Arable Market Report - 02 April 2024

Tuesday, 2 April 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

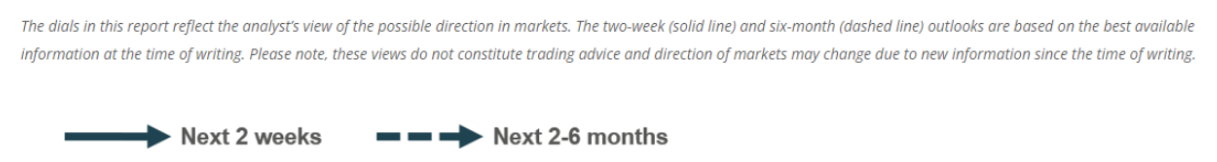

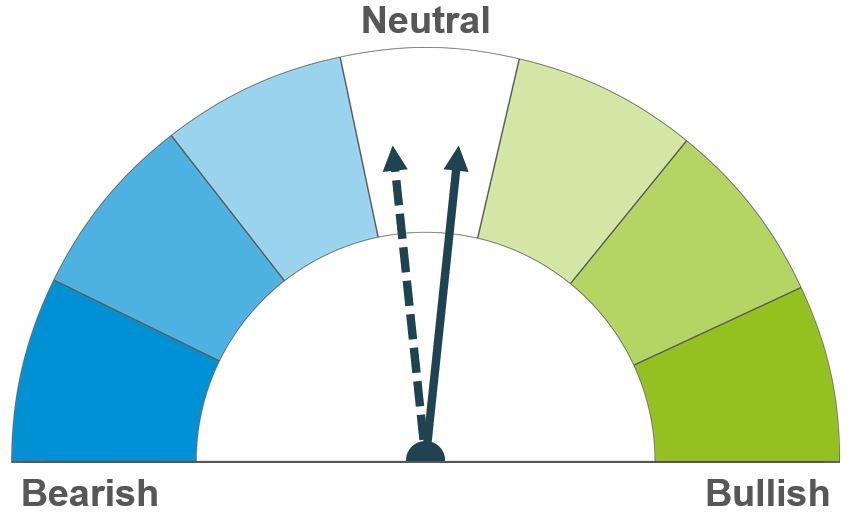

Early forecasts point to a tighter global wheat and more balanced global grain supply and demand in 2024/25. With mixed global crop conditions so far, weather will be a key driver of the market in the weeks ahead.

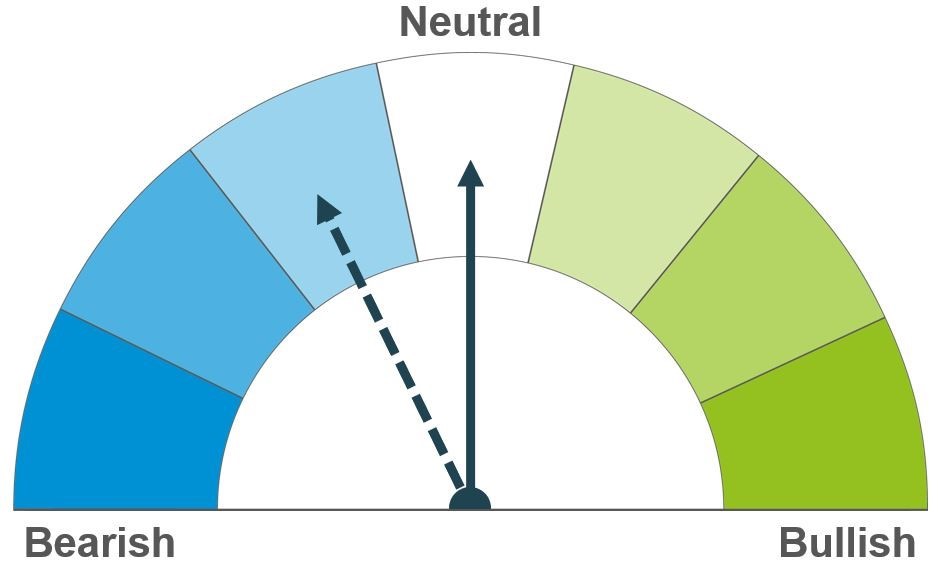

Global forecasts continue to show a well-supplied global maize market in 2023/24, though uncertainty over the Brazilian crop continues. US weather and planting progress are key watch points now, especially given the smaller area planned.

