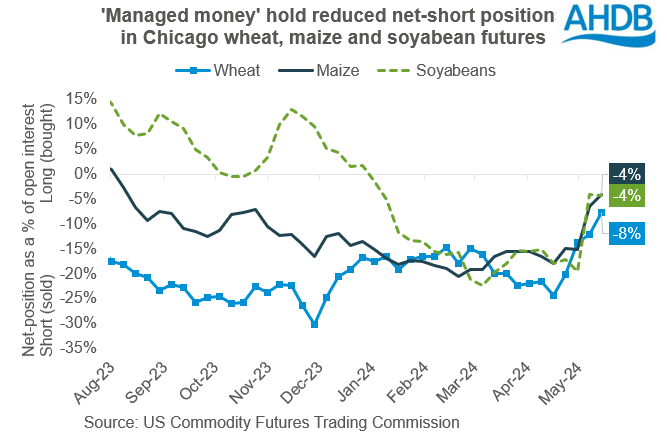

Earlier this year the ‘managed money’, held substantial net-short positions in Chicago wheat, maize and soyabean futures (CFTC). Just a month ago, these net-short positions equated to -24% of open interest for Chicago wheat and -18% for Chicago maize and soyabean futures.

Net-short positions are often used by this type of trader to profit from falling prices. Conversely, net-long positions can bring profits from future price rises. Investment Funds also held large net-shorts in Paris milling wheat futures until early March (Euronext).

But since then, the funds have shifted positions in both European and US futures markets. They have bought back previously sold contracts and, in some cases, even developed net-long positions.

Indeed, the funds held much smaller net-shorts in Chicago futures by 14 May. These net-shorts were equivalent to just -8% of open interest (all open contracts) by 14 May in Chicago wheat, and -4% for Chicago maize and soyabean futures.

The funds are even now net-long in Paris milling wheat futures, by 11% of open interest (on 10 May). For Paris rapeseed, the net-long equated to 12% of open interest on the same date.

These shifts in position were likely triggered by growing concerns for 2024 wheat crops in key exporters, such as the US and Russia. But this buying by speculative traders may have also added to the market momentum.

There are anecdotal reports that further buying by speculative traders contributed to the market rises yesterday (LSEG). Read more on the market drivers above.

Looking ahead

We’ve seen before that market rallies need new information about the crop, or the supply and demand situation worsening to sustain them. Further price rises could trigger more re-positioning by speculative traders.

But without a regular flow of such information, markets soon start to drift or decline. With the funds now long in some markets, any sustained dips in prices could trigger some selling or ‘unwinding’ of long positions.

While the involvement of speculative traders can add to short-term variability in prices, over the longer-term the fundamentals of markets always determine price direction. So, it’s important to continue to monitor supply and demand, and access to those supplies.

We gain insights in the positions held by speculative traders, including investment funds, in the Chicago futures markets from reports by the Commodity Futures Trading Commission (CFTC). These reports show the positions held by ‘managed money’ at the end of trading on a Tuesday and are released on a Friday evening.

In Europe, the futures exchanges release similar data. Euronext (Paris futures) release reports on a Wednesday, showing the positions at the at the end of trading on the previous Friday. While trading patterns between these reports will vary, they still give good insights into market trends.

Both the CFTC and Euronext report the number of long and short positions each category of trader holds. The difference between the number of long and short positions is the net position. Long positions are often shown as a positive figure, while short positions are often shown as a negative figure. However, futures markets can vary greatly in their size. The size of markets is measured by the number of open contracts, called open interest.

For example, yesterday (20 May) the open interest in Paris milling wheat futures was 406,085 contracts. But, for Chicago maize futures the open interest was over 1.5 million contracts.

So, to enable comparisons in the scale of the positions held by speculative traders across different futures markets, the net position is shown as a percentage of the open interest in that market.

The weekly reports are the main source of insight. But anecdotal reports, including those from LSEG, can also help interpret the day-to-day market movements.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.