Dry Russian winter wheat areas in focus: Grain market daily

Friday, 26 April 2024

Market commentary

- Wheat futures gained further yesterday, as dry weather concerns continue for the Russian (more below) and the US wheat crops. Buying by speculative traders was also likely a factor. Speculative traders remained short of wheat last week in both the Chicago and Paris wheat futures markets (CFTC, Euronext). Forecasts of rain for the US limited the gains.

- For UK feed wheat futures, the May-24 and Nov-24 contracts both gained £0.60/t to settle at £180.55/t and £205.60/t, respectively. These are smaller gains proportionally than most global wheat futures contracts. Sterling rose against the US dollar and euro as US economic growth was weaker than expected, while German consumer confidence remained negative.

- The EU Commission cut its projection of the 2024 EU-27 soft wheat (exc. Durum) crop from 120.8 Mt to 120.2 Mt. The crop was already the lowest for four years after wet weather in the autumn limited winter planting. The latest cut follows another trim to the estimated planted area.

- Paris rapeseed futures for Nov-24 dipped slightly, down €1.00/t to €464.50/t. Chicago soyabean futures were almost unchanged yesterday as concerns about Argentina’s harvest results offset poorer-than-expected US export sales last week.

Dry Russian winter wheat areas in focus

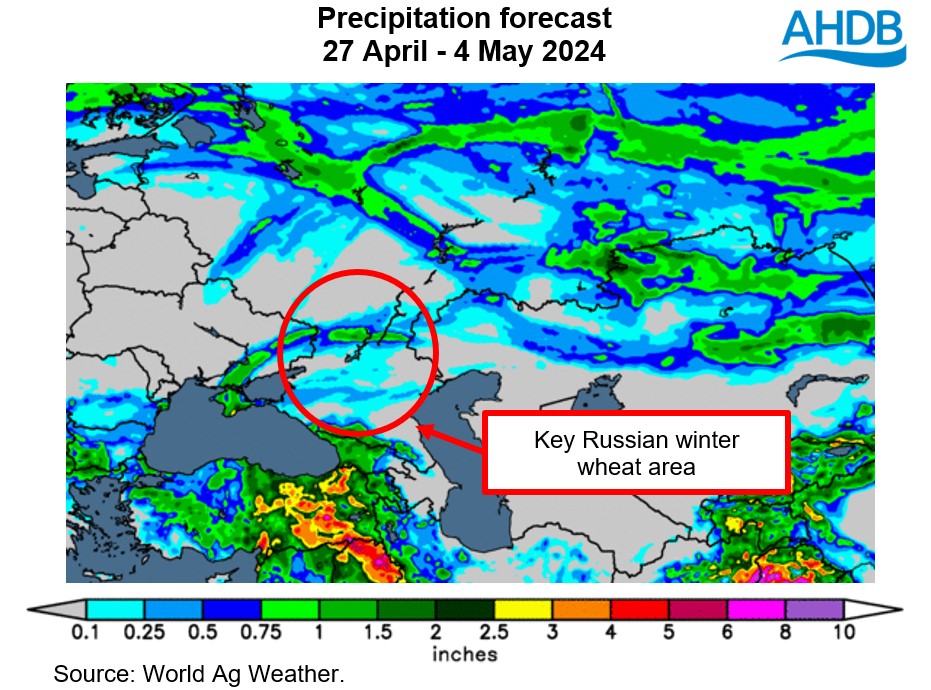

Dry weather in Russia is one of the main factors supporting wheat prices currently, as forecasts show limited rainfall for key winter wheat areas.

Historically, over 70% of Russian wheat is winter sown, with Southern Russia and the Northern Caucasus regions the top producing areas (2017-2021, USDA). Currently the 2024 Russian crop is projected to be another large one; SovEcon forecast the crop at 93.0 Mt. While this is up on last year’s 92.8 Mt, it is 1.0 Mt lower than forecast in late-March due to dry weather concerns.

After below-average rainfall in March, the key areas remained dryer than usual this month. Continued dry weather poses a risk to the current large crop projections and SovEcon reports that the coming weeks are important. So, weather forecasts will be watched closely. Currently, the forecasts show only limited amounts of rain for the main winter wheat areas in the next week.

Often weather is in the driving seat at this time of year, though early supply and demand projections mean greater potential for weather-related volatility this year. The International Grains Council (IGC) predicts that total global grain production and demand will be finely balanced in 2024/25.

Behind the headline grain figures, the IGC already expects major exporters’ wheat stocks to tighten. So, any cuts to wheat crop sizes for major exporters, such as Russia, could exacerbate this situation and offer more support to prices.

However, the weather forecasts need to be watched. If the wheat crops in Russia and/or the US receive timely rain, it’s likely to ease the current concerns and could soften prices again.

It’s also worth keeping in mind that two weeks today (10 May), the USDA issues its first predictions of global supply and demand in 2024/25. These projections can often shape market sentiment in the months that follow.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.