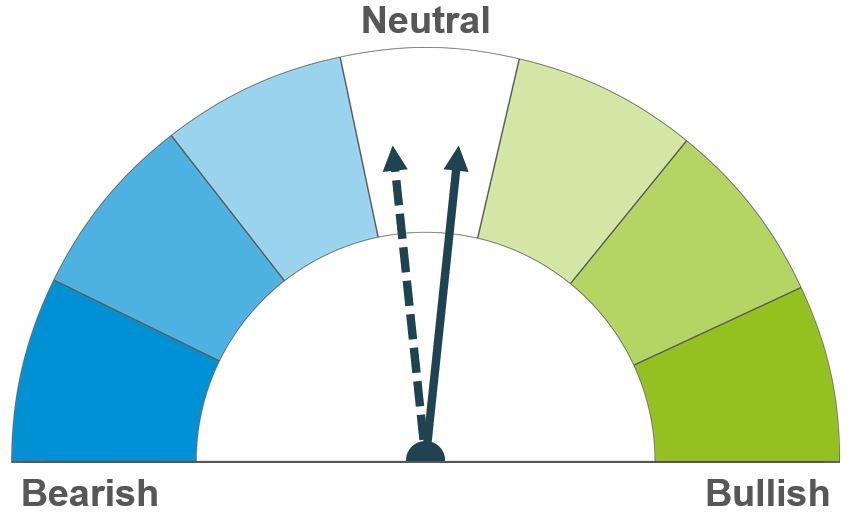

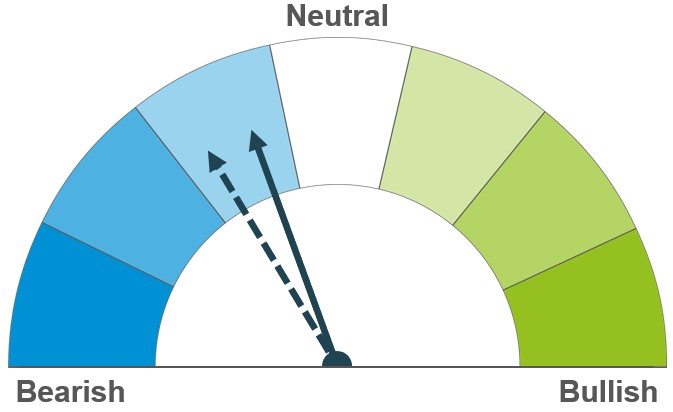

While larger crops are expected for key global producers in 2024, European planting delays and dry soils in Canada continue to mean uncertainty over the outlook in the longer term.

Global grain markets

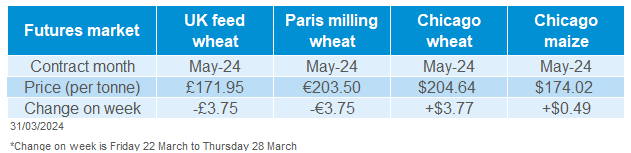

Global grain futures

It was a mixed week for grain prices last week (Friday 22 – Thursday 28 March), with rises for Chicago maize and wheat futures but declines for Paris futures. Prices generally fell in the early part of last week as concerns about Black Sea supplies from the previous week eased and speculative traders re-positioned ahead of key USDA data.

On Thursday the USDA revealed US farmers intend to plant 36.4 Mha of maize, less than the market expected (37.1 Mha, LSEG). US maize stocks on 1 March were also towards the lower end of expectations, though up 13% year-on-year (USDA, LSEG). This data triggered price rises that surpassed earlier losses for the Chicago markets and reduced them for Paris futures.

While US farmers planted less winter wheat than expected, this is offset by a larger planned spring area. US stock levels on 1 March for wheat were higher than the market expected (USDA).

Yesterday (1 April), the US markets eased back due to a stronger US dollar and good weather for spring planting in the US. Chicago wheat futures (May-24) lost $1.20/t to close at $204.64/t, while Chicago maize futures (May-24) lost $2.56/t to close at $171.46/t.

