Global grain crop and stock projections cut: Grain market daily

Friday, 19 April 2024

Market commentary

- UK feed wheat futures were little changed again yesterday. The May-24 contract gained £0.30/t to settle at £173.00/t, while the Nov-24 contract lost £0.15/t to close at £195.15/t.

- Support for prices from global weather concerns were largely offset by shifting exchange rates and competitive Russian supplies. Weather worries focus on drier than ideal soils in parts of Russia and Hard Red Winter wheat growing areas in the US. The International Grains Council also cut its forecasts for global production yesterday; see below for more.

- Paris rapeseed futures rose due a weaker euro against the US dollar and meaning rapeseed could shrug off falls in Chicago soyabean prices. Chicago soyabean prices remain under pressure from strong competition from South American soyabeans. This is due to the US dollar hitting a 13-month high against the Brazilian real, making US soyabeans less attractive against Brazilian soyabeans.

- Paris May-24 rapeseed futures rose €2.25/t to close at €450.50/t, while the Nov-24 contract rose €1.75/t to €456.25/t.

Global grain crop and stock projections cut

The International Grains Council (IGC) cut its projections of both the 2023/24 and 2024/25 global grain crops and stocks yesterday.

The IGC cut 2023/24 global grain production by 3.5 Mt due to the impact of rising disease and drought stress in parts of the southern hemisphere on maize output. Meanwhile, stronger wheat demand in India is the main factor pushing up the global grain demand estimate.

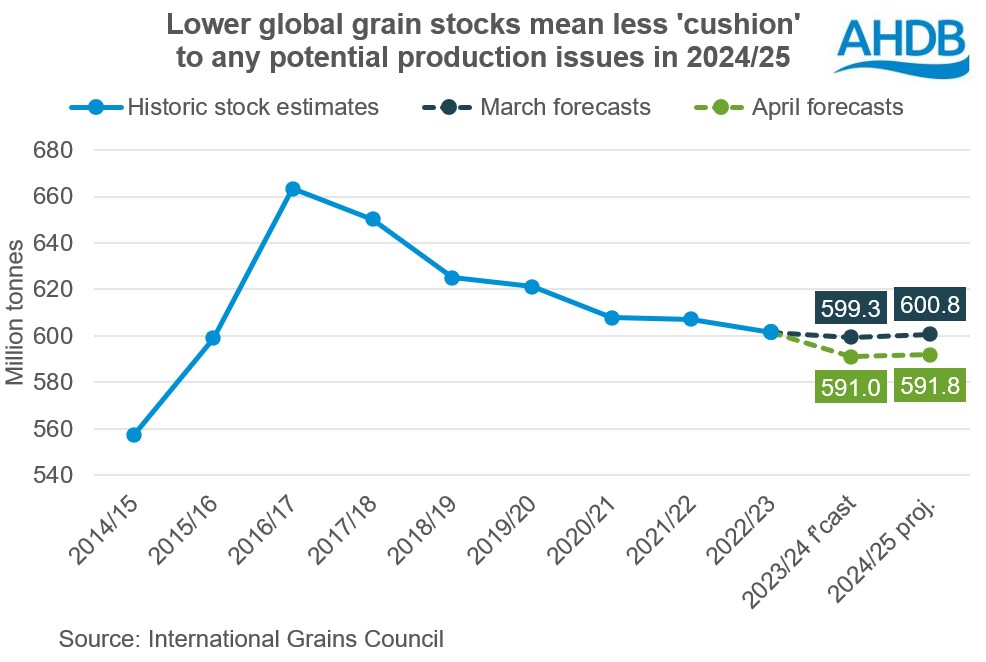

The changes mean a sharper fall in 2023/24 carry-out stocks than forecast in March, which would reduce the ‘cushion’ to any production issues in 2024/25. In total, global grain stocks at the end of 2023/24 are projected 8.4 Mt lower than the IGC’s March report, with a 3.6 Mt fall for wheat and a 4.8 Mt fall for maize.

There was an even sharper cut to the 2024/25 global grain crop production projection, down 10.1 Mt to 2,322.1 Mt. This is predominantly due to a smaller US maize figure and likely factors in the results of US planting intentions survey, out at the end of March. EU wheat production was also cut by 1.8Mt to 128.7Mt.

Despite the cuts, total global grain production in 2023/24 is still projected 21.3 Mt higher year-on-year and would set a new record. Demand is expected to rise by less than projected in March, mainly due to lower US feed demand.

Despite big changes, the updated projections for 2024/25 continue to show global grain supply and demand finely balanced. This leaves little room for error and will keep grain markets sensitive to changing weather reports in the weeks and months ahead.

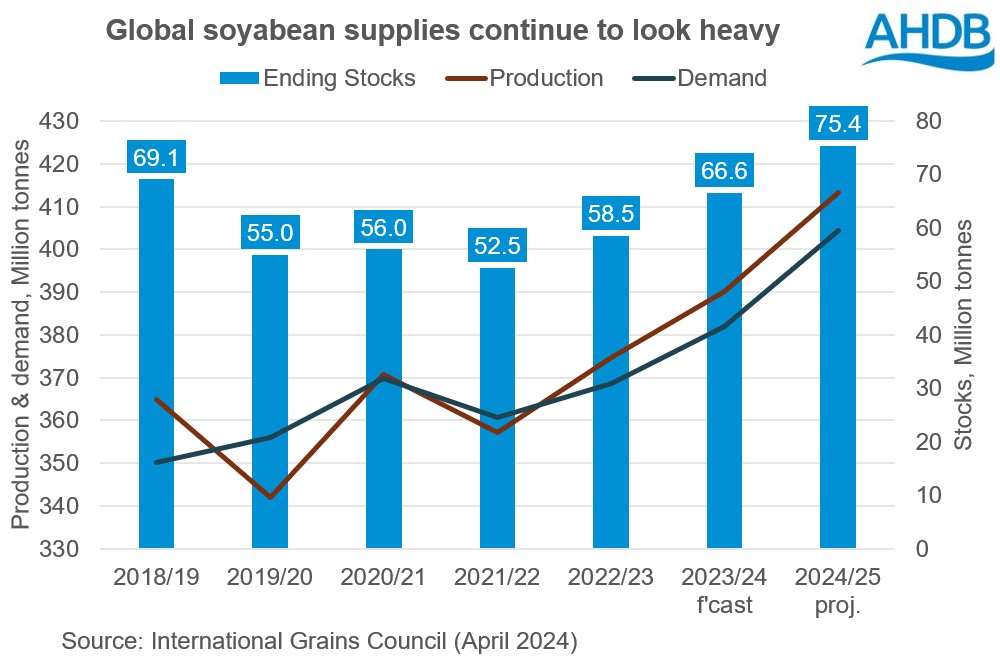

In contrast, the global soyabean supply and demand picture for both this (2023/24) and next (2024/25) season continues to look heavy. The IGC increased its 2023/24 end of season stock projection for soyabeans by 0.3 Mt, and 2024/25 projection by 0.5 Mt, largely due to larger Argentinian crop forecasts.

In the absence of any weather event, these heavy stocks are likely to keep pressure on soyabean prices. The extent of the impact on rapeseed prices will depend on prospects for the 2024/25 rapeseed crops; rapeseed has recently expanded its price gap over soyabeans.

The IGC releases its next forecasts on 23 May, with the USDA releasing its first projections for the 2024/25 season on 10 May.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.