After the markets closed, the USDA reported 56% of the US winter wheat crop as good or excellent in its first rating since November. It is the best score for early April since 2019.

The 2023/24 Brazilian maize crop is now pegged at 122.0 Mt by US attachés, 2.0 Mt below the March USDA estimate but still above many others, including Conab. However, for 2024/25 the attachés project a recovery to 129.0 Mt.

Winter cereal crops are in mediocre condition in large parts of the EU-27, according to the EU crop monitoring service (MARS). Excessively wet conditions impacted sowing, emergence and development of crops in western, northern and eastern Europe. Due to the lower area, the EU Commission cut its forecast for 2024 wheat production in the bloc by 4.8 Mt to a four-year low of 120.8 Mt.

Better weather helped French spring barley sowing progress from 48% to 82% complete by 25 March. But this is still well behind the five-year average of 95% complete (FranceAgriMer).

UK focus

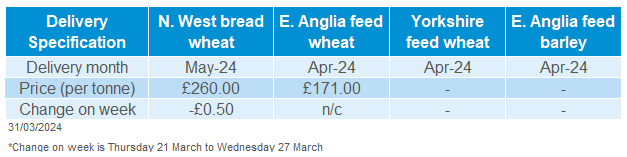

Delivered cereals

May-24 UK feed wheat futures fell £3.75/t last week (Friday 22 – Thursday 28 March) to settle at £171.95/t. This was a steeper fall than global markets as sterling strengthened against the euro. Yet, the Nov-24 contract lost just £0.70/t over the same period to settle at £194.90/t.

UK wheat imports this season (2023/24) are now expected to reach 2.0 Mt in the latest UK cereal supply and demand estimates. This is up from the January estimate, and despite slight increases in demand results in a larger end-of-season stock forecast. Slightly higher maize imports are also projected to meet slightly higher demand. Meanwhile, lower imports but higher exports further squeeze oat stocks.

The impact of the UK’s second wettest August through February since 1837 (when records began) is clearly shown in AHDB’s latest crop condition report. Information collected up to 26 March shows just 33% of GB winter wheat, 38% of winter barley and 37% of winter oats in a good or excellent condition. These ratings are sharply lower than last year and below even March 2020’s levels.

Spring fieldwork is now taking place on lighter land. For those able to access land how to target inputs is a big challenge with patchy crops and questions over yield potential. However, for many, the land is still too wet. Drilling is delayed and some seedbeds are now wholly unsuitable; a full update will be provided next month.

Comparing with key international competitors shows the importance of yield within the UK system to drive efficiency of input and overhead costs when growing wheat.

Read about the limits to the amount of land businesses can put into the Sustainable Farming Incentive (SFI) scheme, announced by Defra, here. Businesses can now only put 25% of their land into the six SFI actions that take land out of food production.

Oilseeds

Rapeseed

Soyabeans

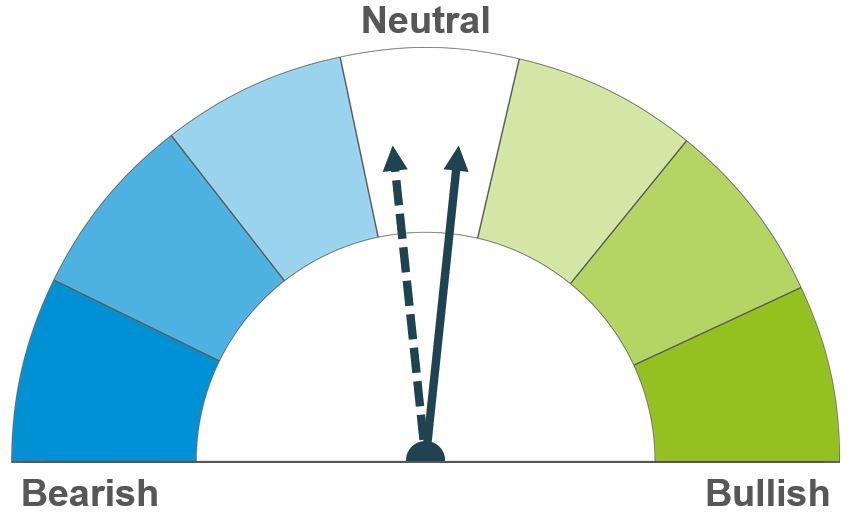

The focus is on EU crop conditions as we enter spring. Rapeseed prices will continue to follow soyabeans’ sentiment, depending on upcoming Canadian plantings going as forecast.

Increased supply from South America continues to weigh on the market, as well as an increase in the U.S. soyabean area reported by the USDA last week. Market focus will be on US planting progress over the coming weeks.

Global oilseed markets

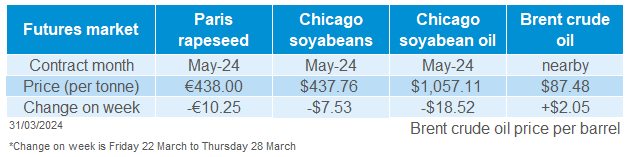

Global oilseed futures

It was a week of pressure for Chicago soyabean futures (May-24) as the market fell by 0.1% to close last Thursday at $437.76/t. The market was supported at the start of last week as the overspill support from tensions in the Black Sea fed into commodity prices.

However, futures were soon pressured by lacklustre Chinese demand, South American soyabean harvests progressing and positioning squaring ahead of the USDA quarterly stocks report and 2024 prospective plantings.

The main story last week was the USDA data, out Thursday, which for soyabeans was largely in line with trade and market expectations:

- In the quarterly stocks report, US soyabean stocks were estimated at 50.2 Mt as of March 1, rising to a two-year high. This was also higher than the average analyst estimates of 49.7 Mt (USDA, LSEG).

- In the Prospective Plantings report the USDA estimated the soyabean area at 35.0 Mha, slightly lower than analyst’s predictions. However, this area is up 3% on the year as farmers switch to soyabeans (USDA, LSEG).

On Monday, the Chicago soyabean market was open and continued to digest this information. The market closed down (May-24) 0.5% on Monday’s close at $435.64/t. The USDA data wasn’t surprising and South American supplies also continue to weigh on the market, which are proving to be a stiff competition for US origin soyabeans.

Yesterday, it was reported by the Brazilian soyabean harvest is now 74% complete, up 5 percentage points from the previous week (Ag Rural). In Argentina the soyabean harvest is just starting with timeous drier weather, which has benefitted the start of the campaign. As of last Wednesday, farmers had harvested 4.4% of the soyabean crop (Buenos Aires Grain Exchange).

All eyes for the market now are on US weather for the plantings of these spring crops. To some extent the attention is on European spring oilseed crops being planted too. It was reported last week that Ukrainian farmers will increase their soyabean area by 23.5% for 2024 to 2.2 Mha, according to the Agricultural Ministry. This is due to soyabeans being one of the few only profitable crops in 2023.

Rapeseed focus

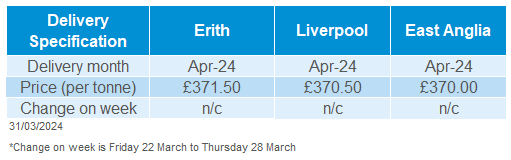

UK delivered oilseed prices

Paris rapeseed futures (May-24) were down across the week by €10.25/t, closing at €438.00/t on Thursday. New crop (Nov-24) futures were also down by €3.00/t over the same period, closing at €450.75/t.

Domestic delivered rapeseed into Erith (Apr-24) was quoted at £371.50/t on Thursday, with no comparison on the week. Delivery for harvest-24 was quoted at £379.50/t, unchanged from the previous week.

The EU rapeseed output forecast has been lowered again by Stratégie Grains for this harvest, to 18.1 Mt. This is down from previous projections of 18.3 Mt, due to an expectant reduced French harvest. The new figure sits 9% below last year’s EU rapeseed harvest (19.9 Mt).

In GB, winter oilseed rape established better than most winter wheat, having had more time to develop before the autumn rain. However, after sitting in water for so long, many plants died and there are some very bare patches in the Midlands particularly. Overall, only 31% of the GB winter oilseed rape crop is rated as in good or excellent condition. This is well below the 70% rated good-excellent at the end of March 2023 and 64% at the same point in 2022. The March 2024 crop development report can also be found in full here, detailing current crop condition and growth for GB crops.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.